Answered step by step

Verified Expert Solution

Question

1 Approved Answer

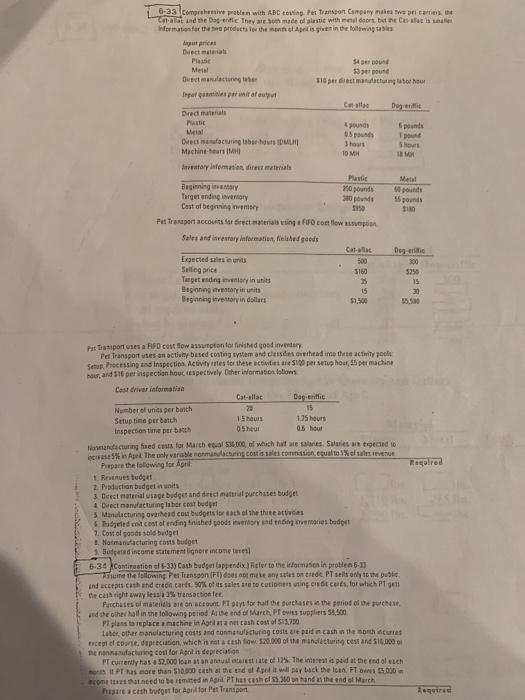

6-33 Comprehensive problem with ABC costing. Per Transport Company makes two pri carries Cat-alat and the Dog-erific They are both made of plastic with

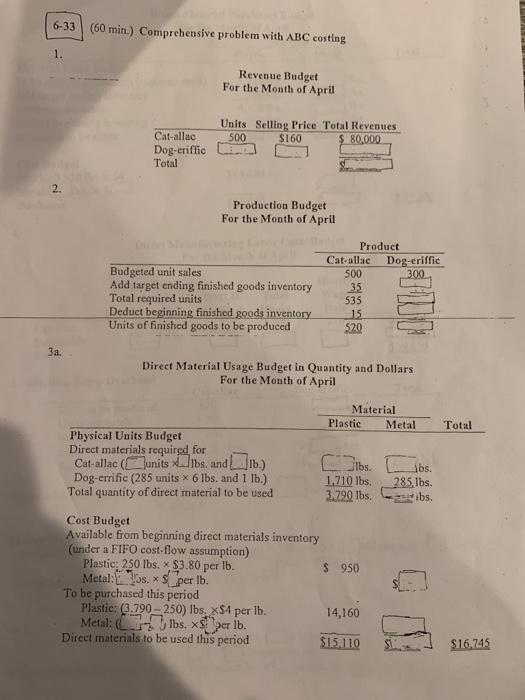

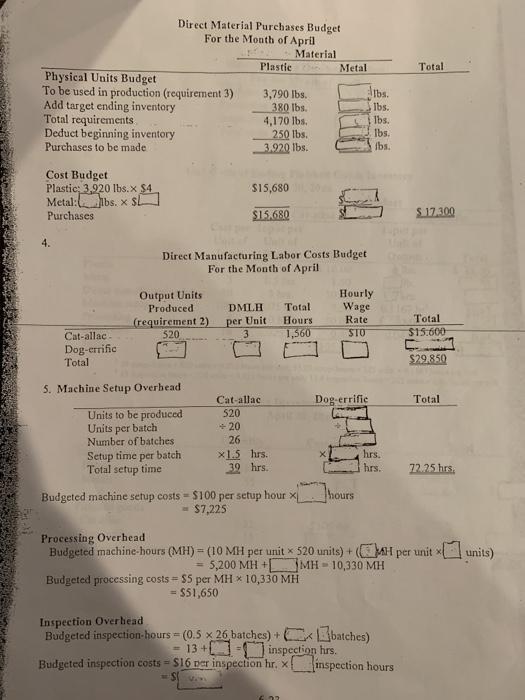

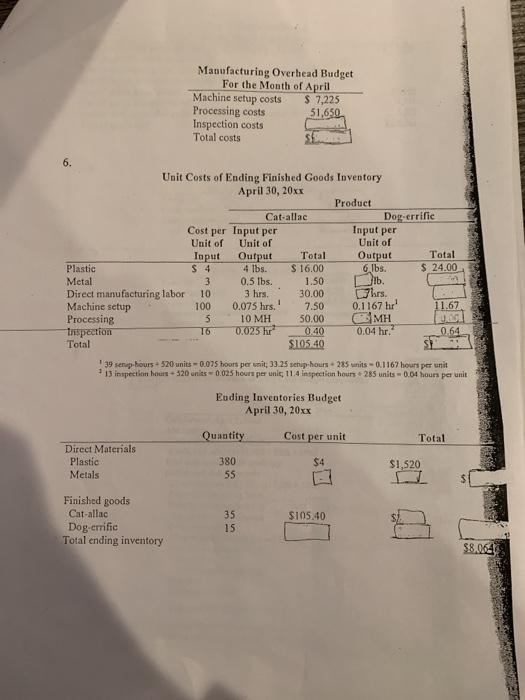

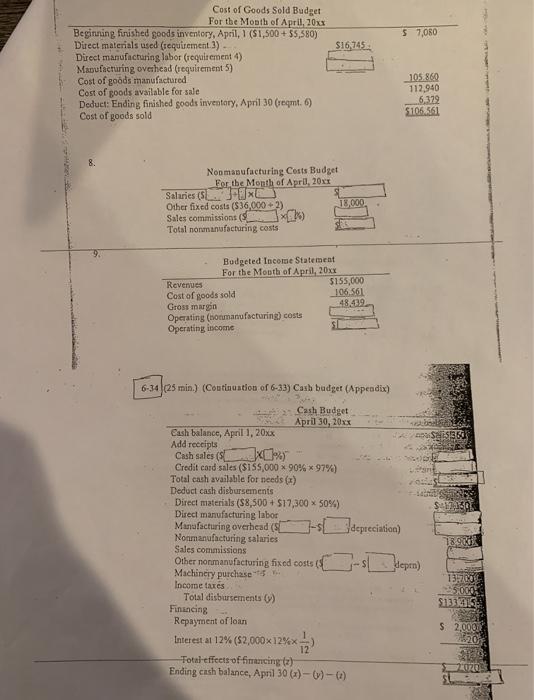

6-33 Comprehensive problem with ABC costing. Per Transport Company makes two pri carries Cat-alat and the Dog-erific They are both made of plastic with meal doors, but the Cas-affa in ma information for the products for the month of April is given in the following tables prices Diect materials Plassic Metal Dect manulacturing taber Inpot quantities per unit of output Expected sales in units Selling price Target ending inventory in units Drect materials Plastic Metal Direct manufacturing taber-hours IDMLHI Machine-heurs (MH) Inventory information, direcz materials Beginning intory Target ending inventory Cast of beginning inventory Pet Transport accounts for direct materials using a FIFO cost flow assumption Sales and investory information, finished goods Beginning inventory in units Beginning inventory in dollars Number of units per batch Setup time per batch Inspection time per batch Cat-allac 29 15 hours 05hour 54 per pound 53 per pound $10 per direct manufacturing labor hour Dog-erific 15 Call 1.75 hours 0.5 hour 1. Revenues budget 2. Production budget in units 3. Derect material usage budget and direct material purchases budget 4 Direct manufacturing labor cost budget 7. Cost of goods sold budget 8. Normanufacturing costs budget 3. Budgeted income statement lignore income tares) 4 pounds 0.5 pounds 1 hours 10 MH Pat Transport uses a FIFO cost flow assumption for finished good inventory Pet Transport uses an activity based costing system and clessidies overhead ime three actity pools Setup, Processing and Inspection Activity rates for these activities are $100 per setup hour, 55 per machine hour, and 116 per inspection hout respectively. Other information follows Cast driver information Plastic 250 pounds 300 pounds 5150 Car- 500 $160 25 15 5 Manulacturing overhead cost budgets for each of the three activies & Budgeted unit cost of ending finished goods inventory and ending vemories budget Dogrific Nomandecturing fixed cests for March equal $36.000, of which halt ate salaries. Salaries are expected to ecrease 5% in Apel The only variable nonmanufacturing cost is sales commission, equal to 1% of sales revenue Prepare the following for Agrit 5 pounds 1 pound Shours 18MM Metal 60 pounds 55 pounds $10 Deg-erific 300 $250 6-34 Continuation of 6-33) Cash budget lappendix) Rister to the information in problem 5-13 Assume the following Pet Transpon (PT) does not make any sales on crede. PT sells only to the public and accepts cash and crede cards. 90% of its sales are to customers using credit cards, for which P1 get the cash right away lessia 3% transaction fee. 15 30 55,500 Purchases of materials are on account FT pays for half the purchases is the period of the purchase. and the other hall in the following period. At the end of March, PT owes suppliers 58,500 PT plans to replace a machine in Agril as a net cash cost of $3,750 Laber, other manufacturing costs and conmanufacturing costs are paid in cash in the north incurres Except of course. reciation, which is not a cash flow $20,000 of the manufacturing cest and $10,000 the nannanufacturing cost for April is depreciation PT currently has a $2,000 loan at an annual interest rate of 12%. The interest is paid at the end of each month I PT has more than $10,000 cash at the end of Aped it will pay back the loan. FT owes 15.000 come tes that need to be remited in April PT has cash of 55.360 on hand at the end of March Prasare a cesh budget for April for Pet Transport Required Aequired 6-33 (60 min.) Comprehensive problem with ABC costing 1. 2. 3a. Cat-allac Dog-eriffic Total Revenue Budget For the Month of April Units Selling Price Total Revenues 500 $160 $ 80,000 Production Budget For the Month of April Budgeted unit sales Add target ending finished goods inventory Total required units Deduct beginning finished goods inventory Units of finished goods to be produced Physical Units Budget Direct materials required for Cat-allac (units lbs. and lb.) Dog-errific (285 units x 6 lbs. and 1 lb.) Total quantity of direct material to be used Cost Budget Available from beginning direct materials inventory (under a FIFO cost-flow assumption) Product Plastic: 250 lbs. x $3.80 per lb. Metal: os. x per lb. To be purchased this period Plastic: (3.790-250) lbs. x$4 per lb. Metal: (lbs. x$per lb. Direct materials to be used this period Cat-allac 500 35 535 Direct Material Usage Budget in Quantity and Dollars For the Month of April 15 $20 Material Plastic lbs. 1,710 lbs. 3.790 lbs. Dog-eriffic 300 $ 950 14,160 $15.110 Metal jbs. 285, lbs. ibs. Total $16.745 Physical Units Budget To be used in production (requirement 3) Add target ending inventory Total requirements Deduct beginning inventory Purchases to be made i Direct Material Purchases Budget For the Month of April Material Cost Budget Plastic; 3,920 lbs.x $4 Metal: bs. x SL Purchases Output Units Produced (requirement 2) 520 Plastic Cat-allac- Dog-errific Total 5. Machine Setup Overhead. Units to be produced Units per batch Number of batches Setup time per batch Total setup time 3,790 lbs. 380 lbs. 4,170 lbs. 250 lbs. 3.920 lbs. $15,680 $15.680 Direct Manufacturing Labor Costs Budget For the Month of April Cat-allac 520 +20 26 DMLH Total per Unit Hours 1,560 x1.5 hrs.. 30 hrs. Budgeted machine setup costs = $100 per setup hour x = $7,225 Metal Hourly Wage Rate STO Dog-errific 27 hours lbs. lbs. lbs. lbs. fbs. hrs. hrs. Inspection Overhead Budgeted inspection-hours= (0.5 x 26 batches) + batches) 13+ inspection hrs. Budgeted inspection costs = $16 per inspection hr. x inspection hours St Total $17.300 Total $15.600 $29.850 Processing Overhead Budgeted machine-hours (MH) = (10 MH per unit x 520 units) + (H per unit units) 5,200 MH+[ MH-10,330 MH Budgeted processing costs $5 per MH * 10,330 MH = $51,650 Total 72.25 hrs. Plastic Metal Direct manufacturing labor Machine setup Processing Inspection Total Direct Materials Plastic Metals: Manufacturing Overhead Budget For the Month of April Machine setup costs Finished goods Cat-allac Dog-errific Total ending inventory Processing costs Inspection costs Total costs Unit Costs of Ending Finished Goods Inventory April 30, 20xx Product Cost per Input per Unit of Unit of Input $4 3 10 100 5 16 3 hrs. 0.075 hrs. 10 MH 0.025 hr Output 4 lbs. 0.5 lbs. Cat-allac Quantity 380 55 35 15 $ 7,225 51,650 . SE 1 Ending Inventories Budget i April 30, 20xx Cost per unit $4 Total $16.00 1.50 30.00 7.50 50.00 0.40 $105.40 Dog-errific $105.40 Input per Unit of 39 serup-hours + 520 units-0.075 hours per unit, 33.25 senap-hours 285 units-0.1167 hours per unit 13 inspection hours 520 units-0.025 hours per unit; 11.4 inspection hours 285 units-0.04 hours per unit Output 6 lbs. b. hrs. 0.1167 hr 0.04 hr. Total $ 24.00 M 11.67 $1,520 0.64 Total $8.0640 TE NORMA Cost of Goods Sold Budget For the Month of April, 20xx Beginning finished goods inventory, April, 1 ($1,500+ $5,580) Direct materials used (requirement 3)- Direct manufacturing labor (requirement 4) Manufacturing overhead (requirement 5) Cost of goods manufactured Cost of goods available for sale. Deduct: Ending finished goods inventory, April 30 (reqmt. 6) Cost of goods sold Nonmanufacturing Costs Budget For the Month of April, 20xx Salaries (S Other fixed costs ($36,000+2) Sales commissions (x) Total nonmanufacturing costs Budgeted Income Statement For the Month of April, 20xx Revenues Cost of goods sold Gross margin Operating (nonmanufacturing) costs Operating income Cash balance, April 1, 20xx Add receipts $16,745 Cash sales (S 6-34 (25 min.) (Continuation of 6-33) Cash budget (Appendix) Cash Budget April 30, 20xx Sales commissions Other nonmanufacturing fixed costs i Machinery purchase Income taxes. Total disbursements (v) X%) Credit card sales ($155,000* 90% * 97%) Total cash available for needs (x) Deduct cash disbursements Direct materials ($8,500+ $17,300 x 50%) Direct manufacturing labor Financing Repayment of loan Interest at 12% ($2,000x12%*- 18,000 $155,000 106.561 48.439 S 1/2 Manufacturing overhead (S-s depreciation) Nonmanufacturing salaries $7,080 Total effects of financing (2) Ending cash balance, April 30 (x)-(v)-(1) 105.860 112,940 6,379 $106.561 depen) $350 $1332415 $ 2,000 20209

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

5 Manufacturing overhead cost budgets for each of the three activities Machine Setup overhead Catall...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started