Question

Jul. 12: Sold computers on account for $7,500 to a customer, terms 3/15, n/30. The cost of the computers is $3,750. Smart uses the

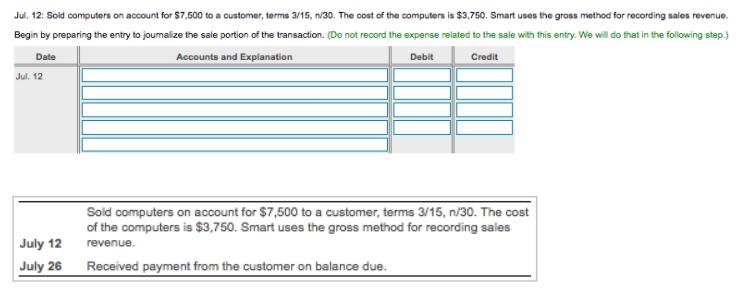

Jul. 12: Sold computers on account for $7,500 to a customer, terms 3/15, n/30. The cost of the computers is $3,750. Smart uses the gross method for recording sales revenue. Begin by preparing the entry to journalize the sale portion of the transaction. (Do not record the expense related to the sale with this entry. We will do that in the following step.) Accounts and Explanation Debit Credit Date Jul. 12 July 12 July 26 Sold computers on account for $7,500 to a customer, terms 3/15, n/30. The cost of the computers is $3,750. Smart uses the gross method for recording sales revenue. Received payment from the customer on balance due.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

In a perpetual inventory system companies maintain detailed records of the cost of each inventory pu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering economy

Authors: Leland Blank, Anthony Tarquin

7th Edition

9781259027406, 0073376302, 1259027406, 978-0073376301

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App