Answered step by step

Verified Expert Solution

Question

1 Approved Answer

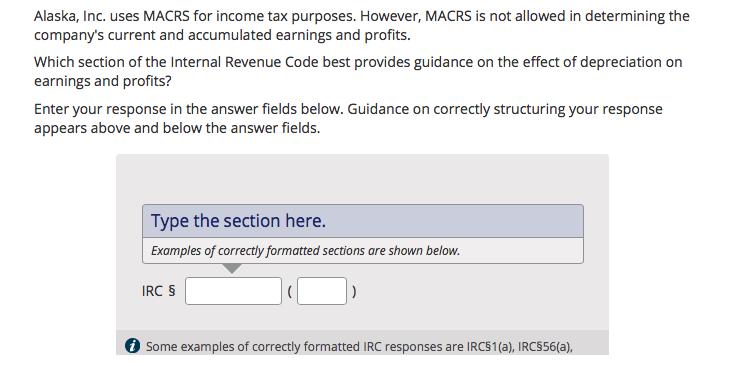

Alaska, Inc. uses MACRS for income tax purposes. However, MACRS is not allowed in determining the company's current and accumulated earnings and profits. Which

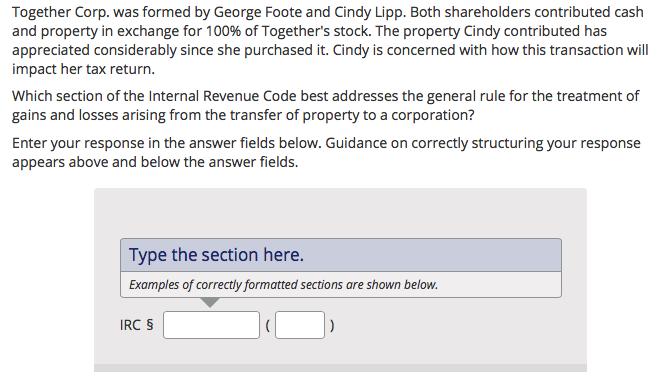

Alaska, Inc. uses MACRS for income tax purposes. However, MACRS is not allowed in determining the company's current and accumulated earnings and profits. Which section of the Internal Revenue Code best provides guidance on the effect of depreciation on earnings and profits? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Type the section here. Examples of correctly formatted sections are shown below. IRC S Some examples of correctly formatted IRC responses are IRCS1(a), IRC$56(a), Together Corp. was formed by George Foote and Cindy Lipp. Both shareholders contributed cash and property in exchange for 100% of Together's stock. The property Cindy contributed has appreciated considerably since she purchased it. Cindy is concerned with how this transaction will impact her tax return. Which section of the Internal Revenue Code best addresses the general rule for the treatment of gains and losses arising from the transfer of property to a corporation? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Type the section here. Examples of correctly formatted sections are shown below. IRC S

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 IRC 312 k provides guidance on the eff...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started