Answered step by step

Verified Expert Solution

Question

1 Approved Answer

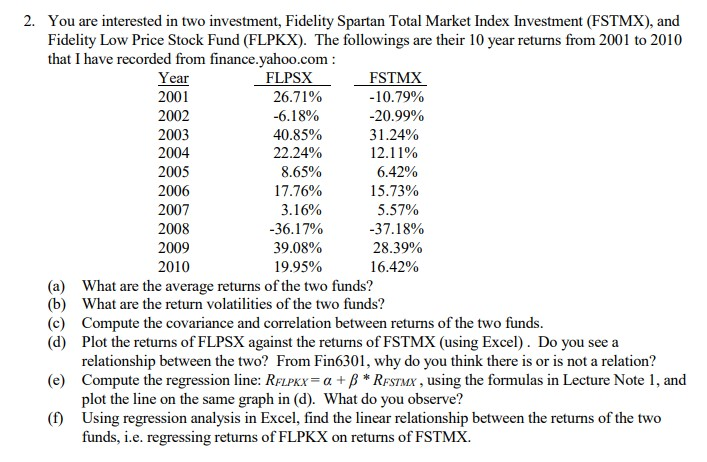

2. You are interested in two investment, Fidelity Spartan Total Market Index Investment (FSTMX), and Fidelity Low Price Stock Fund (FLPKX). The followings are

2. You are interested in two investment, Fidelity Spartan Total Market Index Investment (FSTMX), and Fidelity Low Price Stock Fund (FLPKX). The followings are their 10 year returns from 2001 to 2010 that I have recorded from finance.yahoo.com: Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 (c) (d) (e) (f) FLPSX 26.71% -6.18% 40.85% 22.24% FSTMX -10.79% -20.99% 31.24% 12.11% 8.65% 17.76% 3.16% -36.17% 39.08% 19.95% (a) What are the average returns of the two funds? What are the return volatilities of the two funds? (b) 6.42% 15.73% 5.57% -37.18% 28.39% 16.42% Compute the covariance and correlation between returns of the two funds. Plot the returns of FLPSX against the returns of FSTMX (using Excel). Do you see a relationship between the two? From Fin6301, why do you think there is or is not a relation? Compute the regression line: RFLPKX=a + * RESTMX, using the formulas in Lecture Note 1, and plot the line on the same graph in (d). What do you observe? Using regression analysis in Excel, find the linear relationship between the returns of the two funds, i.e. regressing returns of FLPKX on returns of FSTMX.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

From given information a The average of two fund is Average of FSTMX 469 and Ave...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started