The company has now been in business 3 years. Nick has been working on growing within the industry and paying down debt. Nick is

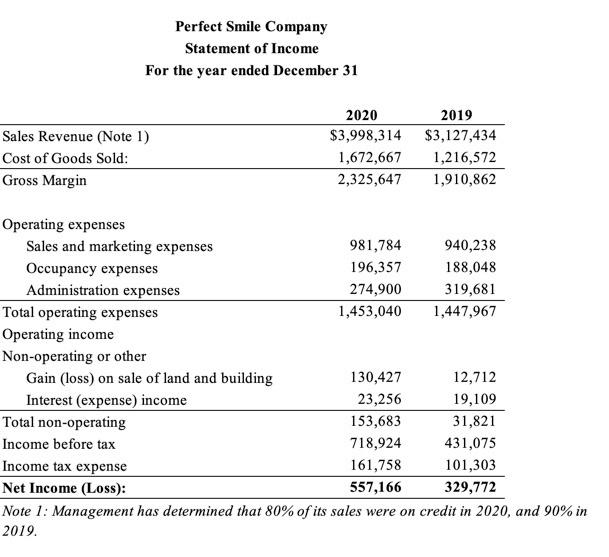

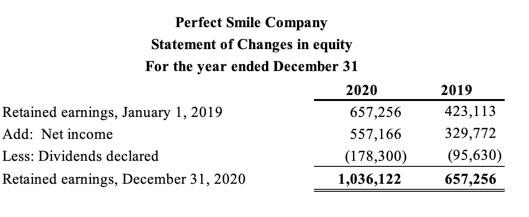

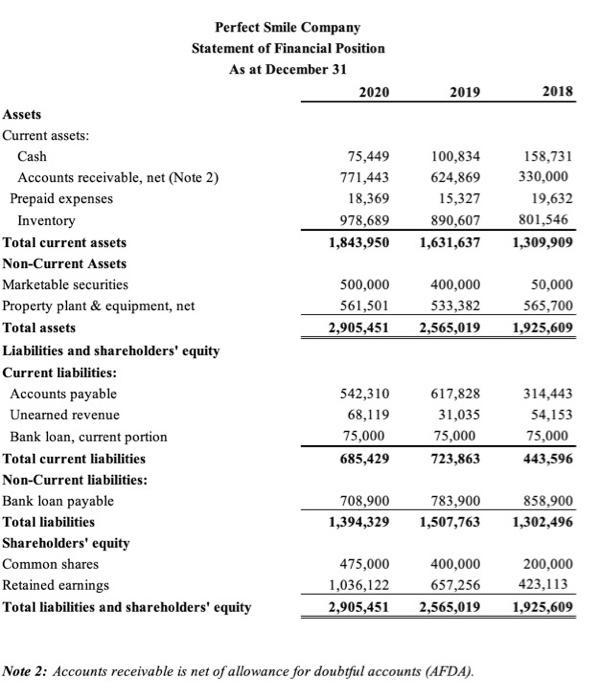

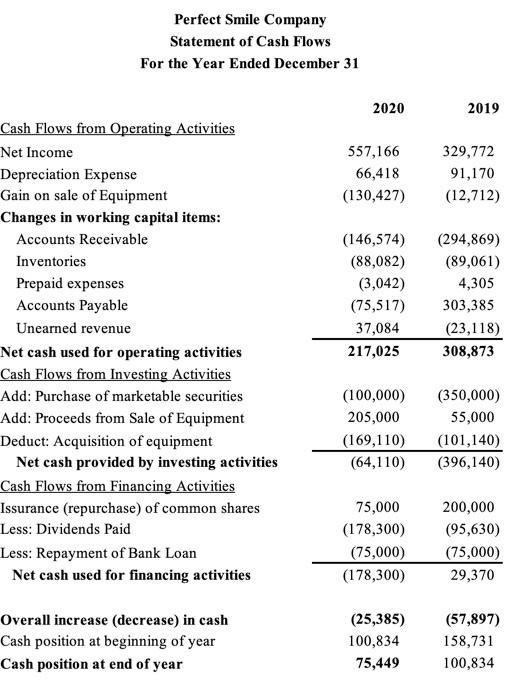

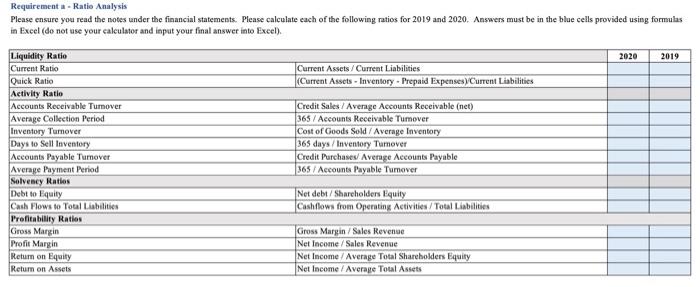

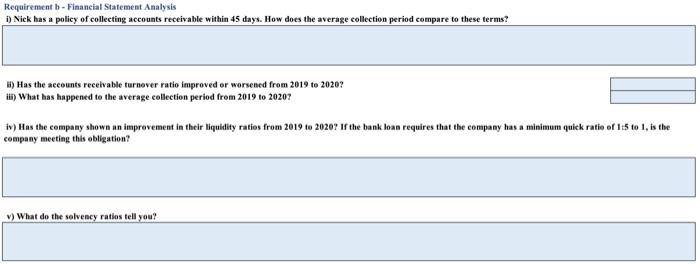

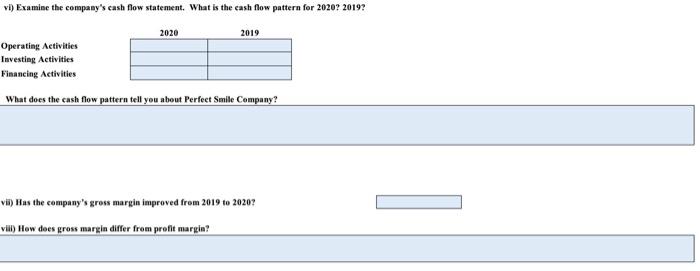

The company has now been in business 3 years. Nick has been working on growing within the industry and paying down debt. Nick is hoping that some additional analysis can be completed on his business to assess its success and is open to any kind of suggestions you may provide him with. Perfect Smile's financial statements are shown below. Analyze the statements, completing the requirements to the right. Your answers should be in the cells noted in blue. Do not make any changes to the financial statements. Sales Revenue (Note 1) Cost of Goods Sold: Gross Margin Operating expenses Perfect Smile Company Statement of Income For the year ended December 31 Sales and marketing expenses Occupancy expenses Administration expenses Total operating expenses Operating income Non-operating or other Gain (loss) on sale of land and building Interest (expense) income Total non-operating Income before tax 2020 2019 $3,998,314 $3,127,434 1,672,667 1,216,572 2,325,647 1,910,862 981,784 196,357 274,900 1,453,040 1,447,967 940,238 188,048 319,681 130,427 12,712 23,256 19,109 153,683 31,821 718,924 431,075 Income tax expense 161,758 101,303 Net Income (Loss): 557,166 329,772 Note 1: Management has determined that 80% of its sales were on credit in 2020, and 90% in 2019. Perfect Smile Company Statement of Changes in equity For the year ended December 31 Retained earnings, January 1, 2019 Add: Net income Less: Dividends declared Retained earnings, December 31, 2020 2020 657,256 557,166 (178,300) 1,036,122 2019 423,113 329,772 (95,630) 657,256 Assets Current assets: Cash Accounts receivable, net (Note 2) Prepaid expenses Inventory Total current assets Non-Current Assets Marketable securities Property plant & equipment, net Total assets Perfect Smile Company Statement of Financial Position As at December 31 Liabilities and shareholders' equity Current liabilities: Accounts payable Unearned revenue Bank loan, current portion Total current liabilities Non-Current liabilities: Bank loan payable Total liabilities Shareholders' equity Common shares Retained earnings Total liabilities and shareholders' equity 2020 2019 100,834 624,869 15,327 890,607 542,310 68,119 75,000 685,429 75,449 771,443 18,369 19,632 978,689 801,546 1,843,950 1,631,637 1,309,909 500,000 400,000 561,501 533,382 2,905,451 2,565,019 617,828 31,035 75,000 723,863 475,000 1,036,122 2,905,451 2,565,019 400,000 657,256 2018 158,731 330,000 Note 2: Accounts receivable is net of allowance for doubtful accounts (AFDA). 708,900 783,900 858,900 1,394,329 1,507,763 1,302,496 50,000 565,700 1,925,609 314,443 54,153 75,000 443,596 200,000 423,113 1,925,609 Perfect Smile Company Statement of Cash Flows For the Year Ended December 31 Cash Flows from Operating Activities Net Income Depreciation Expense Gain on sale of Equipment Changes in working capital items: Accounts Receivable Inventories Prepaid expenses Accounts Payable Unearned revenue Net cash used for operating activities Cash Flows from Investing Activities Add: Purchase of marketable securities Add: Proceeds from Sale of Equipment Deduct: Acquisition of equipment Net cash provided by investing activities Cash Flows from Financing Activities Issurance (repurchase) of common shares Less: Dividends Paid Less: Repayment of Bank Loan Net cash used for financing activities Overall increase (decrease) in cash Cash position at beginning of year Cash position at end of year 2020 557,166 66,418 (130,427) (100,000) 205,000 (169,110) (64,110) (146,574) (294,869) (88,082) (89,061) (3,042) 4,305 (75,517) 303,385 37,084 (23,118) 217,025 308,873 75,000 (178,300) (75,000) (178,300) 2019 (25,385) 100,834 75,449 329,772 91,170 (12,712) (350,000) 55,000 (101,140) (396,140) 200,000 (95,630) (75,000) 29,370 (57,897) 158,731 100,834 Requirement a - Ratio Analysis Please ensure you read the notes under the financial statements. Please calculate each of the following ratios for 2019 and 2020. Answers must be in the blue cells provided using formulas in Excel (do not use your calculator and input your final answer into Excel). Liquidity Ratio Current Ratio Quick Ratio Activity Ratio Accounts Receivable Tumover Average Collection Period Inventory Turnover Days to Sell Inventory Accounts Payable Turnover Average Payment Period Solvency Ratios Debt to Equity Cash Flows to Total Liabilities Profitability Ratios Gross Margin Profit Margin Return on Equity Return on Assets Current Assets/Current Liabilities (Current Assets- Inventory- Prepaid Expenses) Current Liabilities Credit Sales/Average Accounts Receivable (net) 365/Accounts Receivable Tumover - Cost of Goods Sold / Average Inventory 365 days/Inventory Turnover Credit Purchases/ Average Accounts Payable 365/Accounts Payable Turnover Net debt / Shareholders Equity Cashflows from Operating Activities/Total Liabilities Gross Margin / Sales enue Net Income / Sales Revenue Net Income/Average Total Shareholders Equity Net Income / Average Total Assets 2020 2019 Requirement b- Financial Statement Analysis i) Nick has a policy of collecting accounts receivable within 45 days. How does the average collection period compare to these terms? H) Has the accounts receivable turnover ratio improved or worsened from 2019 to 2020? iii) What has happened to the average collection period from 2019 to 2020? iv) Has the company shown an improvement in their liquidity ratios from 2019 to 2020? If the bank loan requires that the company has a minimum quick ratio of 1:5 to 1, is the company meeting this obligation? v) What do the solvency ratios tell you? vi) Examine the company's cash flow statement. What is the cash flow pattern for 2020? 2019? 2020 2019 Operating Activities Investing Activities Financing Activities What does the cash flow pattern tell you about Perfect Smile Company? vii) Has the company's gross margin improved from 2019 to 2020? vili) How does gross margin differ from profit margin?

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started