Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a manager of a bond portfolio for a bank, you have a total sum of n loans in your portfolio. If each of

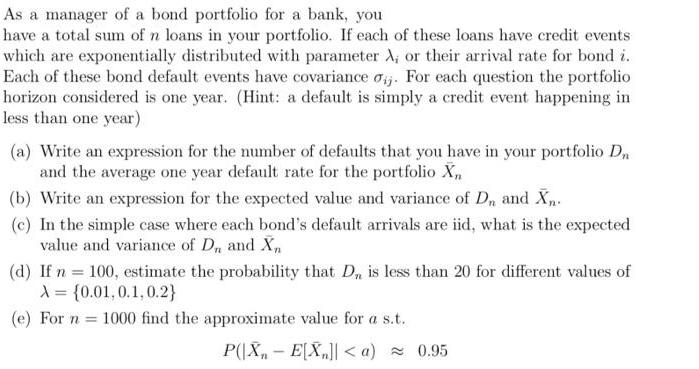

As a manager of a bond portfolio for a bank, you have a total sum of n loans in your portfolio. If each of these loans have credit events which are exponentially distributed with parameter A, or their arrival rate for bond i. Each of these bond default events have covariance oj. For each question the portfolio horizon considered is one year. (Hint: a default is simply a credit event happening in less than one year) (a) Write an expression for the number of defaults that you have in your portfolio D, and the average one year default rate for the portfolio X, (b) Write an expression for the expected value and variance of D, and X. (c) In the simple case where each bond's default arrivals are iid, what is the expected value and variance of D, and X, (d) If n = 100, estimate the probability that D, is less than 20 for different values of 1 = {0.01,0.1,0.2} (e) For n = 1000 find the approximate value for a s.t. P(|X, - E[X]| < a) = 0.95

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here Xi denotes the th credit event ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started