Answered step by step

Verified Expert Solution

Question

1 Approved Answer

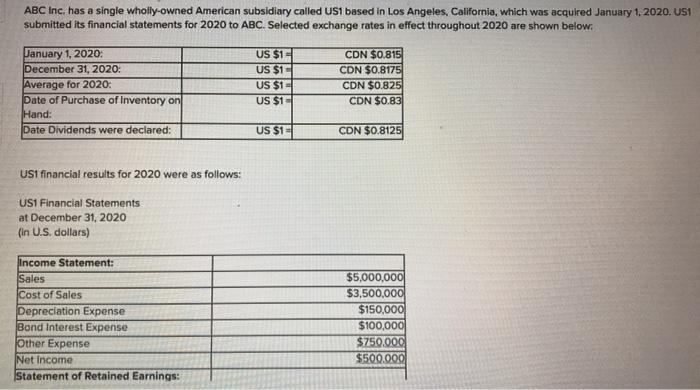

ABC Inc. has a single wholly-owned American subsidiary called US1 based in Los Angeles, California, which was acquired January 1, 2020. US1 submitted its

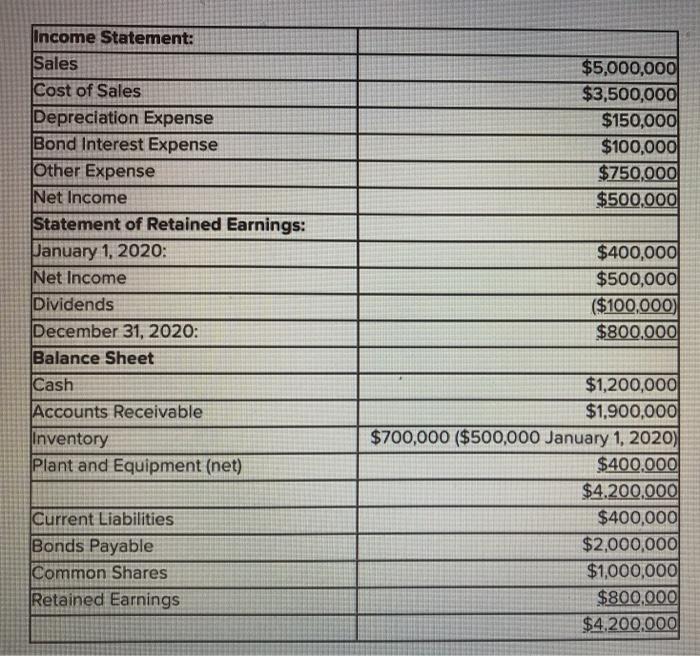

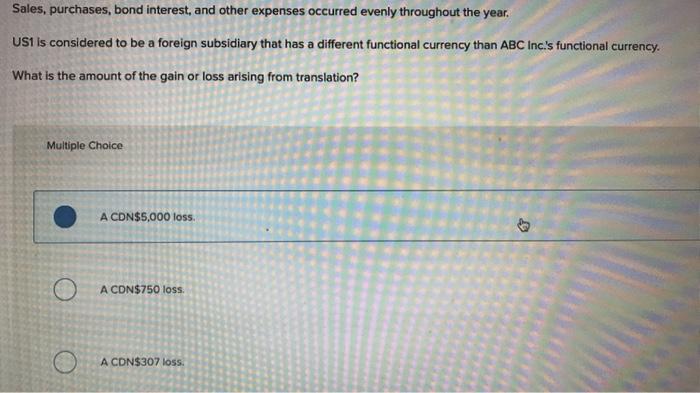

ABC Inc. has a single wholly-owned American subsidiary called US1 based in Los Angeles, California, which was acquired January 1, 2020. US1 submitted its financial statements for 2020 to ABC. Selected exchange rates in effect throughout 2020 are shown below: January 1, 2020: December 31, 2020: Average for 2020: Date of Purchase of Inventory on Hand: US $1- US $1- US $1= US $1- CDN $0.815 CDN $0.8175 CDN $0.825 CDN $0.83 Date Dividends were declared: US $1= CDN $0.8125 USI financial results for 2020 were as follows: USI Financial Statements at December 31, 2020 (in U.S. dollars) Income Statement: Sales Cost of Sales Depreciation Expense Bond Interest Expense Other Expense Net Income $5,000,000 $3,500,000 $150,000 $100,000 $750.000 $500.000 Statement of Retained Earnings: Income Statement: Sales $5,000,000 $3,500,000 $150,000 $100,000 $750,000 $500,000 Cost of Sales Depreciation Expense Bond Interest Expense Other Expense Net Income Statement of Retained Earnings: January 1, 2020: Net Income Dividends December 31, 2020: Balance Sheet Cash Accounts Receivable Inventory Plant and Equipment (net) $400,000 $500,000 ($100,000) $800.000 $1,200,000 $1,900,000 $700,000 ($500,000 January 1, 2020) $400,000 $4.200,000 $400,000 $2,000,000 $1,000,000 $800,000 $4.200,000 Current Liabilities Bonds Payable Common Shares Retained Earnings Sales, purchases, bond interest, and other expenses occurred evenly throughout the year. US is considered to be a foreign subsidiary that has a different functional currency than ABC Inc.'s functional currency. What is the amount of the gain or loss arising from translation? Multiple Choice A CDN$5,000 loss. A CDN$750 loss. A CDN$307 loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer is option 2 A CDN 750 loss Net assets on Jan 12020 common shares reta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started