Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2019, Black Ltd entered into an arrangement to lease a machine from White Ltd. The terms of the lease agreement are

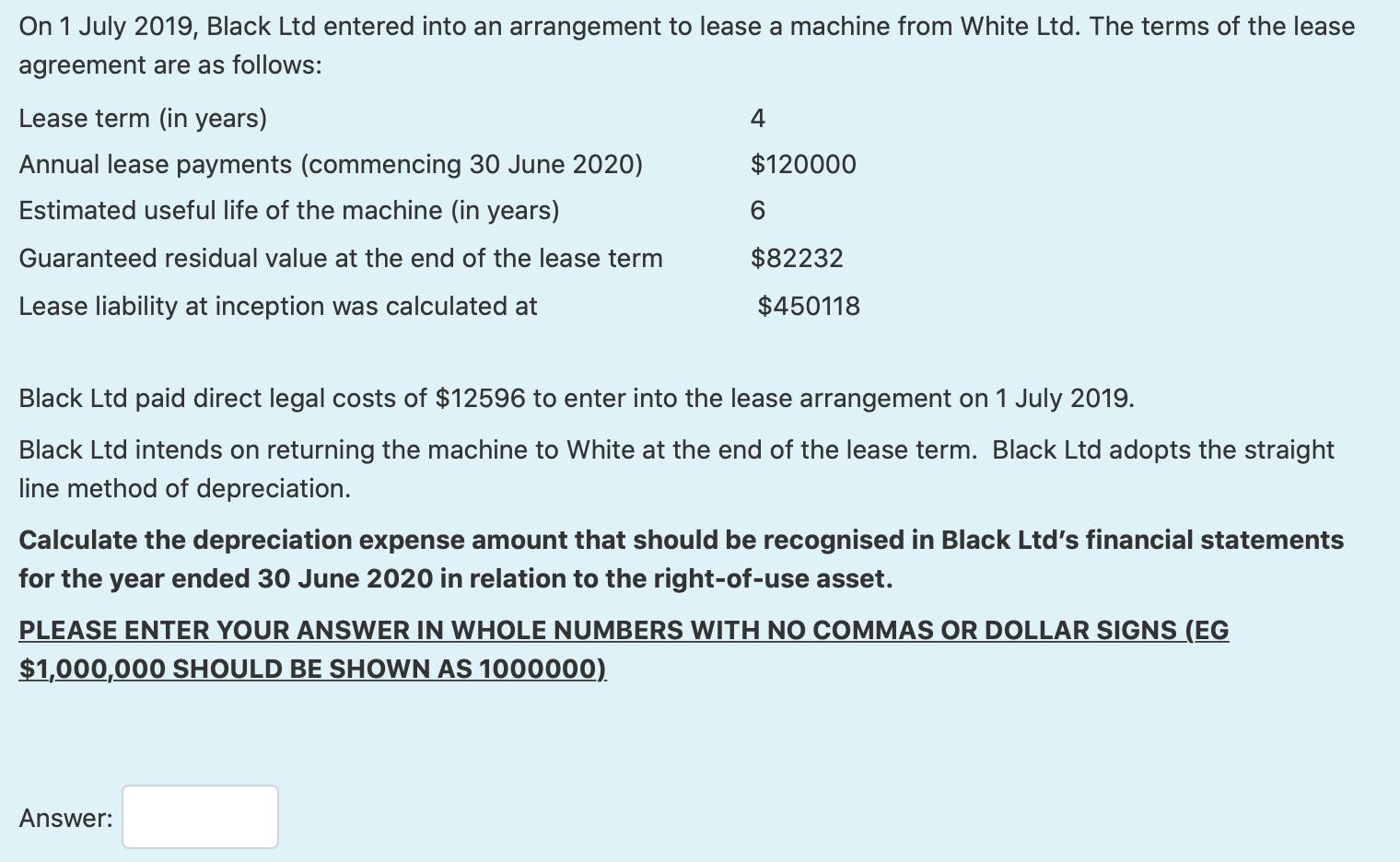

On 1 July 2019, Black Ltd entered into an arrangement to lease a machine from White Ltd. The terms of the lease agreement are as follows: Lease term (in years) 4 Annual lease payments (commencing 30 June 2020) $120000 Estimated useful life of the machine (in years) 6. Guaranteed residual value at the end of the lease term $82232 Lease liability at inception was calculated at $450118 Black Ltd paid direct legal costs of $12596 to enter into the lease arrangement on 1 July 2019. Black Ltd intends on returning the machine to White at the end of the lease term. Black Ltd adopts the straight line method of depreciation. Calculate the depreciation expense amount that should be recognised in Black Ltd's financial statements for the year ended 30 June 2020 in relation to the right-of-use asset. PLEASE ENTER YOUR ANSWER IN WHOLE NUMBERS WITH NO COMMAS OR DOLLAR SIGNS (EG $1,000,000 SHOULD BE SHOWN AS 1000000). Answer:

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started