Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCOUNTING 210 PATRICIA O'SULLIVAN FINANCIAL STATEMENT PROJECT DUE DECEMBER 5, 2017 You must create a company in an industry and name it and identify the

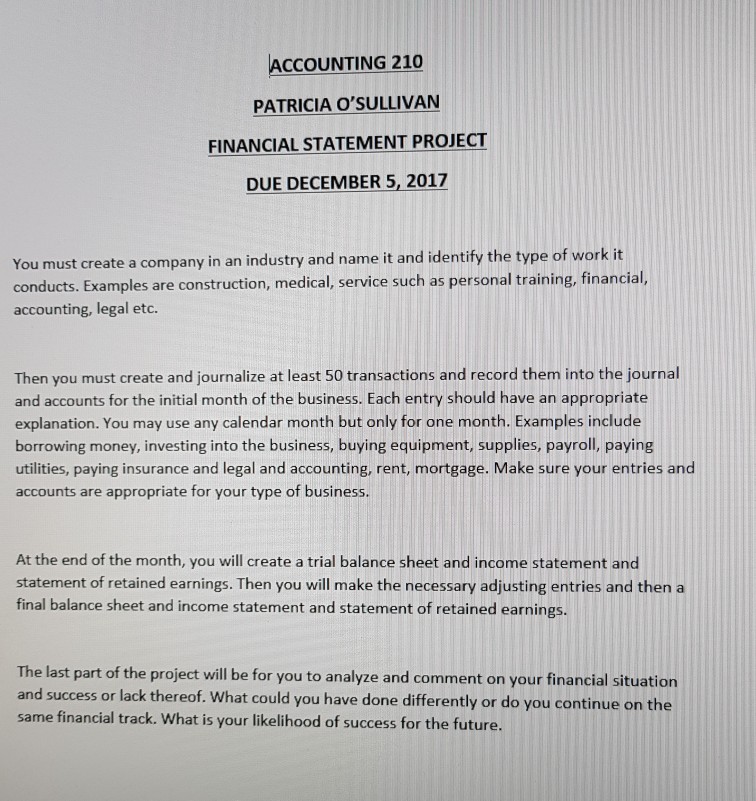

ACCOUNTING 210 PATRICIA O'SULLIVAN FINANCIAL STATEMENT PROJECT DUE DECEMBER 5, 2017 You must create a company in an industry and name it and identify the type of work it conducts. Examples are construction, medical, service such as personal training, financial accounting, legal etc. Then you must create and journalize at least 50 transactions and record them into the journal and accounts for the initial month of the business. Each entry should have an appropriate explanation. You may use any calendar month but only for one month. Examples include borrowing money, investing into the business, buying equipment, supplies, payroll, paying utilities, paying insurance and legal and accounting, rent, mortgage. Make sure your entries and accounts are appropriate for your type of business. At the end of the month, you will create a trial balance sheet and income statement and statement of retained earnings. Then you will make the necessary adjusting entries and then a final balance sheet and income statement and statement of retained earnings The last part of the project will be for you to analyze and comment on your financial situation and success or lack thereof. What could you have done differently or do you continue on the same financial track. What is your likelihood of success for the future. ACCOUNTING 210 PATRICIA O'SULLIVAN FINANCIAL STATEMENT PROJECT DUE DECEMBER 5, 2017 You must create a company in an industry and name it and identify the type of work it conducts. Examples are construction, medical, service such as personal training, financial accounting, legal etc. Then you must create and journalize at least 50 transactions and record them into the journal and accounts for the initial month of the business. Each entry should have an appropriate explanation. You may use any calendar month but only for one month. Examples include borrowing money, investing into the business, buying equipment, supplies, payroll, paying utilities, paying insurance and legal and accounting, rent, mortgage. Make sure your entries and accounts are appropriate for your type of business. At the end of the month, you will create a trial balance sheet and income statement and statement of retained earnings. Then you will make the necessary adjusting entries and then a final balance sheet and income statement and statement of retained earnings The last part of the project will be for you to analyze and comment on your financial situation and success or lack thereof. What could you have done differently or do you continue on the same financial track. What is your likelihood of success for the future

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started