Answered step by step

Verified Expert Solution

Question

1 Approved Answer

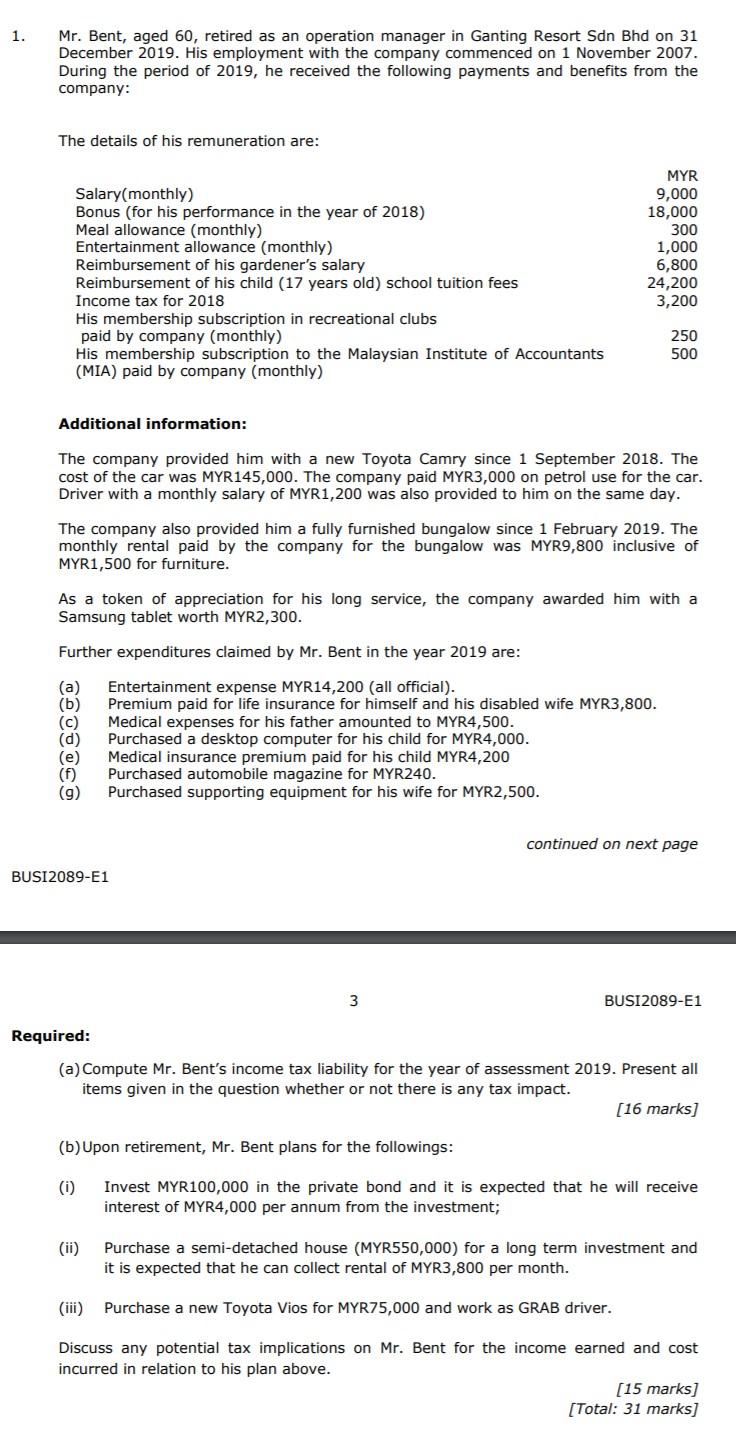

1. Mr. Bent, aged 60, retired as an operation manager in Ganting Resort Sdn Bhd on 31 December 2019. His employment with the company

1. Mr. Bent, aged 60, retired as an operation manager in Ganting Resort Sdn Bhd on 31 December 2019. His employment with the company commenced on 1 November 2007. During the period of 2019, he received the following payments and benefits from the company: The details of his remuneration are: Salary(monthly) Bonus (for his performance in the year of 2018) Meal allowance (monthly) Entertainment allowance (monthly) Reimbursement of his gardener's salary Reimbursement of his child (17 years old) school tuition fees Income tax for 2018 His membership subscription in recreational clubs paid by company (monthly) His membership subscription to the Malaysian Institute of Accountants (MIA) paid by company (monthly) Additional information: The company provided him with a new Toyota Camry since 1 September 2018. The cost of the car was MYR145,000. The company paid MYR3,000 on petrol use for the car. Driver with a monthly salary of MYR1,200 was also provided to him on the same day. (c) (d) (e) (f) (9) The company also provided him a fully furnished bungalow since 1 February 2019. The monthly rental paid by the company for the bungalow was MYR9,800 inclusive of MYR1,500 for furniture. MYR 9,000 18,000 As a token of appreciation for his long service, the company awarded him with a Samsung tablet worth MYR2,300. Further expenditures claimed by Mr. Bent in the year 2019 are: (a) Entertainment expense MYR14,200 (all official). (b) Premium paid for life insurance for himself and his disabled wife MYR3,800. Medical expenses for his father amounted to MYR4,500. Purchased a desktop computer for his child for MYR4,000. Medical insurance premium paid for his child MYR4,200 Purchased automobile magazine for MYR240. Purchased supporting equipment for his wife for MYR2,500. BUSI2089-E1 300 1,000 6,800 24,200 3,200 250 500 3 (ii) continued on next page BUSI2089-E1 Required: (a) Compute Mr. Bent's income tax liability for the year of assessment 2019. Present all items given in the question whether or not there is any tax impact. [16 marks] (b) Upon retirement, Mr. Bent plans for the followings: (1) Invest MYR100,000 in the private bond and it is expected that he will receive interest of MYR4,000 per annum from the investment; Purchase a semi-detached house (MYR550,000) for a long term investment and it is expected that he can collect rental of MYR3,800 per month. (iii) Purchase a new Toyota Vios for MYR75,000 and work as GRAB driver. Discuss any potential tax implications on Mr. Bent for the income earned and cost incurred in relation to his plan above. [15 marks] [Total: 31 marks]

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Comp ute Mr Bent s income tax liability for the year of assessment 2019 Present all items given in the question whether or not there is any tax impa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started