Sunita inherits $45,000 from a distant relative. She decides to invest her inheritance in a diversified, dividend-paying mutual fund. At the time of her

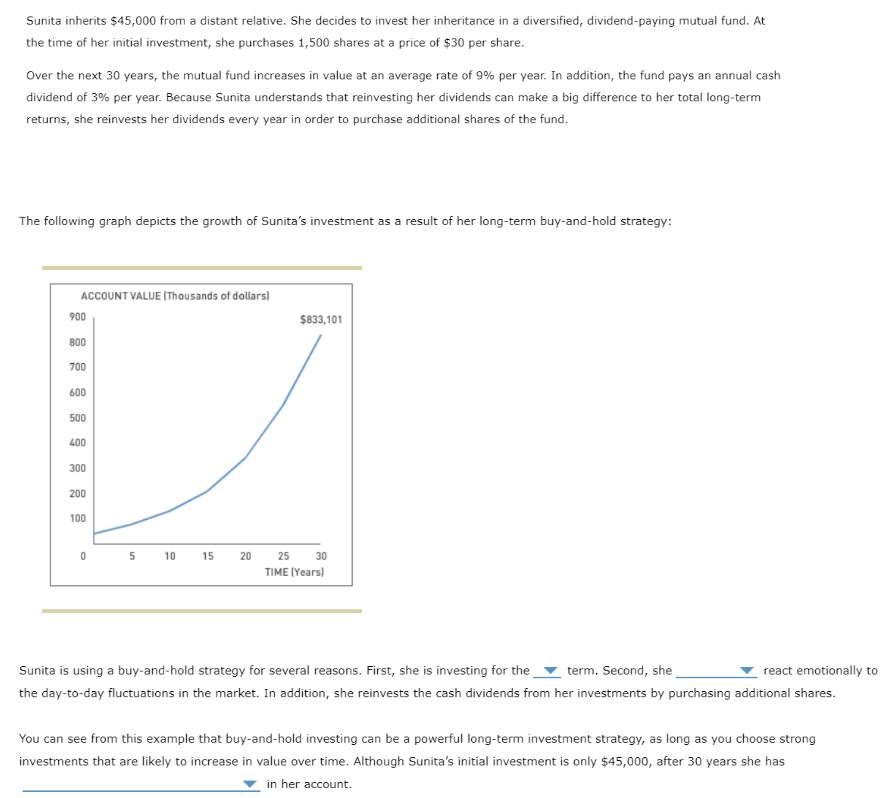

Sunita inherits $45,000 from a distant relative. She decides to invest her inheritance in a diversified, dividend-paying mutual fund. At the time of her initial investment, she purchases 1,500 shares at a price of $30 per share. Over the next 30 years, the mutual fund increases in value at an average rate of 9% per year. In addition, the fund pays an annual cash dividend of 3% per year. Because Sunita understands that reinvesting her dividends can make a big difference to her total long-term returns, she reinvests her dividends every year in order to purchase additional shares of the fund. The following graph depicts the growth of Sunita's investment as a result of her long-term buy-and-hold strategy: ACCOUNT VALUE (Thousands of dollars) 900 800 700 600 500 400 300 200 100 0 5 10 15 20 $833,101 25 30 TIME (Years) Sunita is using a buy-and-hold strategy for several reasons. First, she is investing for the term. Second, she react emotionally to the day-to-day fluctuations in the market. In addition, she reinvests the cash dividends from her investments by purchasing additional shares. You can see from this example that buy-and-hold investing can be a powerful long-term investment strategy, as long as you choose strong investments that are likely to increase in value over time. Although Sunita's initial investment is only $45,000, after 30 years she has in her account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided Sunita initially invests 45000 in a mutual fund by purchasing 1500 shares at a price of 30 per share The mutual fund increases in value at an average rate of 9 per ye...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started