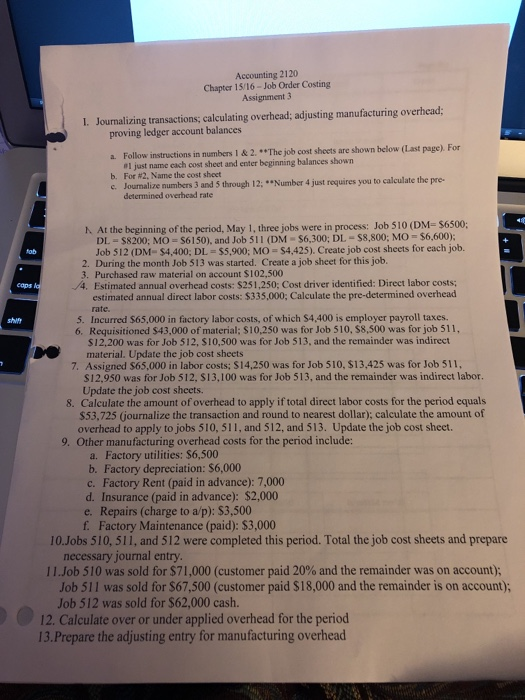

Accounting 2120 Chapter 15/16 - Job Order Costing Assignment 3 1. Journalizing transactions, calculating overhead; adjusting manufacturing overhead: proving ledger account balances a. Follow instructions in numbers 1 & 2. ** The job cost sheets are shown below (Last page). For I just name each cost sheet and enter beginning balances shown b. For N2. Name the cost sheet c. Journalize numbers 3 and 5 through 12; **Number 4 just requires you to calculate the pre determined overhead rate At the beginning of the period, May 1, three jobs were in process: Job 510 (DM-S6500; DL - $8200; MO = S6150), and Job 511 (DM-S6,300; DL - $8.800; MO - $6,600): Job 512 (DM- $4,400, DL - $5.900; MO = $4,425). Create job cost sheets for each job. 2. During the month Job 513 was started. Create a job sheet for this job. 3. Purchased raw material on account S102,500 4. Estimated annual overhead costs: S251.250; Cost driver identified: Direct labor costs estimated annual direct labor costs: $335.000; Calculate the pre-determined overhead rate. 5. Incurred $65.000 in factory labor costs, of which S4.400 is employer payroll taxes. 6. Requisitioned $43,000 of material: S10.250 was for Job 510, S8,500 was for job 511, $12,200 was for Job 512, SIO,500 was for Job 513, and the remainder was indirect material. Update the job cost sheets 7. Assigned $65,000 in labor costs: S14.250 was for Job 510, $13.425 was for Job 511, $12.950 was for Job 512, 513,100 was for Job 513, and the remainder was indirect labor. Update the job cost sheets. 8. Calculate the amount of overhead to apply if total direct labor costs for the period equals $53.725 (journalize the transaction and round to nearest dollar): calculate the amount of overhead to apply to jobs 510, 511, and 512, and 513. Update the job cost sheet. 9. Other manufacturing overhead costs for the period include: a. Factory utilities: $6,500 b. Factory depreciation: $6,000 c. Factory Rent (paid in advance): 7,000 d. Insurance (paid in advance): $2,000 e. Repairs (charge to a/p): $3,500 f. Factory Maintenance (paid): $3,000 10.Jobs 510, 511, and 512 were completed this period. Total the job cost sheets and prepare necessary journal entry. 11.Job 510 was sold for $71,000 (customer paid 20% and the remainder was on account); Job 311 was sold for $67.500 (customer paid $18,000 and the remainder is on account); Job 512 was sold for $62,000 cash. 12. Calculate over or under applied overhead for the period 13.Prepare the adjusting entry for manufacturing overhead