Question

ACCOUNTING AND FINANCE FOR MANAGERS QUESTION 1 The CEO of Inperial Holdings Limited recently said the company is targeting growth in the rest of Africa

ACCOUNTING AND FINANCE FOR MANAGERS

QUESTION 1

The CEO of Inperial Holdings Limited recently said the company is targeting growth in the rest of Africa over the next five years in an effort to diversify revenue streams across a wider range of geographies. The first project in Africa that Inperial Holdings has identified is located in Namibia.

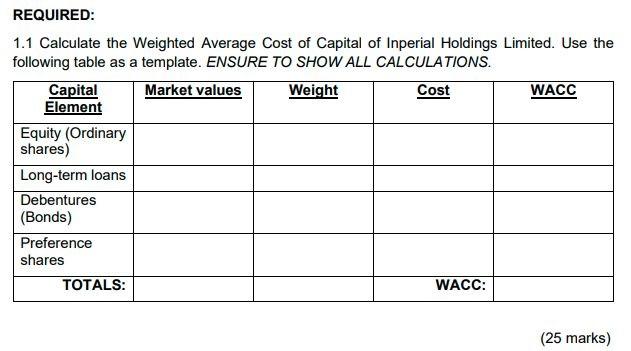

The company has indicated that it will raise financing for the project in South Africa. There is more risk associated with the project because the Namibian trading environment is different to the South African trading environment. Therefore, management has to determine the specific weighted average cost of capital that applies to a project of this nature. Information that may assist management with its calculations is set out below.

Additional information on capital structure and the cost of capital:

Inperial Holdings financial year-end results have recently been released. The companys reported results include 2.1 million issued ordinary shares and earnings after tax of R5.64 million.

Inperials current price/earnings is 13.

Inperial recently declared and paid a dividend of R2.10 per ordinary share.

Over the past few years, the company has maintained a growth rate of 15% per annum in earnings and dividends. This growth rate is sustainable for the foreseeable future.

The company has a long-term loan with a book value of R10 million. The loan will be repaid in full in three years time at a premium of 5%. Similar long-term loans are currently traded in the market at 12% per annum before tax.

Inperial has issued 180 000 12% redeemable debentures with a par value of R100 per debenture. These debentures are currently trading at R102 per debenture. The debentures will be redeemed at a premium of 2% in five years time.

Inperial has 200 000 non-cumulative, non-redeemable preference shares in issue at a nominal value of R80 per share. If market-related dividends were paid, dividends would be R1 800 000. According to the terms of the share, the company may declare R2 000 000 non-cumulative preference dividends in any one year.

The company tax rate is 28% per year.

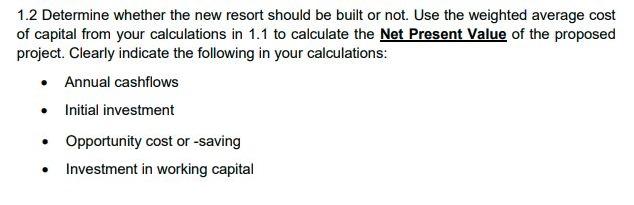

Additional information on the Namibian project:

Inperial Holdings Limited is planning a new resort with 20 units.

The research and development department have given the following estimates:

The proposed rental is R4 000 per unit per night.

Expected occupancy for the first year is 50% increasing to 80% for the following five years.

Due to the highly demanding international tourism, Inperial only budgets on five years per resort at the capital budgeting stage.

The costs associated with the new resort are:

Additional working capital will initially amount to R1 000 000.

The total amount of capital required is R10 000 000 that will be used for the construction of buildings and the purchase of game and equipment. The residual value of the assets should be R3 000 000 at the end of the five years. The assets are not sold at the end of the five years.

The direct cost per night per unit is R1 500 that is only incurred if the unit is occupied. Fixed costs, excluding employee costs of R7 million per annum will also be incurred.

The new resort will be built on land that is currently rented out at R500 000 per year.

A number of staff will be transferred from another resort and will continue receiving their current salaries totalling R1 500 000 per annum. If the project does not go ahead, the employees will be retrenched from their current position and retrenchment costs of R2 000 000 will be incurred.

General head office overheads of R130 000 will be allocated to the project should it go ahead.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started