Answered step by step

Verified Expert Solution

Question

1 Approved Answer

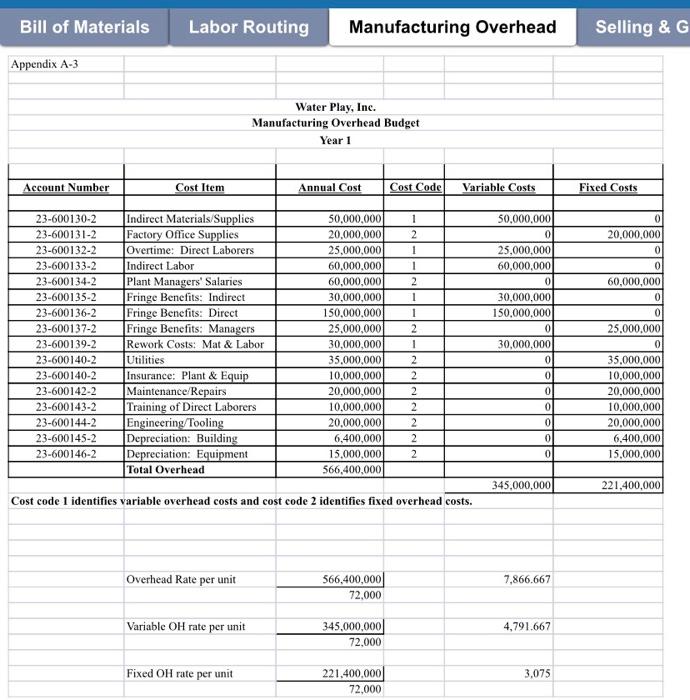

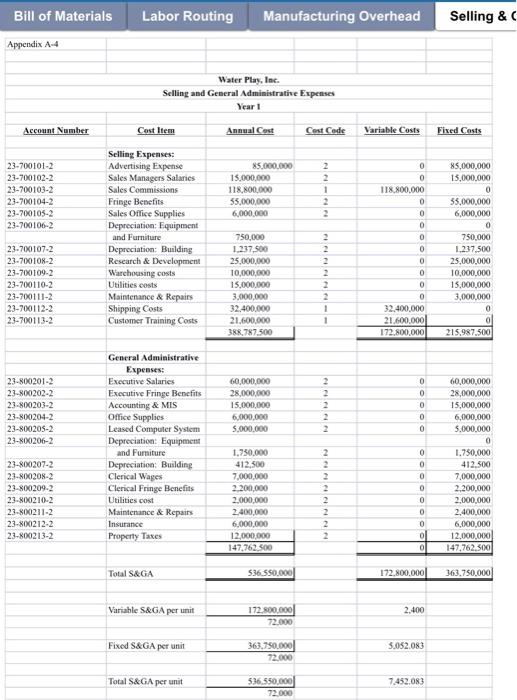

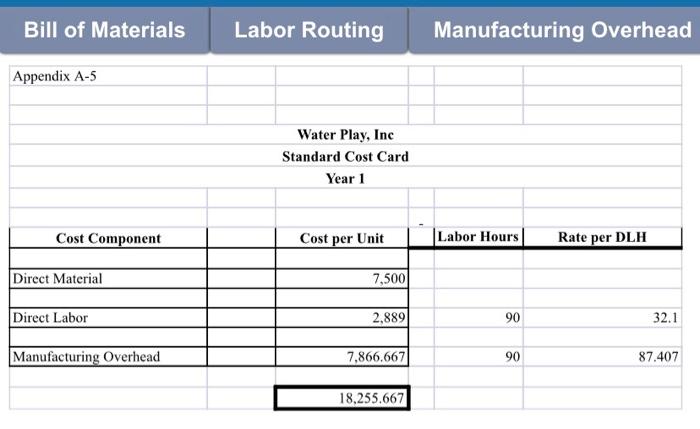

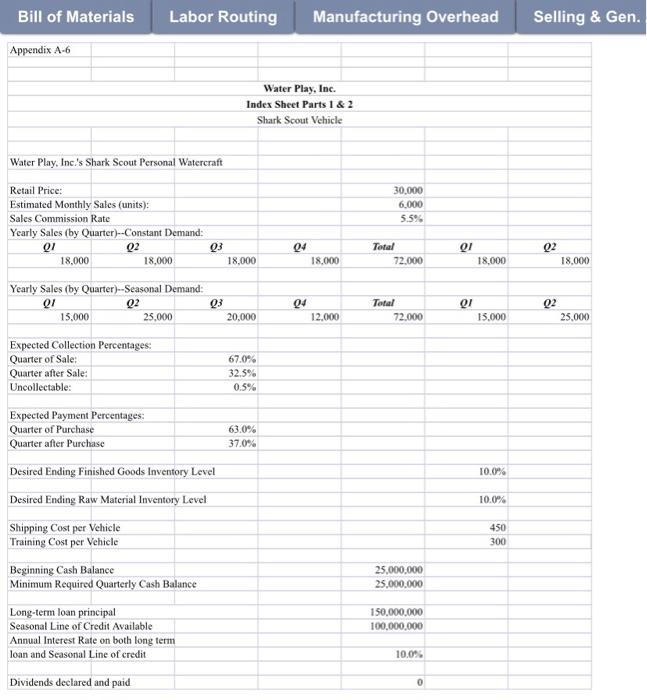

1. Identify the following information about the costs in the bill of materials, labor routing, manufacturing overhead and the selling and general administrative expense

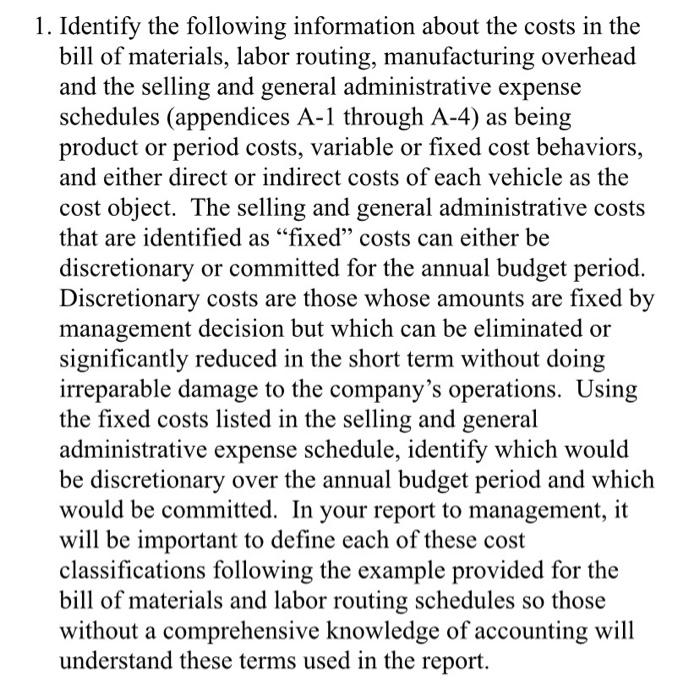

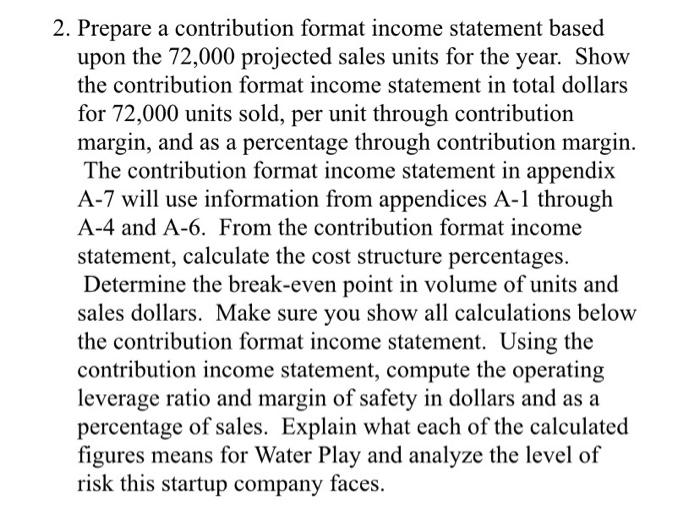

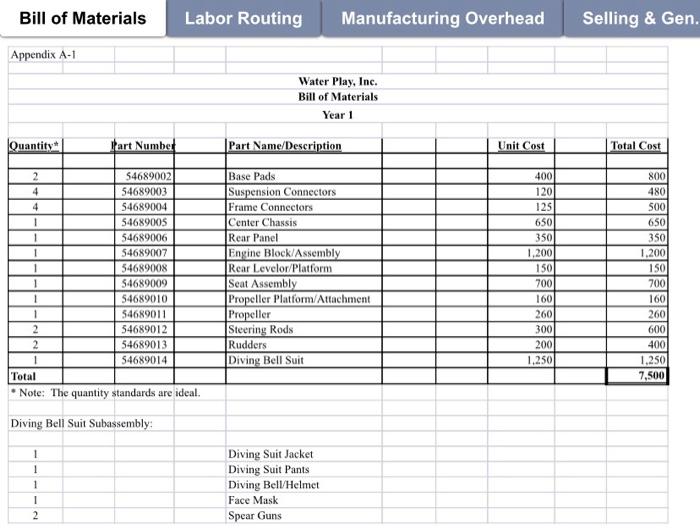

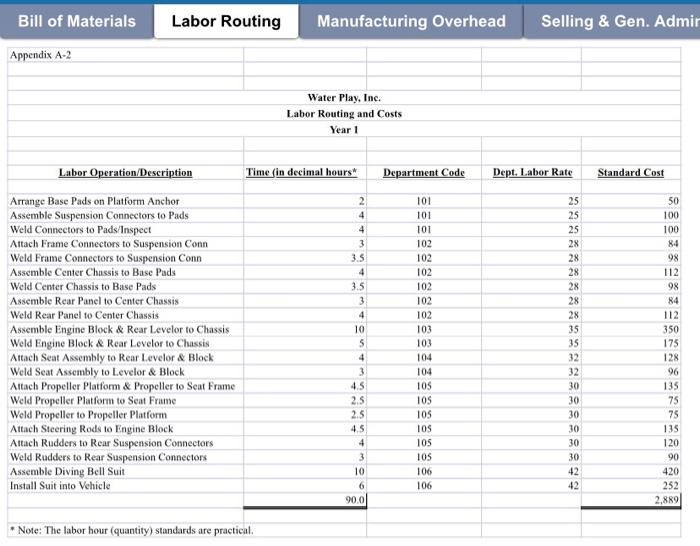

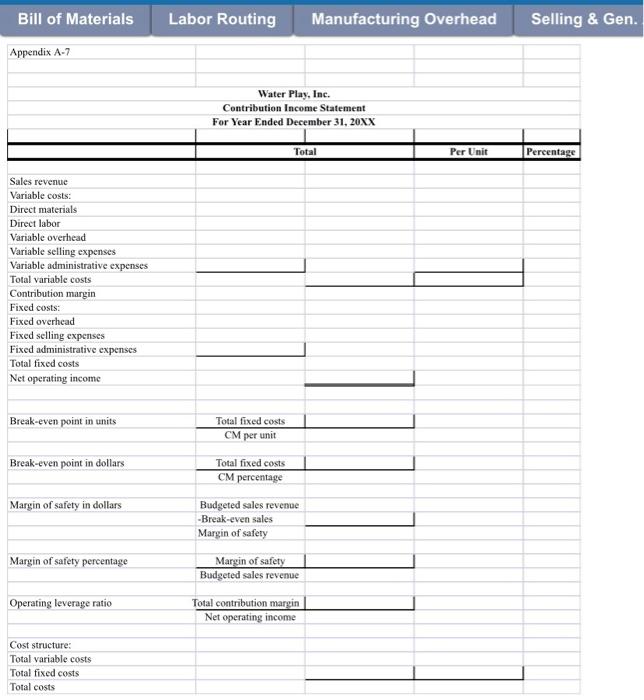

1. Identify the following information about the costs in the bill of materials, labor routing, manufacturing overhead and the selling and general administrative expense schedules (appendices A-1 through A-4) as being product or period costs, variable or fixed cost behaviors, and either direct or indirect costs of each vehicle as the cost object. The selling and general administrative costs that are identified as "fixed" costs can either be discretionary or committed for the annual budget period. Discretionary costs are those whose amounts are fixed by management decision but which can be eliminated or significantly reduced in the short term without doing irreparable damage to the company's operations. Using the fixed costs listed in the selling and general administrative expense schedule, identify which would be discretionary over the annual budget period and which would be committed. In your report to management, it will be important to define each of these cost classifications following the example provided for the bill of materials and labor routing schedules so those without a comprehensive knowledge of accounting will understand these terms used in the report. 2. Prepare a contribution format income statement based upon the 72,000 projected sales units for the year. Show the contribution format income statement in total dollars for 72,000 units sold, per unit through contribution margin, and as a percentage through contribution margin. The contribution format income statement in appendix A-7 will use information from appendices A-1 through A-4 and A-6. From the contribution format income statement, calculate the cost structure percentages. Determine the break-even point in volume of units and sales dollars. Make sure you show all calculations below the contribution format income statement. Using the contribution income statement, compute the operating leverage ratio and margin of safety in dollars and as a percentage of sales. Explain what each of the calculated figures means for Water Play and analyze the level of risk this startup company faces. Bill of Materials Labor Routing Manufacturing Overhead Selling & Gen. Appendix A-1 Water Play, Inc. Bill of Materials Year 1 Quantity* Part Number Part Name/Deseription Unit Cost Total Cost Base Pads Suspension Connectors Frame Connectors 2 54689002 400 800 4 54689003 120 480 4 54689004 125 500 54689005 Center Chassis 650 650 Rear Panel Engine Block/Assembly Rear Levelor/Platform Seat Assembly Propeller Platform/Attachment Propeller Steering Rods Rudders Diving Bell Suit 54689006 350 350 54689007 1,200 1,200 54689008 150 150 54689009 700 700 54689010 160 160 54689011 260 260 2 54689012 300 600 2 54689013 200 400 54689014 1,250 1,250 Total 7,500 Note: The quantity standards are ideal. Diving Bell Suit Subassembly: Diving Suit Jacket Diving Suit Pants Diving Bell/Helmet 1 Face Mask Spear Guns Bill of Materials Labor Routing Manufacturing Overhead Selling & Gen. Admir Appendix A-2 Water Play, Inc. Labor Routing and Costs Year 1 Labor Operation/Description Time (in decimal hours" Department Code Dept. Labor Rate Standard Cost Arrange Base Pads on Platform Anchor Assemble Suspension Connectors to Pads Weld Connectors to Pads/Inspect Attach Frame Connectors to Suspension Conn Weld Frame Connectors to Suspension Conn 2 101 25 50 4 101 25 100 4 101 25 100 3. 102 28 84 3.5 102 28 98 Assemble Center Chussis to Base Pads 4 102 28 112 Weld Center Chassis to Base Pads 3.5 102 28 98 Assemble Rear Panel to Center Chassis 3. 102 28 84 Weld Rear Panel to Center Chassis 4 102 28 112 Assemble Engine Block & Rear Levelor to Chassis Weld Engine Block & Rear Levelor to Chassis Attach Seat Assembly to Rear Levelor & Block Weld Seat Assembly to Levelor & Block Attach Propeller Platform & Propeller to Seat Frame Weld Propeller Platform to Seat Frame Weld Propeller to Propeller Platform 10 103 35 350 103 35 175 4 104 32 128 3. 104 32 96 4.5 105 30 135 2.5 105 30 75 2.5 105 30 75 Attach Steering Rods to Engine Block 4.5 105 30 135 Attach Rudders to Rear Suspension Connectors Weld Rudders to Rear Suspension Connectors Assemble Diving Bell Suit Install Suit into Vehicle 105 30 120 3. 105 30 90 10 106 42 420 106 42 252 90.0 2,889 Note: The labor hour (quantity) standards are practical. Bill of Materials Labor Routing Manufacturing Overhead Selling & G Appendix A-3 Water Play, Inc. Manufacturing Overhead Budget Year 1 Account Number Cost Item Annual Cost Cost Code Variable Costs Fixed Costs Indirect Materials/Supplies Factory Office Supplies Overtime: Direct Laborers Indirect Labor Plant Managers' Salaries Fringe Benefits: Indirect Fringe Benefits: Dircct Fringe Benefits: Managers Rework Costs: Mat & Labor 23-600130-2 50,000,000 50,000,000 23-600131-2 20,000,000 2 20,000,000 25,000,000 60,000,000 23-600132-2 25,000,000 23-600133-2 60,000,000 23-600134-2 60,000,000 ol 60,000,000 23-600135-2 30,000,000 30,000,000 23-600136-2 150,000,000 150,000,000 23-600137-2 25,000,000 2 25,000,000 23-600139-2 30,000,000 30,000,000 35,000,000 10,000,000 20,000,000 10,000,000 23-600140-2 Utilities 35,000,000 Insurance: Plant & Equip Maintenance/Repairs Training of Direct Laborers Engineering/Tooling Depreciation: Building Depreciation: Equipment Total Overhead 23-600140-2 10,000,000 2 20,000,000 10.000,000 23-600142-2 2 23-600143-2 23-600144-2 20,000,000 20,000,000 23-600145-2 6,400,000 2 6,400,000 23-600146-2 15,000,000 2 15,000,000 566,400,000 345,000,000 221,400,000 Cost code 1 identifies variable overhead costs and cost code 2 identifies fixed overhead costs. Overhead Rate per unit 566,400,000| 7,866.667 72,000 Variable OH rate per unit 345,000,000| 4,791.667 72,000 Fixed OH rate per unit 221,400,000 3,075 72,000 Bill of Materials Labor Routing Manufacturing Overhead Selling & ( Appendix A-4 Water Play, Inc. Selling and General Administrative Expenses Year I Account Number Cost Item Annual Cost Cost Code Variable Costs Fixed Costs Selling Expenses: Advertising Expense Sales Managers Salaries Sales Commissions 23-700101-2 85.000.000 85,000,000 23-700102-2 15.000.000 2 15,000,000 118,800,000 55,000,000 23-700103-2 118,800,000 Fringe Benefits Sales Office Supplies Depreciation: Equipment 23-700104-2 55,000,000 23-700105-2 6,000,000 6,000,000 23-700106-2 and Furniture 750,000 750,000 Depreciation: Building Research & Development 23-700107-2 1,237,500 1,237,500 23-700108-2 25,000,000 25,000,000 23-700109-2 Warehousing costs Utilities costs 10,000,000 10,000,000 23-700110-2 15,000,000 3,000,000 15,000,000 3,000,000 23-700111-2 Maintenance & Repairs Shipping Costs Customer Training Costs 23-700112-2 32.400,000 32,400,000 23-700113-2 21.600,000 21.600,000 388,787.500 172,800,000 215,987.500 General Administrative Expenses: Executive Salaries 23-800201-2 60,000,000 60,000,000 23-800202-2 Executive Fringe Benefits Accounting & MIS Office Supplies 28,000,000 28,000,000 23-800203-2 15,000,000 6,000,000 15,000,000 23-800204-2 6,000,000 23-800205-2 Leased Computer System Depreciation: Equipment and Furmiture 5,000,000 5,000,000 23-800206-2 1,750,000 1,750,000 23-800207-2 Depreciation: Building Clerical Wages Clerical Fringe Benefits 412.500 412.500 23-800208-2 7,000,000 7,000,000 23-800209-2 2.200,000 2,200,000 23-800210-2 Utilities cost 2,000,000 2,000,000 23-800211-2 Maintenance & Repairs 2400,000 6,000,000 2,400,000 23-800212-2 Insurance 6,000,000 12,000,000 147,762,500 23-800213-2 Property Taxes 12,000,000 147,762.500 Total S&GA 536.550,000 172,800,000 363,750,000 Variable S&GA per unit 172.800.000 2,400 72.000 Fixed S&GA per unit 363,750.000 5.052.083 72,000 Total S&GA per unit 536.550,000 7.452.083 72.000 NNNN Bill of Materials Labor Routing Manufacturing Overhead Appendix A-5 Water Play, Inc Standard Cost Card Year 1 Cost Component Cost per Unit Labor Hours Rate per DLH Direct Material 7,500 Direct Labor 2,889 90 32.1 Manufacturing Overhead 7,866.667 87.407 90 18,255.667 Bill of Materials Labor Routing Manufacturing Overhead Selling & Gen. Appendix A-6 Water Play, Inc. Index Sheet Parts 1 & 2 Shark Scout Vehicle Water Play, Inc.'s Shark Scout Personal Watercraft Retail Price: 30,000 Estimated Monthly Sales (units): 6,000 Sales Commission Rate 5.5% Yearly Sales (by Quarter)--Constant Demand: Q2 Q3 18,000 Q4 Total Q2 18,000 18,000 18,000 72.000 18,000 18,000 Yearly Sales (by Quarter)--Seasonal Demand: Q2 QI Q3 Q4 Total QI Q2 15,000 25,000 20,000 12,000 72,000 15.000 25,000 Expected Collection Percentages: Quarter of Sale: 67.0% Quarter after Sale: 32.5% Uncollectable: 0.5% Expected Payment Percentages: Quarter of Purchase Quarter after Purchase 63.0% 37.0% Desired Ending Finished Goods Inventory Level 10.0% Desired Ending Raw Material Inventory Level 10.0% Shipping Cost per Vehicle Training Cost per Vehicle 450 300 Beginning Cash Balance Minimum Required Quarterly Cash Balance 25,000,000 25,000.000 Long-term loan principal 150,000,000 Seasonal Line of Credit Available 100,000,000 Annual Interest Rate on both long term loan and Seasonal Line of credit 10.0% Dividends declared and paid Bill of Materials Labor Routing Manufacturing Overhead Selling & Gen. Appendix A-7 Water Play, Inc. Contribution Income Statement For Year Ended December 31, 20XX Total Per Unit Percentage Sales revenue Variable costs: Direct materials Direct labor Variable overhead Variable selling expenses Variable administrative expenses Total variable costs Contribution margin Fixed costs: Fixed overhead Fixed selling expenses Fixed administrative expenses Total fixed costs Net operating income Break-even point in units Total fixed costs CM per unit Total fixed costs CM percentage Break-even point in dollars Margin of safety in dollars Budgeted sales revenue -Break-even sales Margin of safety Margin of safety Budgeted sales revenue Margin of safety percentage Operating leverage ratio Total contribution margin Net operating income Cost structure: Total variable costs Total fixed costs Total costs

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Bill of material Base pads Product cost Variable cost Direct cost Suspension Connectors Product cost Variable cost Direct cost Frame connectors Product cost Variable cost Direct cost Centre Chassis Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started