Answered step by step

Verified Expert Solution

Question

1 Approved Answer

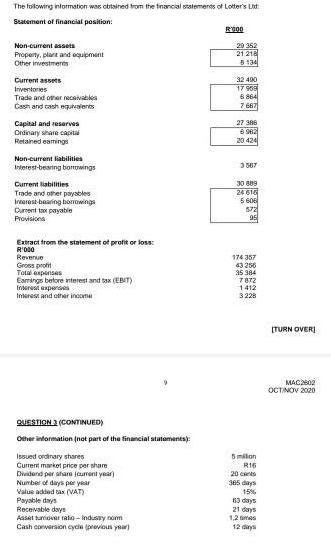

The folowing intormation was obtained rom the tinancial statements of Lotter's Lnt Statement of financial position: Non-current assets Property, plara and equipment Other investments

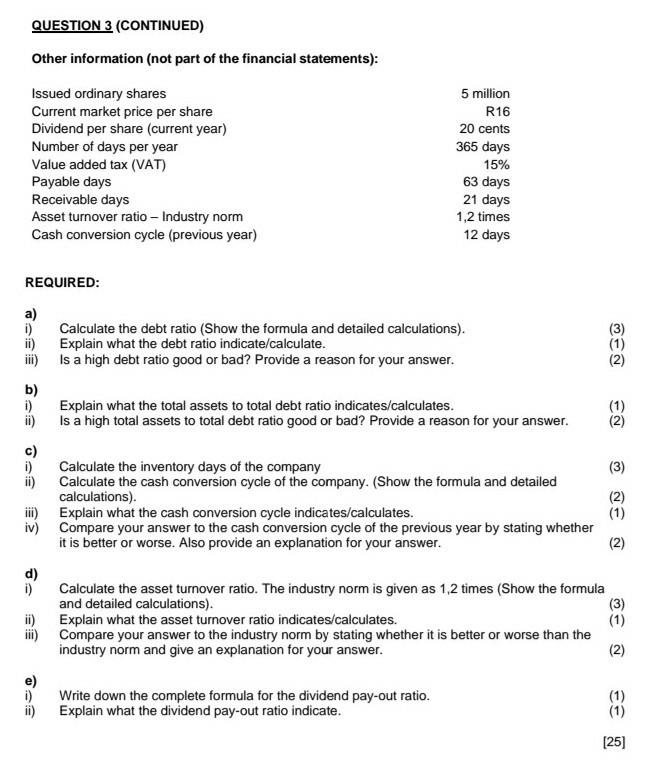

The folowing intormation was obtained rom the tinancial statements of Lotter's Lnt Statement of financial position: Non-current assets Property, plara and equipment Other investments 20 362 21 21 8 134 32 400 17908 6 864 7.667 Current assets Irventories Trade and oher recaivables Cash and cash equtalerts Capital and reserves Ordinary share capita Retained eattings 27 386 6 962 20 424 Non-current liabilities 3567 Interest-bearing borrowings Current liabilities Trade and other payables Interest bearing borowings Current ta payable Provisions 30 809 24 616 5 606 572 95 Extract trom the statement of profit or loss: R'o00 Revenue Gross pro 174 357 43 256 35 384 Total expenses Eamings betore nterest and tax (EBIT) Interest expenaes Interest and other income 7872 1412 3 228 TURN OVERI MAC260 OCTINOV 2020 QUESTION 2 (CONTINUED) Other information (not part of the financial stataments): Issued ordinary shares Current market price per share Diadend per ahare jourent year) Number of days per year Value added tax (VAT) Payable days Receivable days Asset tumover rato-Indusy nom Cash conversion cyce previous year) 5milon R16 20 cents 385 days 15% 63 days 21 days 1,2 times 12 day QUESTION 3 (CONTINUED) Other information (not part of the financial statements): 5 million Issued ordinary shares Current market price per share Dividend per share (current year) Number of days per year Value added tax (VAT) Payable days Receivable days Asset turnover ratio Industry norm Cash conversion cycle (previous year) R16 20 cents 365 days 15% 63 days 21 days 1,2 times 12 days REQUIRED: a) i) Calculate the debt ratio (Show the formula and detailed calculations). Explain what the debt ratio indicate/calculate. ii) iii) Is a high debt ratio good or bad? Provide a reason for your answer. b) i) Explain what the total assets to total debt ratio indicates/calculates. ii) Is a high total assets to total debt ratio good or bad? Provide a reason for your answer. (1) (2) c) Calculate the inventory days of the company i) Calculate the cash conversion cycle of the company. (Show the formula and detailed (3) i) calculations). i) Explain what the cash conversion cycle indicates/calculates. iv) Compare your answer to the cash conversion cycle of the previous year by stating whether it is better or worse. Also provide an explanation for your answer. (2) (1) d) i) Calculate the asset turnover ratio. The industry norm is given as 1,2 times (Show the formula and detailed calculations). Explain what the asset turnover ratio indicates/calculates. (3) (1) iii) Compare your answer to the industry norm by stating whether it is better or worse than the (2) ii) industry norm and give an explanation for your answer. e) i) Write down the complete formula for the dividend pay-out ratio. ii) Explain what the dividend pay-out ratio indicate. (1) (1) [25]

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A I Debt ratio Total debt Total assets or Debt ratio Current liabilities Longterm liabilitiesTotal assets Total debt 308893567 34456 Total assets 6184...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started