Question

Caroline Karimaghaya purchased the residence on March 23, 1997, for $129,400 and improve- ments totaling $5,700 since. The original loan has a balance as

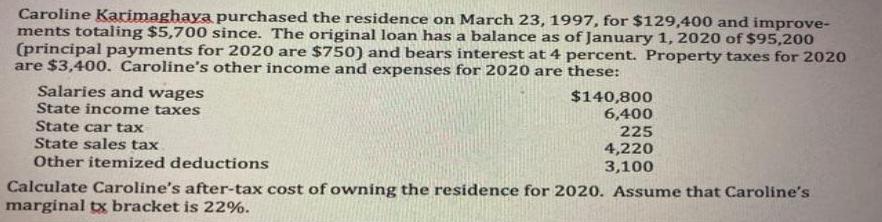

Caroline Karimaghaya purchased the residence on March 23, 1997, for $129,400 and improve- ments totaling $5,700 since. The original loan has a balance as of January 1, 2020 of $95,200 (principal payments for 2020 are $750) and bears interest at 4 percent. Property taxes for 2020 are $3,400. Caroline's other income and expenses for 2020 are these: Salaries and wages State income taxes State car tax State sales tax Other itemized deductions $140,800 6,400 225 4,220 3,100 Calculate Caroline's after-tax cost of owning the residence for 2020. Assume that Caroline's marginal tx bracket is 229%.

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Aftertax interest on houseloan 952004...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

18th edition

538479736, 978-1111534783, 1111534780, 978-0538479738

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App