Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Portfolio Returns and Risk Targeting Consider a portfolio of futures positions with weights w, to asset i. Each asset has a mean of

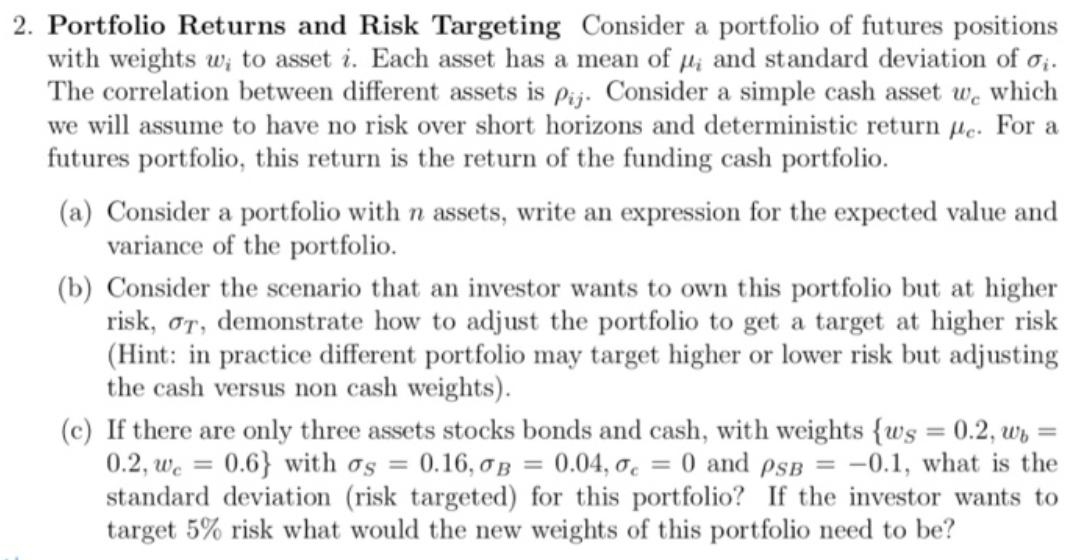

2. Portfolio Returns and Risk Targeting Consider a portfolio of futures positions with weights w, to asset i. Each asset has a mean of , and standard deviation of o. The correlation between different assets is pij. Consider a simple cash asset we which we will assume to have no risk over short horizons and deterministic return e. For a futures portfolio, this return is the return of the funding cash portfolio. (a) Consider a portfolio with n assets, write an expression for the expected value and variance of the portfolio. (b) Consider the scenario that an investor wants to own this portfolio but at higher risk, oT, demonstrate how to adjust the portfolio to get a target at higher risk (Hint: in practice different portfolio may target higher or lower risk but adjusting the cash versus non cash weights). = (c) If there are only three assets stocks bonds and cash, with weights {ws = 0.2, wb = 0.2, we 0.6} with og = 0.16, 0B = 0.04, 0 = 0 and PSB = -0.1, what is the standard deviation (risk targeted) for this portfolio? If the investor wants to target 5% risk what would the new weights of this portfolio need to be?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a The expected value and variance of the portfolio with n as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started