(Accounting) Answer if you know how to complete it all correctly. I will give thumbs up if correct

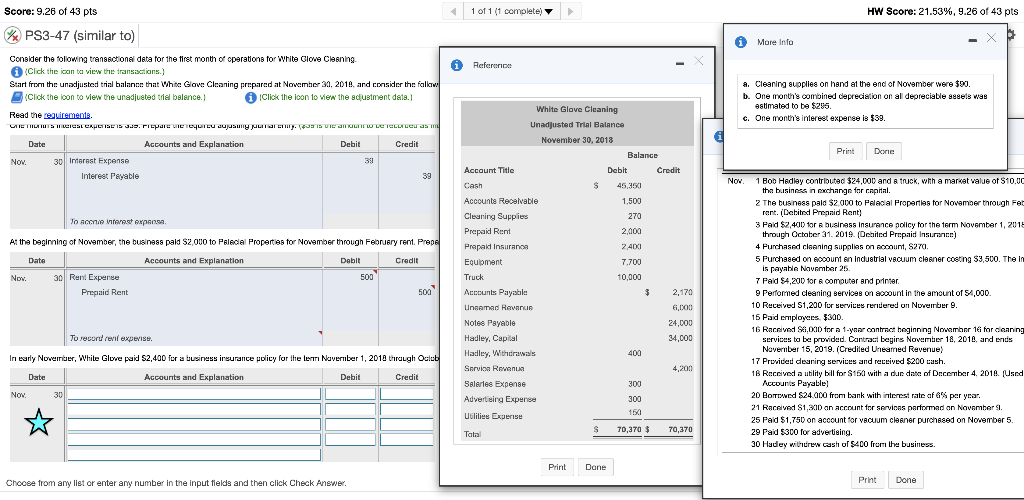

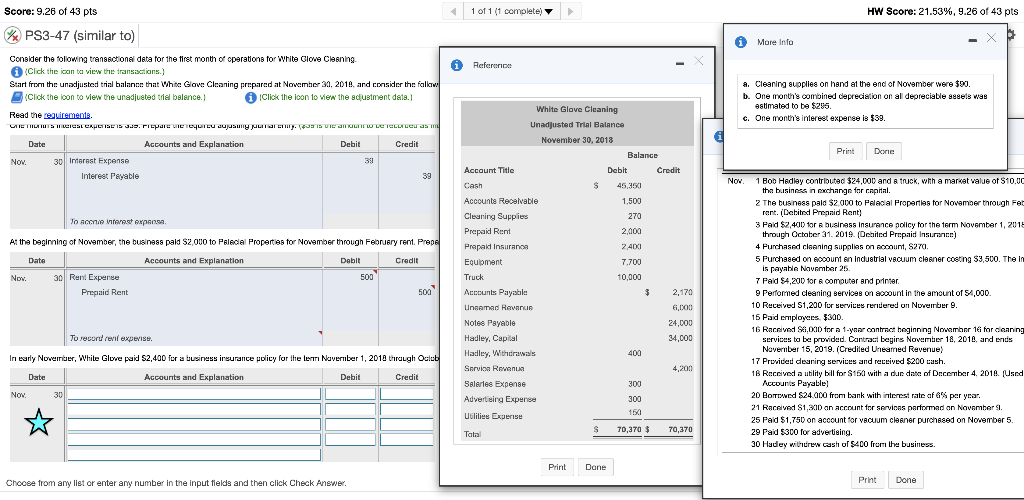

Score: 9.26 of 43 pts 1 of 1 (1 complete) HW Score: 21.53%, 9.26 of 43 pts PS3-47 (similar to) i More Info Reference Consider the following transactional data for the first month of operations for White Glove Cleaning (Click the icon to view the transactions.) Start from the unadjusted trial balance that White Glove Cleaning prepared at November 30, 2014, and consider the folk (Click the loon to view the unadjusted trial balance. Click the icon to view the custment date. Read the requiremente, VIETII SL CASES. riepare de leur cu dumny TeryJS Camo Le Teorem Date Accounts and Explanation Debit Credit Nov 30 Interest Expense 39 Interest Payable 39 a. Cleaning supplies on hand at the end of November were $90. b. One month's combined depreciation on all depreciable 98eets was estimated to be $295. c. One month's interest expense is $39. Print Dorie Now Jo some rest expense At the beginning of November, the business paid $2,000 to Palecial Properties for November through February rent. Prepe Date Accounts and Explanation Dabit Credit White Glave Cleaning Unadjusted Trial Balance November 30, 2018 Balance Account Title Debit Credit Cash S 45,350 Accounts Receivable 1,500 Cleaning Supplies 270 Prepaid Rent 2,000 Prepaid Insurance 24 Equipment 7.700 Truck 10,000 Accounts Payable 2,170 Unnamed Revenue 6,000 Notes Payable 24.000 Hadley, Capital 34,000 Hadley, Withdrawals 400 Sarvion Revenue 4,200 Salaries Expense 300 Advertising Experise 300 150 Utlilies Experise S 70,370 $ 70,370 Talal Nox 500 30 Rent Expense Prepaid Rent 500 1 Bob Hedley contributed $24,000 and a truck, with a marcat value of $10.00 the business in exchange for capital. 2 The business paid $2,000 to Palacial Properties for November through Fet rent. (Debited Prennid Rant) 3 Faid $2,400 for a business Insurance policy for the term November 1, 2015 through October 31, 2019. (Dehited Prepaid Insurance) 4 Purchased cleaning supplies on account, S270). 5 Purchased on account en industrial Vacuum Cleaner costing $3,500. The in is payabia November 25. 7 Paid $4,200 for computer and printer 9 Performed cleaning services on account in the amount of 54.000. 10 Received S1,200 for services reridered on November 9. 15 Paid employees. $300. 16 Raceived Si, DD for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 18, 2010, and ends November 15, 2019. (Crediled Uneamed Revenue 17 Provided dearing services and received $200 cash. 18 Received a utility bill for $150 with a due date of December 4, 2014. (Used Accounts Payable 20 Bored $24.000 from bank with interest rate af G' per year. 21 Raceived $1,300 an account for services parformad on November 9. 25 Paid $1,750 on account for vacuum cleaner purchased on November 5. 29 Paid $300 for adverteing. 30 Hadley withcrew cast of $400 from the business. To record reviaxpeise, In early November, White Glure paid $2,400 for a business insurance policy for the letti Navernber 1, 2018 through Oclub Date Accounts and Explanation Debit Credit NOW, 301 Print Dane Choose from any list or enter any number in the input fields and then click Check Answer. Print Done