Answered step by step

Verified Expert Solution

Question

1 Approved Answer

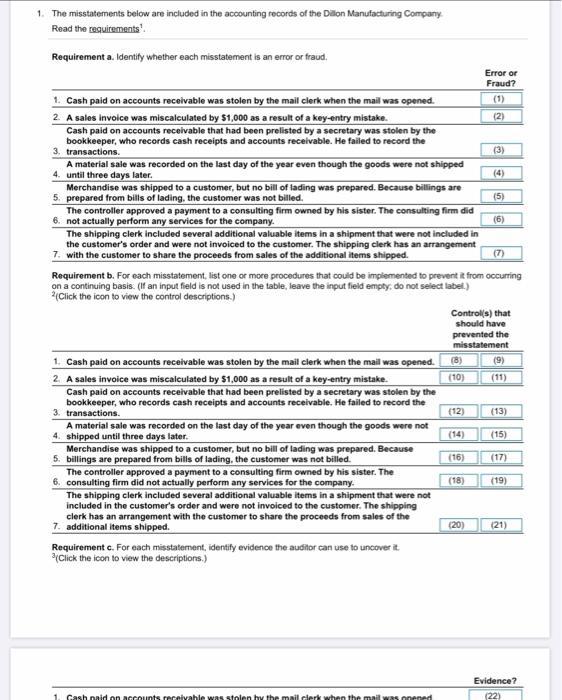

1. The misstatements below are included in the accounting records of the Dilon Manufacturing Company Read the requirements'. Requirement a. Identify whether each misstatement

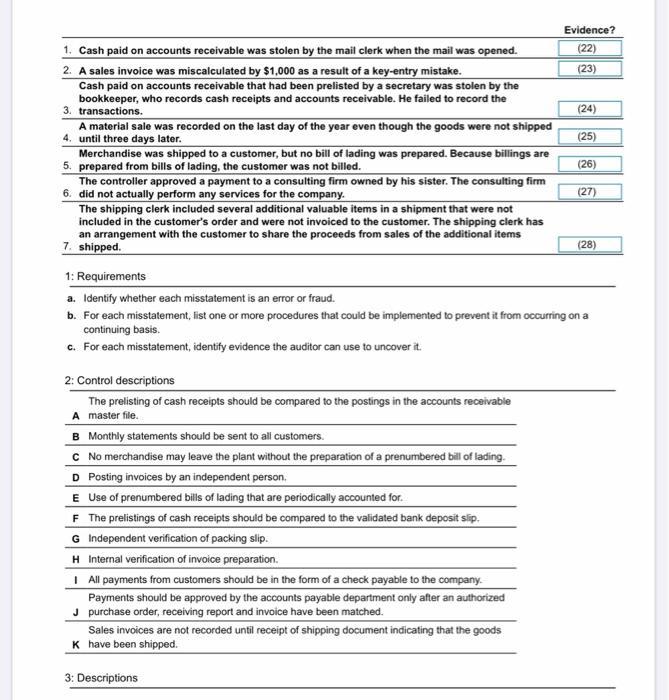

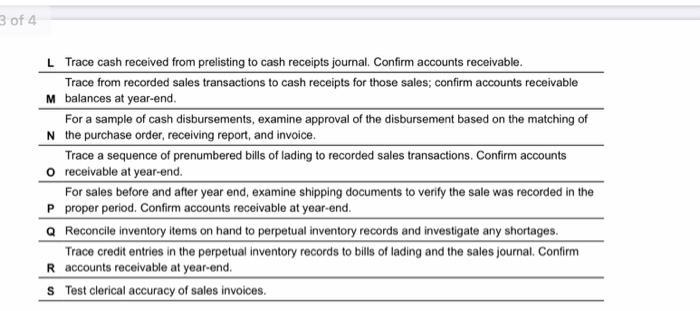

1. The misstatements below are included in the accounting records of the Dilon Manufacturing Company Read the requirements'. Requirement a. Identify whether each misstatement is an error or fraud. Error or Fraud? 1. Cash paid on accounts receivable was stolen by the mail clerk when the mail was opened. 2. A sales invoice was miscalculated by $1,000 as a result of a key-entry mistake. (1) (2) Cash paid on acounts receivable that had been prelisted by a secretary was stolen by the bookkeeper, who records cash receipts and accounts receivable. He failed to record the 3. transactions. A material sale was recorded on the last day of the year even though the goods were not shipped 4. until three days later. (3) (4) Merchandise was shipped to a customer, but no bill of lading was prepared. Because billings are 5. prepared from bills of lading. the customer was not billed. The controller approved a payment to a consulting firm owned by his sister. The consulting firm did 6. not actually perform any services for the company. The shipping clerk included several additional valuable items in a shipment that were not included in the customer's order and were not invoiced to the customer. The shipping clerk has an arrangement 7. with the customer to share the proceeds from sales of the additional items shipped. (5) (6) (7) Requirement b. For each misstatement, list one or more procedures that could be implemented to prevent it from occurring on a continuing basis. (If an input field is not used in the table, leave the input field empty: do not select label.) (Click the icon to view the control descriptions.) Control(s) that should have prevented the misstatement 1. Cash paid on accounts receivable was stolen by the mail clerk when the mail was opened. (8) (9) (10) 2. A sales invoice was miscalculated by $1,000 as a result of a key-entry mistake. Cash paid on accounts receivable that had been prelisted by a secretary was stolen by the bookkeeper, who records cash receipts and accounts receivable. He failed to record the 3. transactions. A material sale was recorded on the last day of the year even though the goods were not 4. shipped until three days later. Merchandise was shipped to a customer, but no bill of lading was prepared. Because 5. billings are prepared from bills of lading, the customer was not billed. The controller approved a payment to a consulting firm owned by his sister. The 6. consulting firm did not actually perform any services for the company. The shipping clerk included several additional valuable items in a shipment that were not included in the customer's order and were not invoiced to the customer. The shipping clerk has an arrangement with the customer to share the proceeds from sales of the 7. additional items shipped. (11) (12) (13) (14) (15) (16) (17) (18) (19) (20) (21) Requirement c. For each misstatement, identify evidence the auditor can use to uncover it. (Click the icon to view the descriptions.) Evidence? 1. Cash naid on accounts receivahle was stolen hy the mail clerk when the mail was onened (22) Evidence? 1. Cash paid on accounts receivable was stolen by the mail clerk when the mail was opened. (22) (23) 2. A sales invoice was miscalculated by $1,000 as a result of a key-entry mistake. Cash paid on accounts receivable that had been prelisted by a secretary was stolen by the bookkeeper, who records cash receipts and accounts receivable. He failed to record the 3. transactions. A material sale was recorded on the last day of the year even though the goods were not shipped 4. until three days later. (24) (25) Merchandise was shipped to a customer, but no bill of lading was prepared. Because billings are 5. prepared from bills of lading, the customer was not billed. The controller approved a payment to a consulting firm owned by his sister. The consulting firm 6. did not actually perform any services for the company. (26) (27) The shipping clerk included several additional valuable items in a shipment that were not included in the customer's order and were not invoiced to the customer. The shipping clerk has an arrangement with the customer to share the proceeds from sales of the additional items 7. shipped. (28) 1: Requirements a. Identify whether each misstatement is an error or fraud. b. For each misstatement, list one or more procedures that could be implemented to prevent it from occurring on a continuing basis. c. For each misstatement, identify evidence the auditor can use to uncover it. 2: Control descriptions The prelisting of cash receipts should be compared to the postings in the accounts receivable A master file. B Monthly statements should be sent to all customers. C No merchandise may leave the plant without the preparation of a prenumbered bill of lading. D Posting invoices by an independent person. E Use of prenumbered bills of lading that are periodically accounted for. F The prelistings of cash receipts should be compared to the validated bank deposit slip. G Independent verification of packing slip. H Internal verification of invoice preparation. I All payments from customers should be in the form of a check payable to the company. Payments should be approved by the accounts payable department only after an authorized J purchase order, receiving report and invoice have been matched. Sales invoices are not recorded until receipt of shipping document indicating that the goods K have been shipped. 3: Descriptions 3 of 4 L Trace cash received from prelisting to cash receipts journal. Confirm accounts receivable. Trace from recorded sales transactions to cash receipts for those sales; confirm accounts receivable M balances at year-end. For a sample of cash disbursements, examine approval of the disbursement based on the matching of N the purchase order, receiving report, and invoice. Trace a sequence of prenumbered bills of lading to recorded sales transactions. Confirm accounts O receivable at year-end. For sales before and after year end, examine shipping documents to verify the sale was recorded in the P proper period. Confirm accounts receivable at year-end. Q Reconcile inventory items on hand to perpetual inventory records and investigate any shortages. Trace credit entries in the perpetual inventory records to bills of lading and the sales journal. Confirm R accounts receivable at year-end. S Test clerical accuracy of sales invoices.

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Fraud 2 Error 3 Fraud 4 Fraud 5 Error 6 Fraud 7 Fraud b The following procedures may be deployed to avoid such fraud or errors 1 Daily bank deposi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started