Answered step by step

Verified Expert Solution

Question

1 Approved Answer

n Bhd is a construction company incorporated in 2016. During 2020, the following transactions occurred A piece of land is acquired with a building

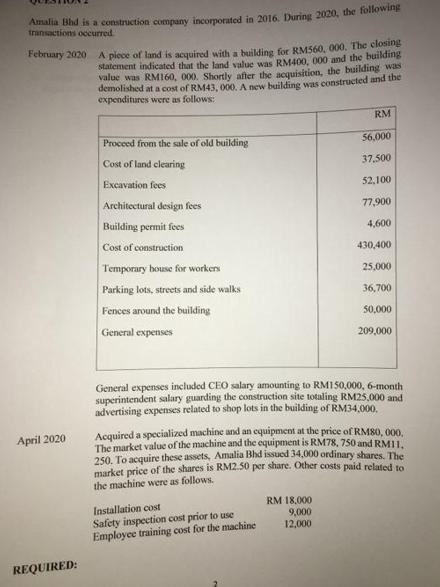

n Bhd is a construction company incorporated in 2016. During 2020, the following transactions occurred A piece of land is acquired with a building for RM560, 000. The closing statement indicated that the land value was RM400, 000 and the building value was RMI60, 000. Shortly after the acquisition, the building was demolished at a cost of RM43, 000, A new building was constructed and the expenditures were as follows: February 2020 RM Procced from the sale of old building 56,000 Cost of land clearing 37.500 Excavation fees 52,100 Architecetural design fees 77,900 Building permit fees 4,600 Cost of construction 430,400 Temporary house for workers 25,000 Parking lots, streets and side walks 36,700 Fences around the building General expenses 50,000 209,000 General expenses included CEO salary amounting to RM150,000, 6-month superintendent salary guarding the construction site totaling RM25,000 and advertising expenses related to shop lots in the building of RM34,000. Acquired a specialized machine and an equipment at the price of RM80, 000, The market value of the machine and the equipment is RM78, 750 and RM11. 250. To acquire these assets, Amalia Bhd issued 34,000 ordinary shares. The market price of the shares is RM2.50 per share. Other costs paid related to April 2020 the machine were as follows. RM 18.000 Installation cost Safety inspection cost prior to use Employee training cost for the machine 9,000 12,000 REQUIRED: (a) Determine the cost of (i) (ii) (iii) Land Building Land improvement (if any) (b) Calculate the cost of specialized machine and equipment purchased in April 2020 and prepare the journal entries.

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

AnswersA i cost of land RM 400000 Working note 1 ii cost of building RM 614500 Working note 2 iii improvement cost RM 86700 Working note 3 Working not...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started