Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Several years ago George Danton, after being laid off, decided he could benefit from his love of flowers and fascination for viewing dead bodies

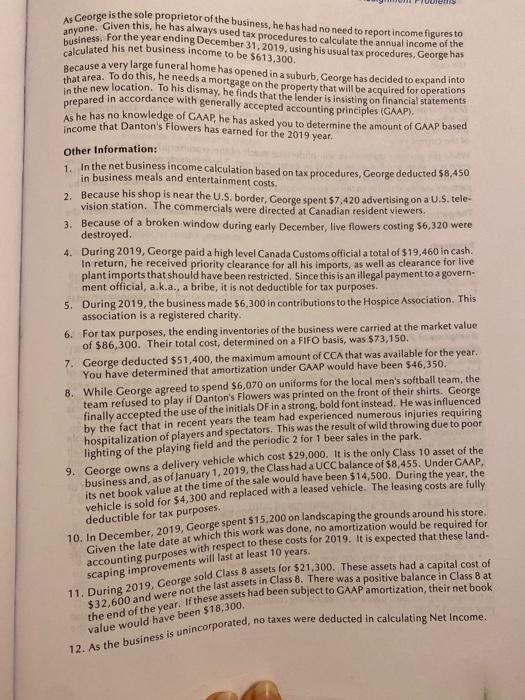

Several years ago George Danton, after being laid off, decided he could benefit from his love of flowers and fascination for viewing dead bodies by opening a flower shop. This allowed him to make frequent visits to the various funeral homes in the area. The shop uses a December 31 taxation year. The business has been a great success, both in terms of being profitable and in enhancing George's enjoyment of life (and death). As George is the sole proprietor of the business, he has had no need to report income figures to anyone. Given this, he has always used tax procedures to calculate the annual income of the business. For the year ending December 31, 2019, using his usual tax procedures, George has calculated his net business income to be $613,300. Because a very large funeral home has opened in a suburb, George has decided to expand into that area. To do this, he needs a mortgage on the property that will be acquired for operations in the new location. To his dismay, he finds that the lender is insisting on financial statements prepared in accordance with generally accepted accounting principles (GAAP). As he has no knowledge of GAAP, he has asked you to determine the amount of GAAP based income that Danton's Flowers has earned for the 2019 year. Other Information: 1. In the net business income calculation based on tax procedures, George deducted $8,450 in business meals and entertainment costs. 2. Because his shop is near the U.S. border, George spent $7,420 advertising on a U.S. tele- vision station. The commercials were directed at Canadian resident viewers. 3. Because of a broken window during early December, live flowers costing $6,320 were destroyed. 4. During 2019, George paid a high level Canada Customs official a total of $19,460 in cash. In return, he received priority clearance for all his imports, as well as clearance for live plant imports that should have been restricted. Since this is an illegal payment to a govern- ment official, a.k.a., a bribe, it is not deductible for tax purposes. 5. During 2019, the business made $6,300 in contributions to the Hospice Association. This association is a registered charity. 6. For tax purposes, the ending inventories of the business were carried at the market value of $86,300. Their total cost, determined on a FIFO basis, was $73,150. 7. George deducted $51,400, the maximum amount of CCA that was available for the year. You have determined that amortization under GAAP would have been $46,350. 8. While George agreed to spend $6,070 on uniforms for the local men's softball team, the team refused to play if Danton's Flowers was printed on the front of their shirts. George finally accepted the use of the initials DF in a strong, bold font instead. He was influenced by the fact that in recent years the team had experienced numerous injuries requiring hospitalization of players and spectators. This was the result of wild throwing due to poor lighting of the playing field and the periodic 2 for 1 beer sales in the par 9. George owns a delivery vehicle which cost $29,000. It is the only Class 10 asset of the business and, as of January 1, 2019, the Class had a UCC balance of $8,455. Under GAAP, its net book value at the time of the sale would have been $14,500. During the year, the vehicle is sold for $4,300 and replaced with a leased vehicle. The leasing costs are fully deductible for tax purposes. 10. In December, 2019, George spent $15,200 on landscaping the grounds around his store. Given the late date at which this work was done, no amortization would be required for accounting purposes with respect to these costs for 2019. It is expected that these land- scaping improvements will last at least 10 years. 11. During 2019, George sold Class 8 assets for $21,300. These assets had a capital cost of $32,600 and were not the last assets in Class 8. There was a positive balance in Class 8 at the end of the year. If these assets had been subject to GAAP amortization, their net book value would have been $18,300. no taxes were deducted in calculating Net Income. 12. As the business is unincorporated, Required: Determine the 2019 GAAP based net income for Danton's Flowers. Do not include in your calculations any tax that George will have to pay on this income. If you do not make an adjustment for some of the items included in other information, indicate why this is the case.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The 2020 GAAP based net income for Dantons flowers would be cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started