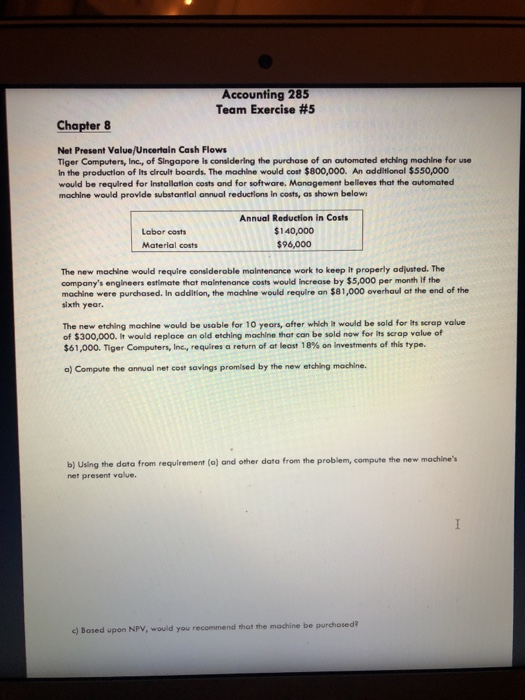

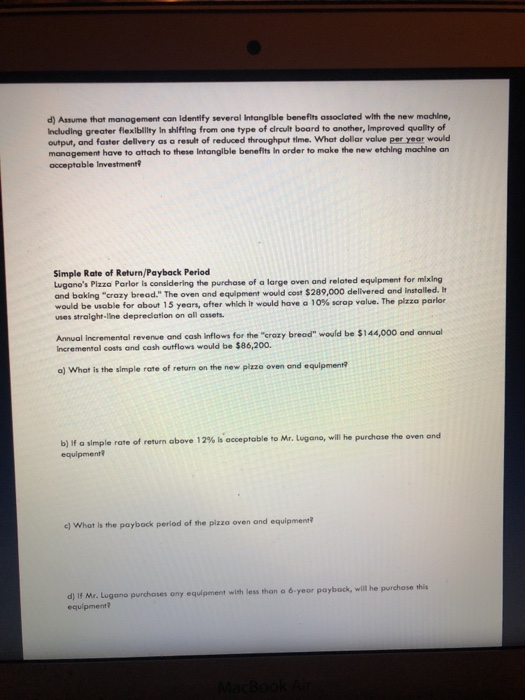

Accounting 285 Team Exercise #5 Chapter 8 Net Present Value/Uncertain Cash Flows Tiger Computers, Inc., of Singapore is considering the purchase of an automated etching machine for use In the production of its roult boards. The machine would cost $800,000. An additional $550,000 would be required for installation costs and for software. Management believes that the automated machine would provide substantial annual reductions in costs, as shown below Labor costs Material costs Annual Reduction in Costs $140,000 $96,000 The new machine would require considerable maintenance work to keep it properly adjusted. The company's engineers estimate that maintenance costs would increase by $5,000 per month If the machine were purchased. In addition, the machine would require an $81,000 overhaul of the end of the sixth year. The new etching machine would be usable for 10 years, after which it would be sold for its srop value of $300,000. It would replace an old etching machine that can be sold now for its scrap value of $61,000. Tiger Computers, Inc., requires a return of at least 18% on investments of this type, a) Compute the annual net cost savings promised by the new etching machine. b) Using the data from requirement (a) and other data from the problem, compute the new machine's not present value Based upon NPV, would you recommend that the machine be purchased d) Assume that management can identify several Intangible benefits sociated with the new machine, Including greater flexibility in shifting from one type of drcuit board to another, Improved quality of output, and faster delivery as a result of reduced throughput time. What dollar value per year would management have to attach to these intangible benefits in order to make the new etching machine an acceptable Investment Simple Rate of Return/Payback Period Lugano's Pizza Parlor is considering the purchase of a large oven and related equipment for mixing and baking crazy bread." The oven and equipment would cost $289,000 delivered and installed. It would be able for about 15 years, after which would have a 10% srop volue. The plazo parlor uses strolgeline depredation on all assets. Annual incremental reverve and cash inflows for the "crazy breed" would be $144,000 and annual Incremental costs and cash outflows would be $86,200. a) What is the simple rate of return on the new plaze oven and equipment b) If a simple rate of return above 12% is acceptable to Mr. Lugano, will he purchase the oven and equipment What is the payback period of the plaze oven and equipment year payback, will the purchase this d) Mr. Lugano purchases any equament with less than a equipment