Answered step by step

Verified Expert Solution

Question

1 Approved Answer

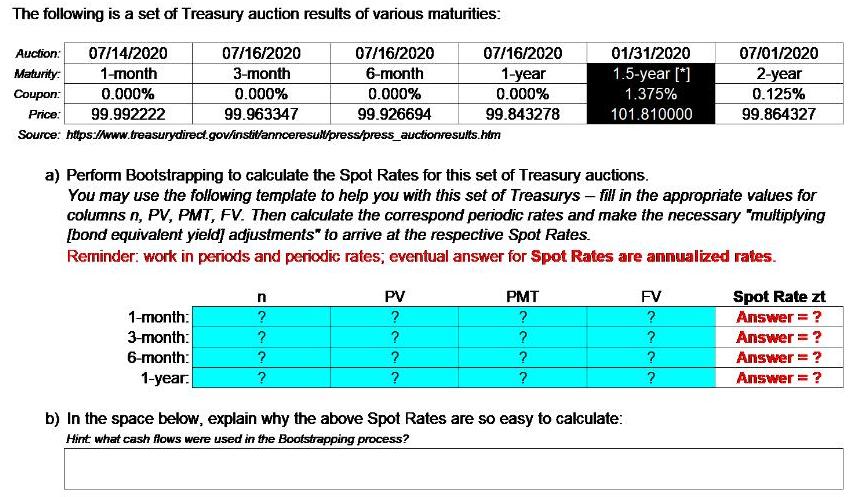

The following is a set of Treasury auction results of various maturities: Auction: 07/14/2020 07/16/2020 07/16/2020 Maturity: 1-month 3-month 6-month Coupon: 0.000% 0.000% Price:

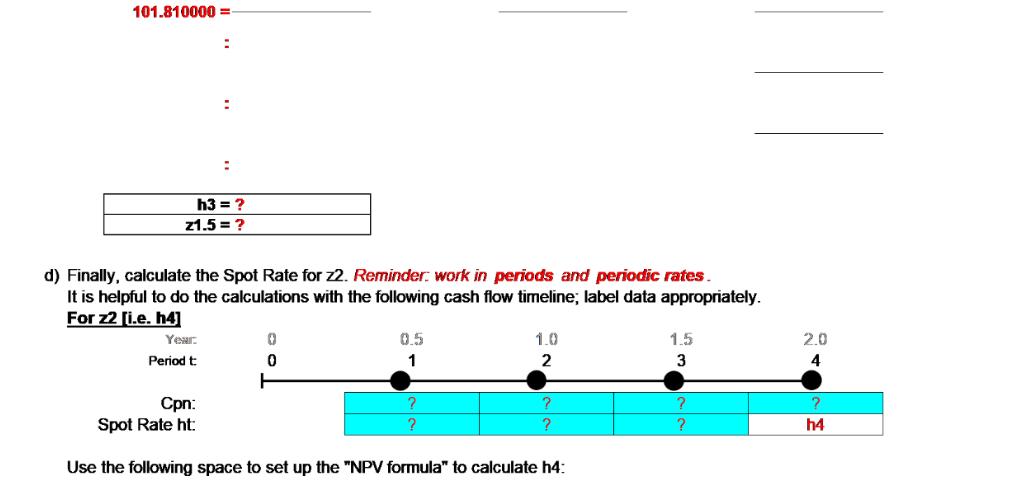

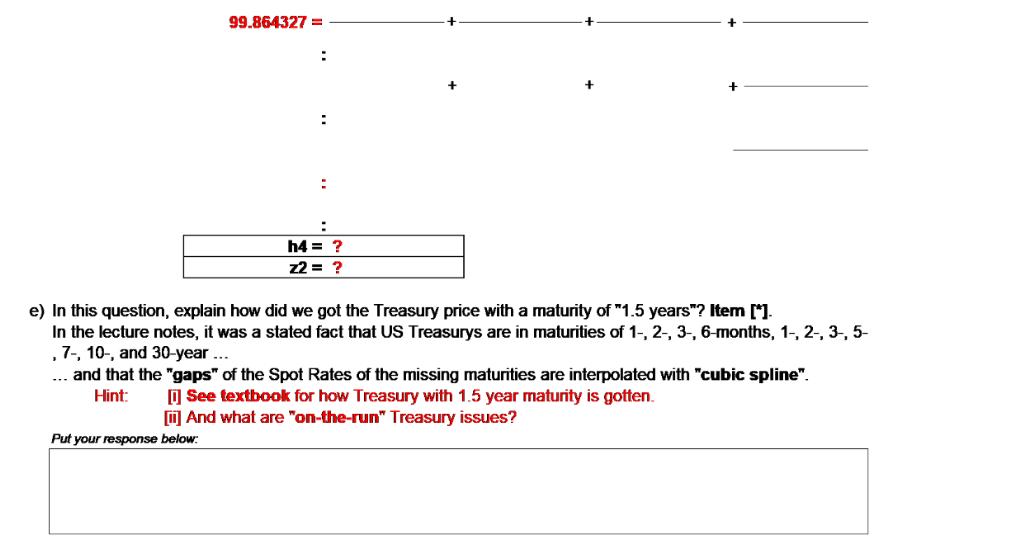

The following is a set of Treasury auction results of various maturities: Auction: 07/14/2020 07/16/2020 07/16/2020 Maturity: 1-month 3-month 6-month Coupon: 0.000% 0.000% Price: 99.992222 99.926694 Source: https://www.treasurydirect.gov/instit/annceresult/press/press_auctionresults.htm 0.000% 99.963347 1-month: 3-month: 6-month: 1-year. n ? ? ? ? 07/16/2020 1-year 0.000% 99.843278 a) Perform Bootstrapping to calculate the Spot Rates for this set of Treasury auctions. You may use the following template to help you with this set of Treasurys - fill in the appropriate values for columns n, PV, PMT, FV. Then calculate the correspond periodic rates and make the necessary "multiplying [bond equivalent yield] adjustments" to arrive at the respective Spot Rates. Reminder: work in periods and periodic rates; eventual answer for Spot Rates are annualized rates. PV ? ? ? ? PMT ? ? ? 01/31/2020 1.5-year [*] 1.375% 101.810000 ? b) In the space below, explain why the above Spot Rates are so easy to calculate: Hint what cash flows were used in the Bootstrapping process? FV ? ? 07/01/2020 2-year 0.125% 99.864327 ? ? Spot Rate zt Answer = ? Answer = ? Answer = ? Answer = ? c) Continuing from the above bootstrapping process, calculate the Spot Rate for z1.5. Reminder: work in periods and periodic rates. It is helpful to do the calculations with the following cash flow timeline; label data appropriately. For z1.5 [i.e. h3] Yr: 0 Prd: 0 Coupons: Cpn Spot Rates: h1 Price =4 1 ? Cpn1 (1 +h1)1 Cpn h2 1.0 2 ? ? Cpn2 (1 + h2)^2 Use the following space to set up the "NPV formula" to calculate h3: Cpn h3 1.5 3 z1.5+2 Cpn3 + Face (1 +h3)^3 101.810000= : : : h3 = ? z1.5 = ? d) Finally, calculate the Spot Rate for z2. Reminder: work in periods and periodic rates. It is helpful to do the calculations with the following cash flow timeline; label data appropriately. For z2 [i.e. h4] Year: Period t 0 0 1 1.0 2 Cpn: Spot Rate ht: Use the following space to set up the "NPV formula" to calculate h4: 1.5 3 2.0 4 ? h4 99.864327 = Put your response below: : : : : h4 = ? Z2 = ? + + e) In this question, explain how did we got the Treasury price with a maturity of "1.5 years"? Item [*]. In the lecture notes, it was a stated fact that US Treasurys are in maturities of 1-, 2-, 3-, 6-months, 1-, 2-, 3-, 5- , 7-, 10-, and 30-year ... ... and that the "gaps" of the Spot Rates of the missing maturities are interpolated with "cubic spline". Hint: [] See textbook for how Treasury with 1.5 year maturity is gotten. [ii] And what are "on-the-run" Treasury issues?

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

We have PV Price x n ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started