A dealer receives an invoice from a wholesaler for the purchase of 100 shirts and 300 shorts. The invoice for RM 1,000 (including a

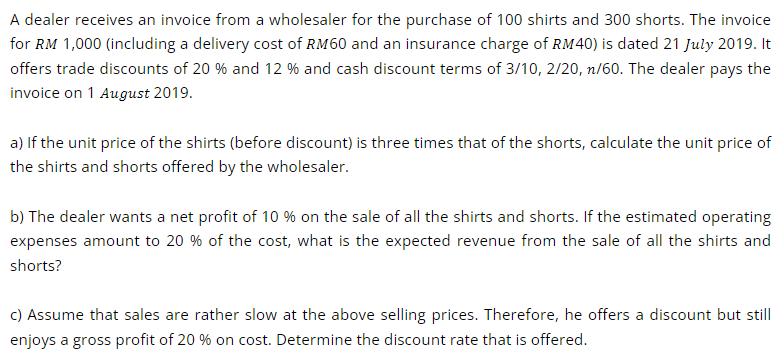

A dealer receives an invoice from a wholesaler for the purchase of 100 shirts and 300 shorts. The invoice for RM 1,000 (including a delivery cost of RM60 and an insurance charge of RM40) is dated 21 July 2019. It offers trade discounts of 20 % and 12 % and cash discount terms of 3/10, 2/20, n/60. The dealer pays the invoice on 1 August 2019. a) If the unit price of the shirts (before discount) is three times that of the shorts, calculate the unit price of the shirts and shorts offered by the wholesaler. b) The dealer wants a net profit of 10 % on the sale of all the shirts and shorts. If the estimated operating expenses amount to 20 % of the cost, what is the expected revenue from the sale of all the shirts and shorts? c) Assume that sales are rather slow at the above selling prices. Therefore, he offers a discount but still enjoys a gross profit of 20 % on cost. Determine the discount rate that is offered.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Par...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started