Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Prepare an economic (market value) balance sheet for The ABC Company as of Year 0 using the following information and the financial statements

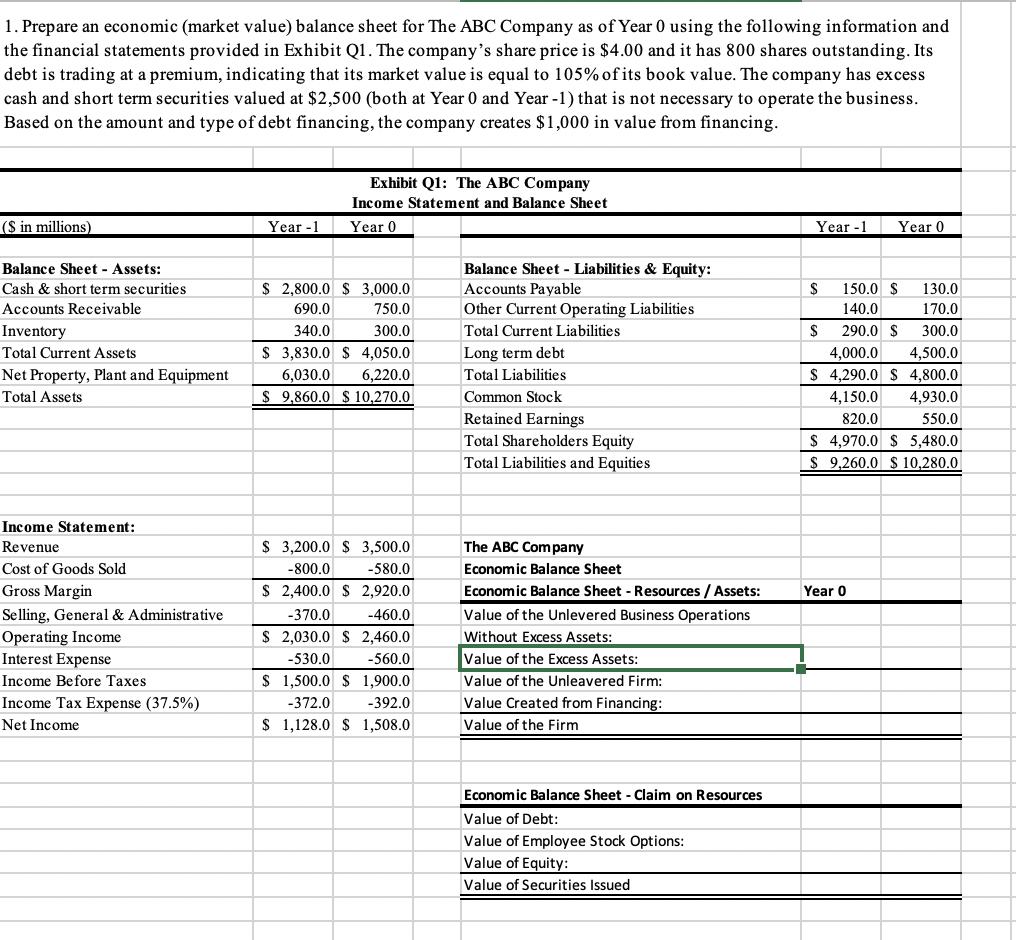

1. Prepare an economic (market value) balance sheet for The ABC Company as of Year 0 using the following information and the financial statements provided in Exhibit Q1. The company's share price is $4.00 and it has 800 shares outstanding. Its debt is trading at a premium, indicating that its market value is equal to 105% of its book value. The company has excess cash and short term securities valued at $2,500 (both at Year 0 and Year -1) that is not necessary to operate the business. Based on the amount and type of debt financing, the company creates $1,000 in value from financing. Exhibit Q1: The ABC Company Income Statement and Balance Sheet (S in millions) Year -1 Year 0 Year -1 Year 0 Balance Sheet - Assets: Balance Sheet - Liabilities & Equity: Accounts Payable Other Current Operating Liabilities Cash & short term securities $ 2,800.0 S 3,000.0 $ 150.0 $ 130.0 Accounts Receivable 690.0 750.0 140.0 170.0 Inventory 340.0 300.0 Total Current Liabilities 290.0 S 300.0 $ 3,830.0 $ 4,050.0 4,500.0 $ 4,290.0 $ 4,800.0 Total Current Assets Long term debt 4,000.0 Net Property, Plant and Equipment 6,030.0 6,220.0 Total Liabilities Total Assets $ 9,860.0 S 10,270.0 Common Stock 4,150.0 4,930.0 Retained Earnings 820.0 550.0 $ 4,970.0 $ 5,480.0 Total Shareholders Equity Total Liabilities and Equities 9,260.0 $ 10,280.0 Income Statement: $ 3,200.0 S 3,500.0 The ABC Company Economic Balance Sheet Revenue Cost of Goods Sold -800.0 -580.0 Gross Margin $ 2,400.0 S 2,920.0 Economic Balance Sheet - Resources / Assets: Year 0 Selling, General & Administrative -370.0 -460.0 Value of the Unlevered Business Operations Operating Income Interest Expense $ 2,030.0 $ 2,460.0 Without Excess Assets: -530.0 -560.0 Value of the Excess Assets: Income Before Taxes $ 1,500.0 $ 1,900.0 Value of the Unleavered Firm: Income Tax Expense (37.5%) -372.0 -392.0 Value Created from Financing: Net Income $ 1,128.0 S 1,508.0 Value of the Firm Economic Balance Sheet - Claim on Resources Value of Debt: Value of Employee Stock Options: Value of Equity: Value of Securities Issued

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Note Excess cash was withdrawn from cash and securities at market value and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started