Accounting 26e

Problems : Series A - PR 4-5A

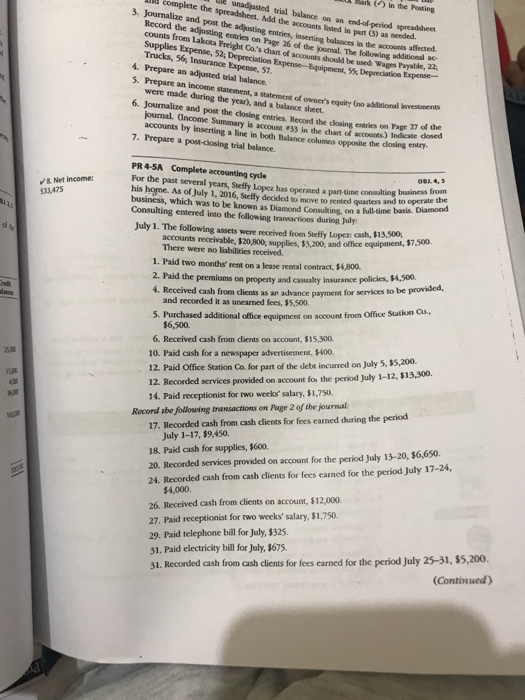

aa complete the spreadsheet. Add the accounts listed in part) as Record the adjusing Supplies Expense, 52; De arkin the Posting trial balance on an end-of period spreadsheet the accounts affected entries on Page 26 of the journal. The following additicala 3. Journalize and post the adjusting entries, inserting needed balances in s chant of accounts should be used Wages Payable, 22 Trucks, 56, Insurance Expense, 57 Expense-Equipment, 55% Depreclation Expense- 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owner's equity (no additional Investment were made during the year), and a balance sheet 6. Journalize and post the closing entries. Record the dlosing entries on Page 77 of the 7. Prepare a post-closing trial balance PR4-5A journal. (Oncome Summary is account 33 in the chart of accouets) Indicate accounts by Inserting a line in both Balance columins opposite the dlosing entry. Complete accounting cycle For the past several years, Suefly Lopez has operated a part-time consulting business his home. As of July 1, 2016, Steffy decided to imove to rented quasters and to operale thed business, which was to be known as Diamond Consulking, on a full-time basis. D Consulting entered into the following trancactions during July: & Net income 533,475 July 1. The following assets were received from Steffy Lopez: cash, $13,500, accounts receivable, $20,800, upplies, $3,200, and office equipment $7.5. There were no liabilities received. 1. Paid two months' rent on a lease reatal contract, $4,800. 2. Paid the premiums on property and casuality insurance policies 4. Received cash from dients as an advance payment for services to be provided, and recorded it as unearned fees, $5,500. 5. Purchased additional office equipment on account from Office Sukion Cu, $6,500. 6. Received cash from dients on account, $15,300 10. Paid cash for a newspaper advertisement, 400. 12. Paid Office Station Co. for part of the debe incurred on July 5, $5,200. 2. Recorded services provided on account fos the period July 1-12, $13,300. 14. Paid receptionist for two weeks' salary, $1,750, 25 Record ube following transactions on Page 2 of tbe journal 17. Recorded cash from cash clients for fees earned during the period July 1-17, $9,450. 18. Paid cash for supplies, $600. 20. Recorded services provided on account for the period July 13-20, $6,650. 24. Recorded cash from cash clients for fees earned for the period July 17-24, 4,000. 26. Received cash from clients on account, $12,000 27. Paid receptionist for two weeks' salary, $1,750. 29. Paid telephone bill for July, $325 31. Paid electricity bill for July, $675. 31. Recorded cash from cash clients for fees earned for the period July 25-31, $5,200. (Continued)