Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7/1 owner put in 50g into company 8/1 company signed 10 year lease for space beginning 9/1. Rent 5g/mo. At signing company paid the

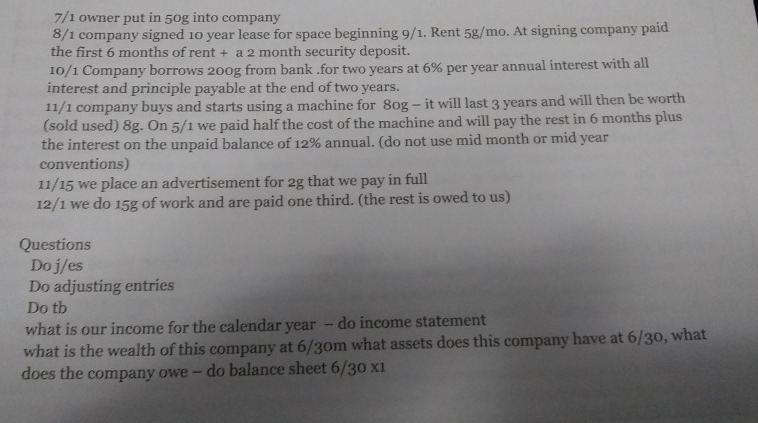

7/1 owner put in 50g into company 8/1 company signed 10 year lease for space beginning 9/1. Rent 5g/mo. At signing company paid the first 6 months of rent + a 2 month security deposit. 10/1 Company borrows 200g from bank .for two years at 6% per year annual interest with all interest and principle payable at the end of two years. 11/1 company buys and starts using a machine for 8og - it will last 3 years and will then be worth (sold used) 8g. On 5/1 we paid half the cost of the machine and will pay the rest in 6 months plus the interest on the unpaid balance of 12% annual. (do not use mid month or mid year conventions) 11/15 we place an advertisement for 2g that we pay in full 12/1 we do 15g of work and are paid one third. (the rest is owed to us) Questions Do j/es Do adjusting entries Do tb what is our income for the calendar year - do income statement what is the wealth of this company at 6/30m what assets does this company have at 6/30, what does the company owe - do balance sheet 6/30 xi

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Does the company need to do adjusting entries Answer Yes the company needs to do adjusting entries Adjusting entries are necessary to ensure that the companys financial statements such as t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started