Answered step by step

Verified Expert Solution

Question

1 Approved Answer

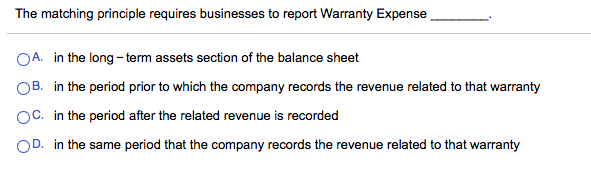

The matching principle requires businesses to report Warranty Expense OA. in the long-term assets section of the balance sheet OB. in the period prior

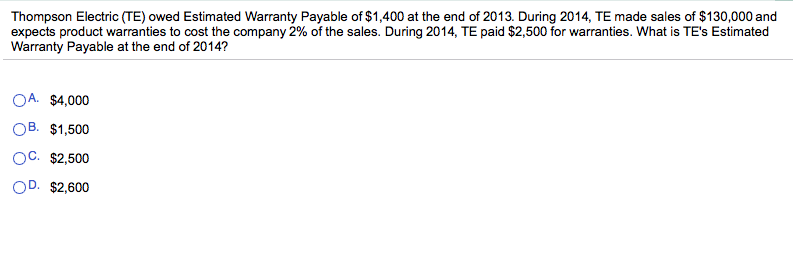

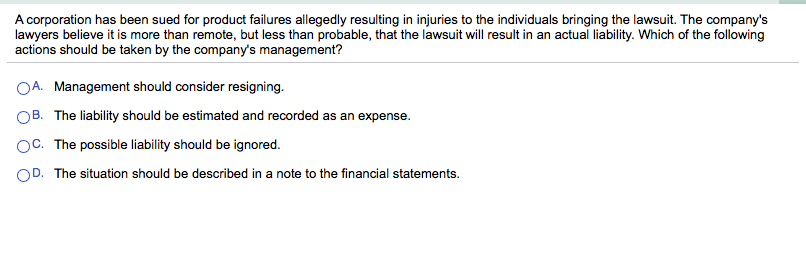

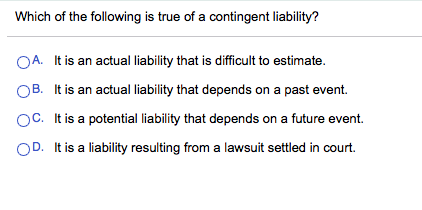

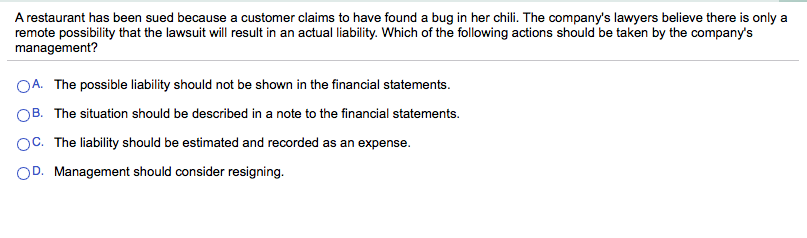

The matching principle requires businesses to report Warranty Expense OA. in the long-term assets section of the balance sheet OB. in the period prior to which the company records the revenue related to that warranty OC. in the period after the related revenue is recorded OD. in the same period that the company records the revenue related to that warranty Thompson Electric (TE) owed Estimated Warranty Payable of $1,400 at the end of 2013. During 2014, TE made sales of $130,000 and expects product warranties to cost the company 2% of the sales. During 2014, TE paid $2,500 for warranties. What is TE's Estimated Warranty Payable at the end of 2014? OA. $4,000 OB. $1,500 OC. $2,500 OD. $2,600 A corporation has been sued for product failures allegedly resulting in injuries to the individuals bringing the lawsuit. The company's lawyers believe it is more than remote, but less than probable, that the lawsuit will result in an actual liability. Which of the following actions should be taken by the company's management? OA. Management should consider resigning. OB. The liability should be estimated and recorded as an expense. OC. The possible liability should be ignored. OD. The situation should be described in a note to the financial statements. Which of the following is true of a contingent liability? OA. It is an actual liability that is difficult to estimate. OB. It is an actual liability that depends on a past event. OC. It is a potential liability that depends on a future event. OD. It is a liability resulting from a lawsuit settled in court. A restaurant has been sued because a customer claims to have found a bug in her chili. The company's lawyers believe there is only a remote possibility that the lawsuit will result in an actual liability. Which of the following actions should be taken by the company's management? OA. The possible liability should not be shown in the financial statements. OB. The situation should be described in a note to the financial statements. OC. The liability should be estimated and recorded as an expense. OD. Management should consider resigning.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Q1 The correct answer is OD In the same period that the company records the revenue related to that warranty This is because the matching p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started