Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.The journal entry to recognize the purchase of the truck will be: 2.Depreciation Expense for Year 3 would be: 3.At the time of sale,the truck

1.The journal entry to recognize the purchase of the truck will be:

2.Depreciation Expense for Year 3 would be:

3.At the time of sale,the truck should be credited for:

4.At the time of sale,cash is debited for:

5.The Gain on Sale of the Truck is entered as a:

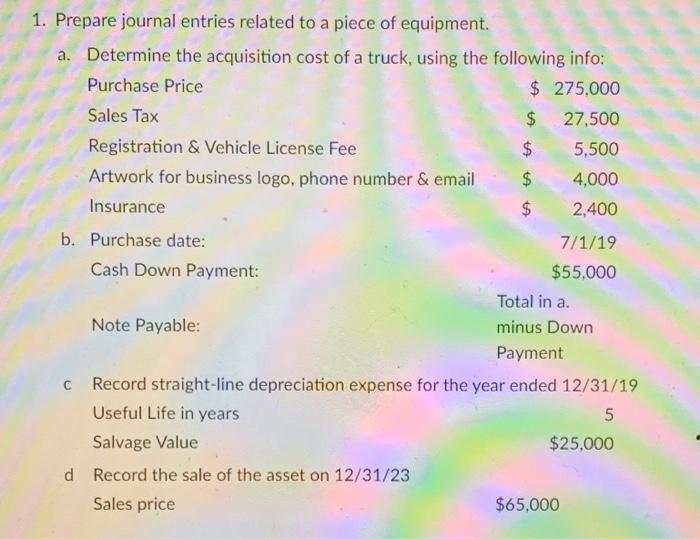

1. Prepare journal entries related to a piece of equipment. a. Determine the acquisition cost of a truck, using the following info: Purchase Price $ 275,000 Sales Tax $27,500 Registration & Vehicle License Fee $5,500 Artwork for business logo, phone number & email $ 4,000 Insurance $ 2,400 b. Purchase date: 7/1/19 Cash Down Payment: $55,000 Total in a. Note Payable: minus Down Payment Record straight-line depreciation expense for the year ended 12/31/19 Useful Life in years Salvage Value $25,000 d Record the sale of the asset on 12/31/23 Sales price $65,000

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

complete ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started