Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Golden Dragon Ltd. begins operations in Vancouver on September 1, 2015. These operations include an elegant sit down restaurant specializing in northern Chinese cuisine,

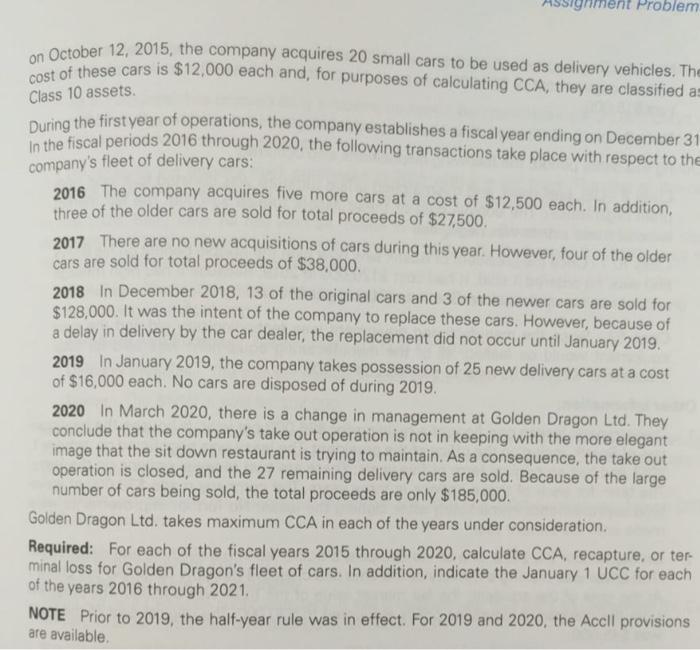

Golden Dragon Ltd. begins operations in Vancouver on September 1, 2015. These operations include an elegant sit down restaurant specializing in northern Chinese cuisine, as well as a take out operation that provides home delivery throughout the city. To facilitate this latter operation, iment Problem October 12, 2015, the company acquires 20 small cars to be used as delivery vehicles. The O of these cars is $12,000 each and, for purposes of calculating CCA, they are classified as Class 10 assets. During the first year of operations, the company establishes a fiscal year ending on December 31 Dhe fiscal periods 2016 through 2020, the following transactions take place with respect to the company's fleet of delivery cars: 2016 The company acquires five more cars at a cost of $12,500 each. In addition, three of the older cars are sold for total proceeds of $27,500. 2017 There are no new acquisitions of cars during this year. However, four of the older cars are sold for total proceeds of $38,000. 2018 In December 2018, 13 of the original cars and 3 of the newer cars are sold for $128,000. It was the intent of the company to replace these cars. However, because of a delay in delivery by the car dealer, the replacement did not occur until January 2019. 2019 In January 2019, the company takes possession of 25 new delivery cars at a cost of $16,000 each. No cars are disposed of during 2019. 2020 In March 2020, there is a change in management at Golden Dragon Ltd. They conclude that the company's take out operation is not in keeping with the more elegant image that the sit down restaurant is trying to maintain. As a consequence, the take out operation is closed, and the 27 remaining delivery cars are sold. Because of the large number of cars being sold, the total proceeds are only $185,000. Golden Dragon Ltd. takes maximum CCA in each of the years under consideration. Required: For each of the fiscal years 2015 through 2020, calculate CCA, recapture, or ter- minal loss for Golden Dragon's fleet of cars. In addition, indicate the January 1 UCC for each of the years 2016 through 2021. NOTE Prior to 2019, the half-year rule was in effect. For 2019 and 2020, the Accll provisions are available.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

We have a given Cost of cars is 12000 Now we will calculate the CCA and profit or loss for the fisca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6232e2132effa_CCAcalculationofacompany.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started