Answered step by step

Verified Expert Solution

Question

1 Approved Answer

accounting and finance MCQ's 1. Which of the following is NOT considered a manufacturing overhead cost. a. Factory rent b. Grease for the manufacturing equipment

accounting and finance MCQ's

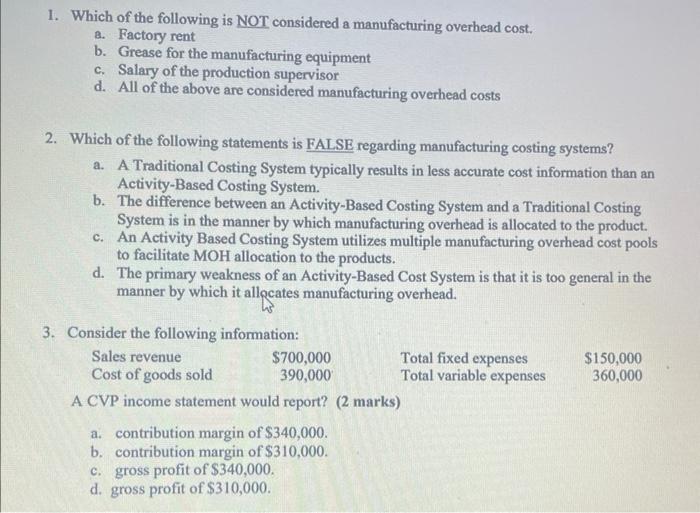

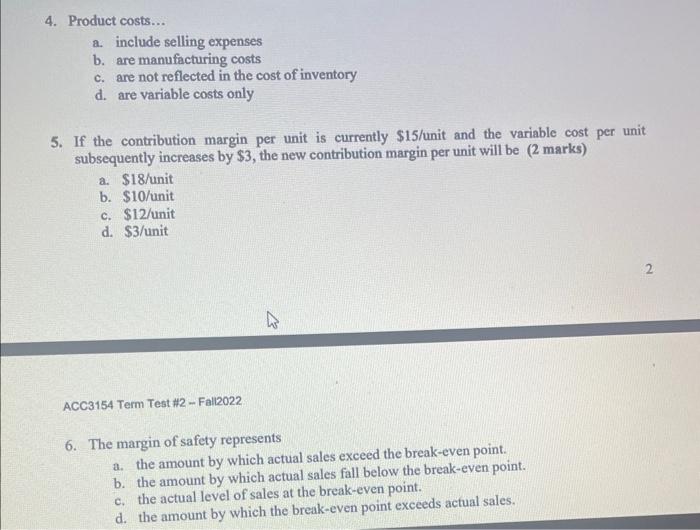

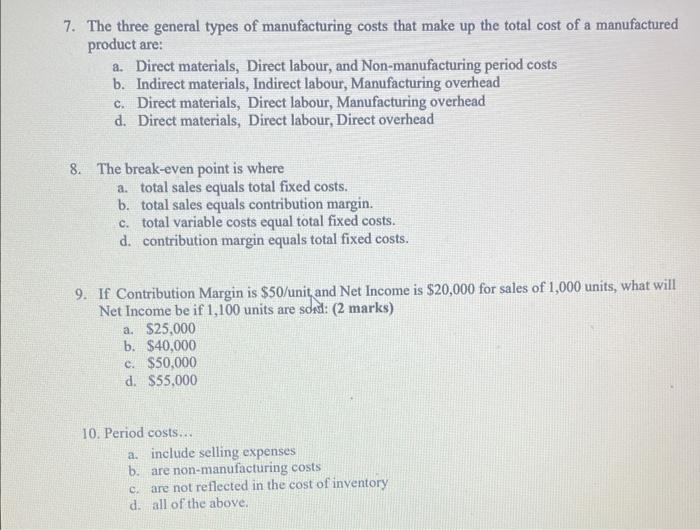

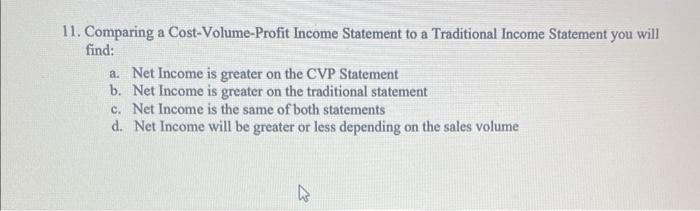

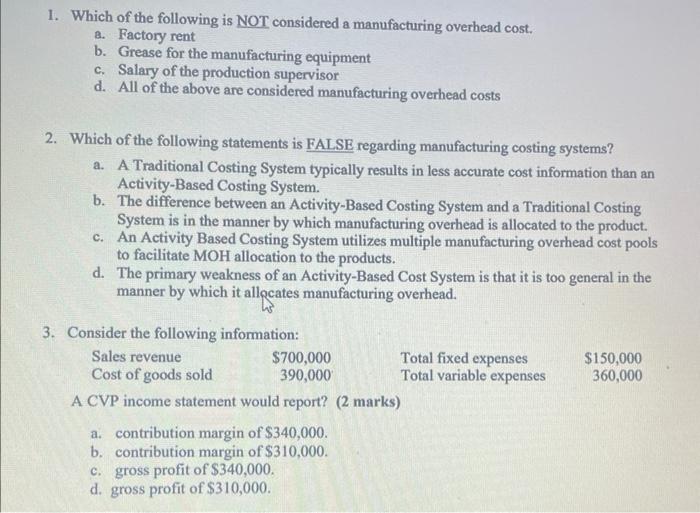

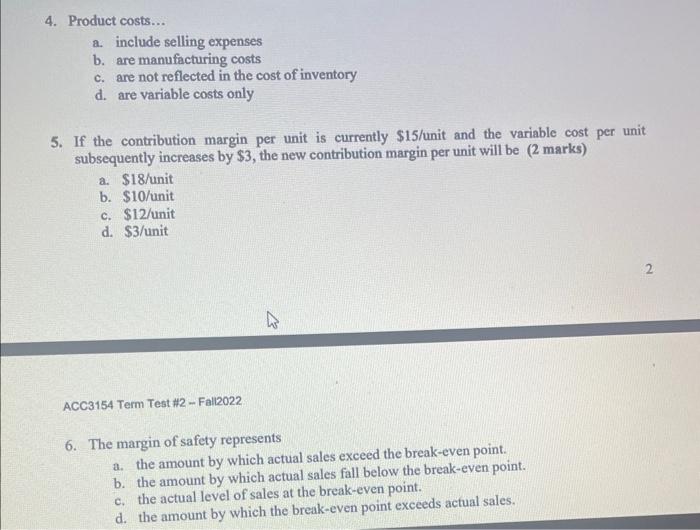

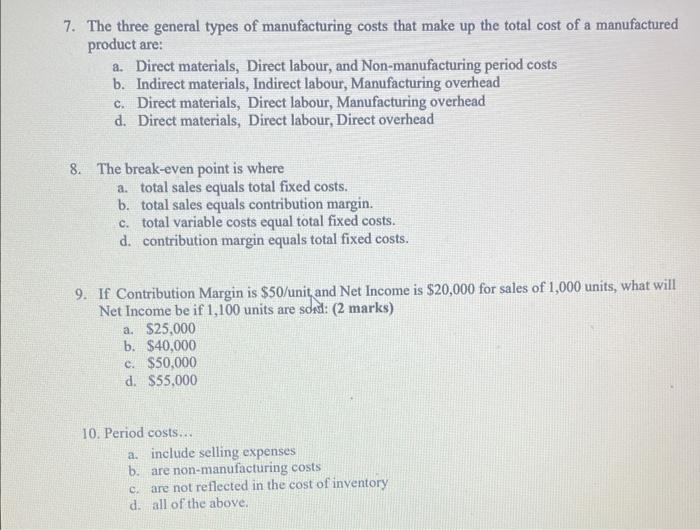

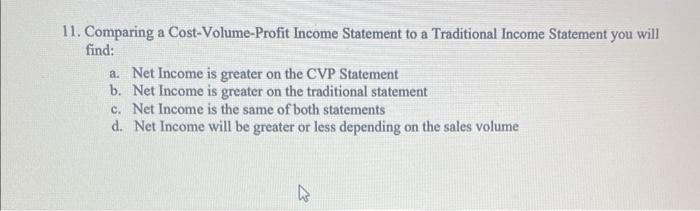

1. Which of the following is NOT considered a manufacturing overhead cost. a. Factory rent b. Grease for the manufacturing equipment c. Salary of the production supervisor d. All of the above are considered manufacturing overhead costs 2. Which of the following statements is FALSE regarding manufacturing costing systems? a. A Traditional Costing System typically results in less accurate cost information than an Activity-Based Costing System. b. The difference between an Activity-Based Costing System and a Traditional Costing System is in the manner by which manufacturing overhead is allocated to the product. c. An Activity Based Costing System utilizes multiple manufacturing overhead cost pools to facilitate MOH allocation to the products. d. The primary weakness of an Activity-Based Cost System is that it is too general in the manner by which it allocates manufacturing overhead. 4. Product costs... a. include selling expenses b. are manufacturing costs c. are not reflected in the cost of inventory d. are variable costs only 5. If the contribution margin per unit is currently $15/ unit and the variable cost per unit subsequently increases by $3, the new contribution margin per unit will be ( 2 marks) a. \$18/unit b. \$10/unit c. $12 unit d. $3/ unit 2 ACC3154 Term Test #2 - Fall2022. 6. The margin of safety represents a. the amount by which actual sales exceed the break-even point. b. the amount by which actual sales fall below the break-even point. c. the actual level of sales at the break-even point. d. the amount by which the break-even point exceeds actual sales. 7. The three general types of manufacturing costs that make up the total cost of a manufactured product are: a. Direct materials, Direct labour, and Non-manufacturing period costs b. Indirect materials, Indirect labour, Manufacturing overhead c. Direct materials, Direct labour, Manufacturing overhead d. Direct materials, Direct labour, Direct overhead 8. The break-even point is where a. total sales equals total fixed costs. b. total sales equals contribution margin. c. total variable costs equal total fixed costs. d. contribution margin equals total fixed costs. 9. If Contribution Margin is $50 /unit and Net Income is $20,000 for sales of 1,000 units, what will Net Income be if 1,100 units are sonil: (2 marks) a. $25,000 b. $40,000 c. $50,000 d. $55,000 10. Period costs... a. include selling expenses b. are non-manufacturing costs c. are not reflected in the cost of inventory d. all of the above. 11. Comparing a Cost-Volume-Profit Income Statement to a Traditional Income Statement you will find: a. Net Income is greater on the CVP Statement b. Net Income is greater on the traditional statement c. Net Income is the same of both statements d. Net Income will be greater or less depending on the sales volume

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started