Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rn REQUIRED: a). Determine the business' cash position by preparing the Statement of Cash Flow for the year ended 31 December 2019. b). Prepare the

rn REQUIRED:

REQUIRED:

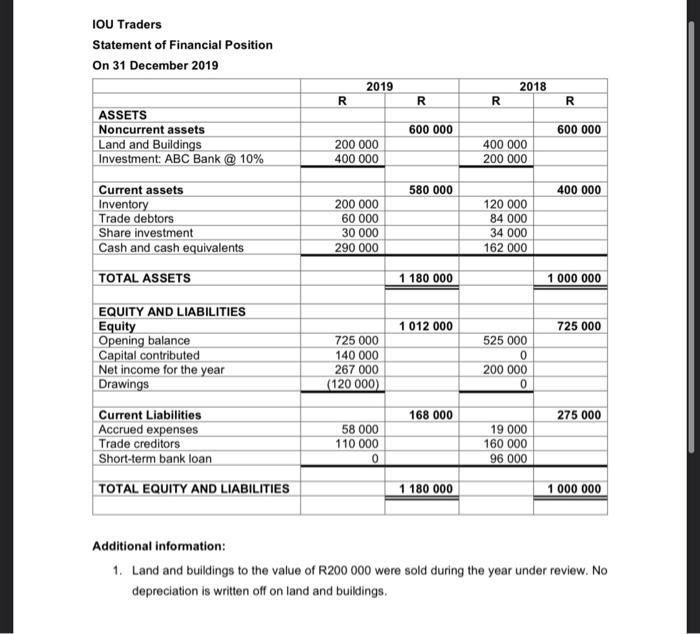

a). Determine the business' cash position by preparing the Statement of Cash Flow for the year ended 31 December 2019.

b). Prepare the following notes to the Statement of Cash Flow

i). Cash received from clients

ii). Administrative expenses

iii). Proceeds with the sale of shares

Statement of profit/loss and other comprehensive income For the year ended 31 December 2019 R R Sales 900 000 (680 000) 220 000 Cost of Sales: Gross profit Other income: Profit on sale of shares Rent received 127 000 3 000 124 000 (100 000) Expenses: Salaries and wages Water and electricity Stationery Commission paid 40 000 20 000 10 000 30 000 Profit before interest and finance costs Interest received Interest paid 247 000 40 000 (20 000) Net profit for the year 267 000

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

IOU TRADERSS Cash Flow Statement Indirect Muthod for the year ended December 31 2019 Amount Amount P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started