Question

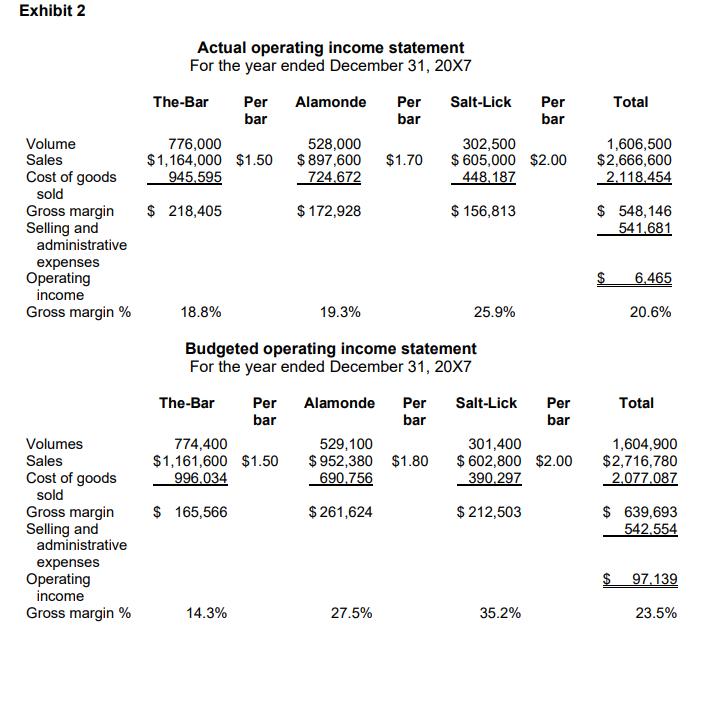

Overview of 20X7 results Prepare an overview of the 20X7 results. Discuss any significant differences between the 20X7 budget and the actual figures (Exhibits 2

Overview of 20X7 results

Prepare an overview of the 20X7 results. Discuss any significant differences between the 20X7 budget and the actual figures (Exhibits 2 to 4). Base the analysis on the revised figures from requirement 1. Your analysis should include a discussion of the following:

• difference between actual and budgeted sales quantities for each product

• changes in unit selling price and effect on sales

• change in gross margin

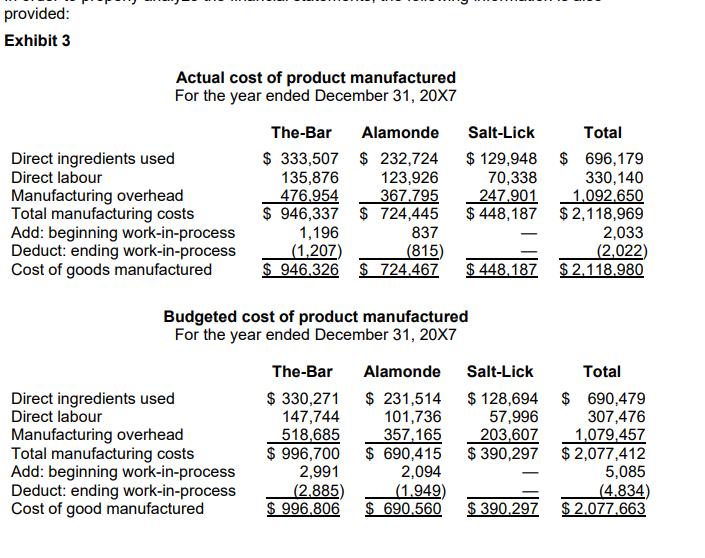

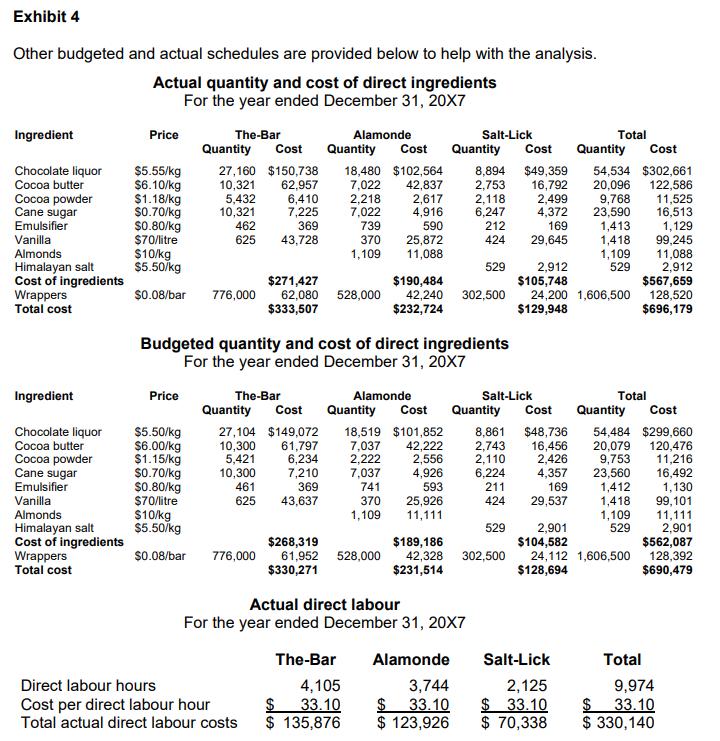

• overall unit cost changes in direct ingredients

• changes in direct labour in relation to sales dollars

A full variance analysis is not expected or required. Brief numerical summaries are encouraged to highlight changes.

• overall unit cost changes in direct ingredients• changes in direct labour in relation to sales dollars

A full variance analysis is not expected or required. Brief numerical summaries are encouraged to highlight changes.

Exhibit 2 Volume Sales Cost of goods sold Gross margin Selling and administrative expenses Operating income Gross margin % Volumes Sales Cost of goods sold Gross margin Selling and administrative expenses Operating income Gross margin % Actual operating income statement For the year ended December 31, 20X7 The-Bar Per bar 776,000 $1,164,000 $1.50 945,595 $ 218,405 18.8% The-Bar Alamonde Per bar $1.70 774,400 $1,161,600 $1.50 996.034 $ 165,566 14.3% 528,000 $ 897,600 724.672 $ 172,928 19.3% Budgeted operating income statement For the year ended December 31, 20X7 Salt-Lick Per bar 529,100 $952,380 $1.80 690,756 $261,624 302,500 $605,000 $2.00 448.187 $ 156,813 Per Alamonde Per Salt-Lick Per bar bar bar 27.5% 25.9% 301,400 $ 602,800 $2.00 390,297 $ 212,503 35.2% 1,606,500 $2,666,600 2.118,454 Total $ 548,146 541,681 $ 6.465 20.6% $ Total 1,604,900 $2,716,780 2,077.087 $ 639,693 542,554 97,139 23.5%

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Sales Product A Actual sales quantity 200000 Budgeted sales quantity 250000 Product B Actual sales quantity 400000 Budgeted sales quantity 350000 Ther...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started