Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCOUNTING 3313 Chapter 7 Bad Debts, the Allowance for Doubtful Accounts and Notes Reeeivable Exercise 1: Bad Debts and the Allowance for Doubtful Accounts Westmoreland

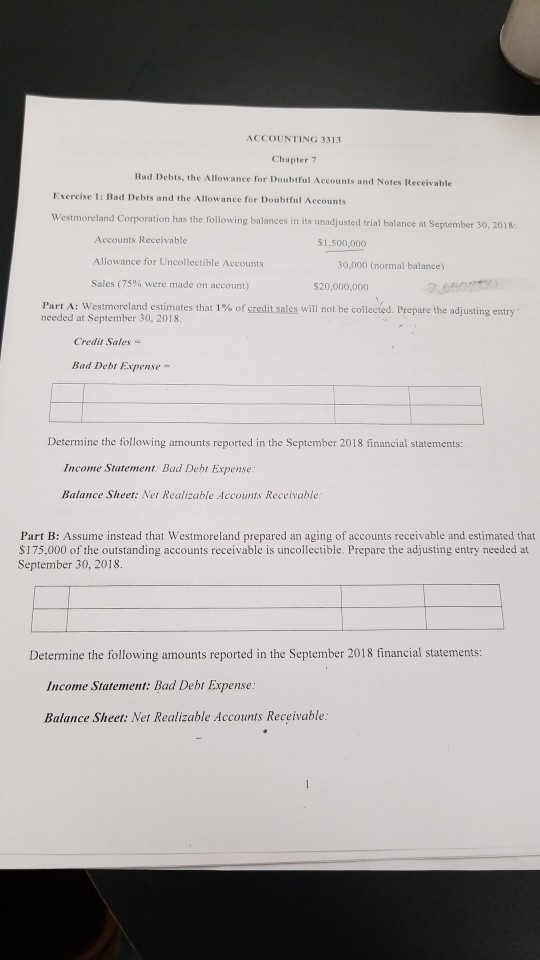

ACCOUNTING 3313 Chapter 7 Bad Debts, the Allowance for Doubtful Accounts and Notes Reeeivable Exercise 1: Bad Debts and the Allowance for Doubtful Accounts Westmoreland Corporation has the following balances in its unadjusted trial balance at September 30, 2018 Accounts Receivable Allowance for Uncollectible Accounts Sales (75% were made on account) $1,500,000 30,000 (normal balance) Part A: Westmoreland estimates that 1% of creditsales will not be collected. Prepare the adjusting entry needed at September 30, 2018. Credit Sales Bad Debt Expense Determine the following amounts reported in the September 2018 financial statements: Income Statement Bad Debt Expense Balance Sheet: Net Realizable Accounts Receivable Part B: Assume instead that Westmoreland prepared an aging of accounts receivable and estimated that $175,000 of the outstanding accounts receivable is uncollectible. Prepare the adjusting entry needed at September 30, 2018. Determine the following amounts reported in the September 2018 financial statements: Income Statement: Bad Debt Expense Balance Sheet: Net Realizable Accounts Receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started