Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting #8 Part C Drop Down Options: A. Depreciation B. Taxes and maintenance costs C. Depreciation and Taxes D. Maintenance Cost E. Taxes (Please answer

Accounting #8

Part C Drop Down Options:

A. Depreciation

B. Taxes and maintenance costs

C. Depreciation and Taxes

D. Maintenance Cost

E. Taxes

(Please answer all parts of the question)

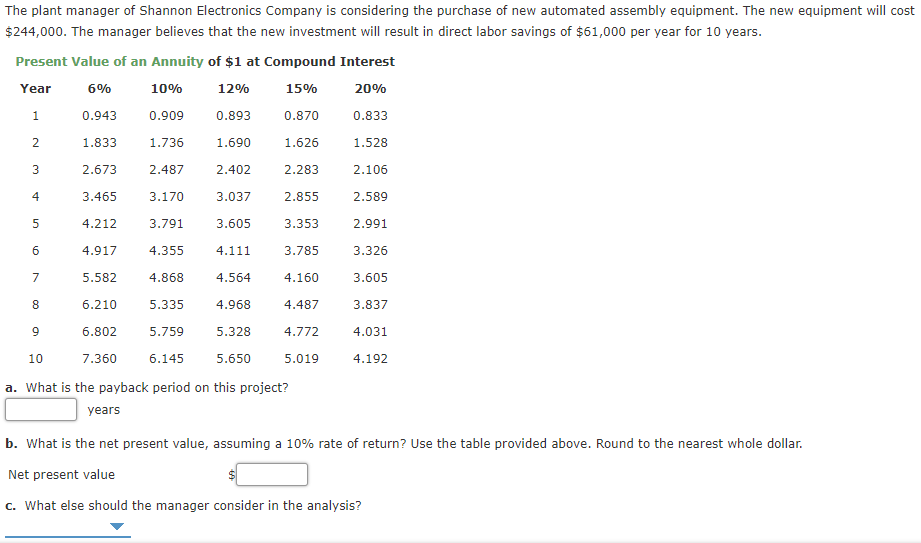

The plant manager of Shannon Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $244,000. The manager believes that the new investment will result in direct labor savings of $61,000 per year for 10 years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.870 0.833 1.626 1.528 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 4.031 4.192 9 6.802 5.759 5.328 4.772 10 7.360 6.145 5.650 5.019 a. What is the payback period on this project? years b. What is the net present value, assuming a 10% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value c. What else should the manager consider in the analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started