Question

**Accounting 2 question, 5 stars for quick and correct answer. Thanks! B2B Co. is considering the purchase of equipment that would allow the company to

**Accounting 2 question, 5 stars for quick and correct answer. Thanks!

B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $384,000 with a 6-year life and no salvage value. It will be depreciated on a straight-line basis. B2B Co. concludes that it must earn at least a 9% return on this investment. The company expects to sell 153,600 units of the equipment?s product each year. The expected annual income related to this equipment follows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Sales | $ | 240,000 | |

| Costs | |||

| Materials, labor, and overhead (except depreciation) | 84,000 | ||

| Depreciation on new equipment | 64,000 | ||

| Selling and administrative expenses | 24,000 | ||

| Total costs and expenses | 172,000 | ||

| Pretax income | 68,000 | ||

| Income taxes (30%) | 20,400 | ||

| Net income | $ | 47,600 | |

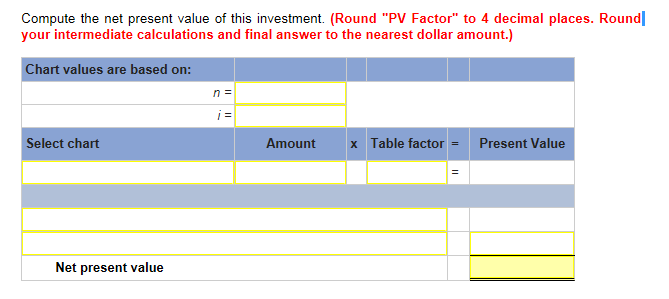

| Compute the net present value of this investment. (Round "PV Factor" to 4 decimal places. Round your intermediate calculations and final answer to the nearest dollar amount.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started