Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC reported a pretax GAAP loss of ($200,000) for the year ended December 31, 2020. ABC's tax accounting methods and GAAP accounting methods are

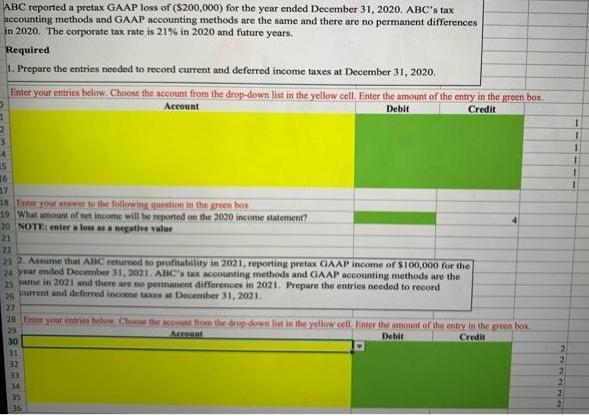

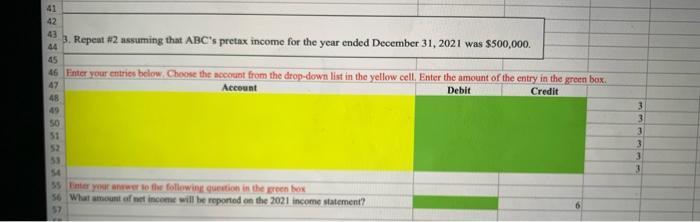

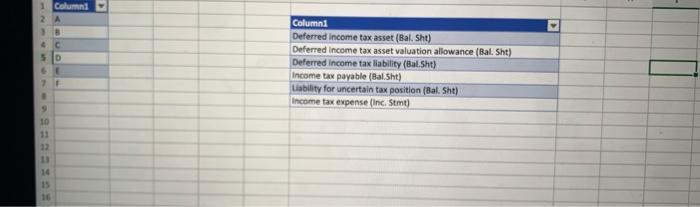

ABC reported a pretax GAAP loss of ($200,000) for the year ended December 31, 2020. ABC's tax accounting methods and GAAP accounting methods are the same and there are no permanent differences in 2020. The corporate tax rate is 21% in 2020 and future years. Required 1. Prepare the entries needed to record current and deferred income taxes at December 31, 2020. 1 2 3 4 15 16 Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Account Debit Credit 17 18 Enter your answer to the following question in the green box 19 What amount of net income will be reported on the 2020 income statement? 20 NOTE: enter a loss as a negative value 21 22 23 2. Assume that ABC returned to profitability in 2021, reporting pretax GAAP income of $100,000 for the 24 year ended December 31, 2021. ABC's tax accounting methods and GAAP accounting methods are the 25 same in 2021 and there are no permanent differences in 2021. Prepare the entries needed to record 25 current and deferred income taxes at December 31, 2021. 27 20 Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box 29 Account Debit Credit 30 32 33 34 35 36 2 2 2 2 2 2 41 42 43 3. Repeat #2 assuming that ABC's pretax income for the year ended December 31, 2021 was $500,000. 44 45 46 Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Account 47 Debit Credit 48 49 50 51 53 54 55 Enter your answer to the following question in the green box 56 What amount of net income will be reported on the 2021 income statement? 57 3 3 3 3 3 3 1 Column1 2 A 10 11 12 13 14 15 Column1 Deferred income tax asset (Bal. Sht) Deferred Income tax asset valuation allowance (Bal. Sht) Deferred income tax liability (Bal.Sht) Income tax payable (Bal.Sht) Liability for uncertain tax position (Bal. Sht) Income tax expense (Inc. Stmt)

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Since there are no temporary differences noted there is no entry using de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started