Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting assignment Sales price : 5.53 Sales quantity: 83309.00 Material cost / piece: 1.46 Total number of products: 84678,00 Number of purchased materials : 90242.00

Accounting assignment

Sales price : 5.53 Sales quantity: 83309.00 Material cost / piece: 1.46 Total number of products: 84678,00 Number of purchased materials : 90242.00 Other operating costs : 37,152.00 Depreciation : 50,065.00 Interest rate: 4.20% New loan from the company during the year: 26,707.00 Repayment of loans during the year: 1,337.00 Tax rate: 20% Dividends distributed by the company: 76,008.00 New investments: 12,965.00

Fixed assets: 414 600

Raw materials and consumables: 10 500

Finished goods for sale (opening): 4650

Accounts receivable (opening): 3 300

Cash and equivalents: 132 000

Shareholder's capital: 420 000

Retained earnings: 9600

profit for the financial year: 0

Non-current liabilities: 79 000

current liabilites: 47 000

accounts payable (opening): 9459

Accounts receivable (closing): 1925

Current liabilites (closing): 42069

Accounts payable (closing): 9450

Fill the excel and answer the following questions:

Critical sales volume (price constant): ? Working capital (opening): ? Net income: ? Change in financial assets: ? Current ratio (closing balance sheet): ?

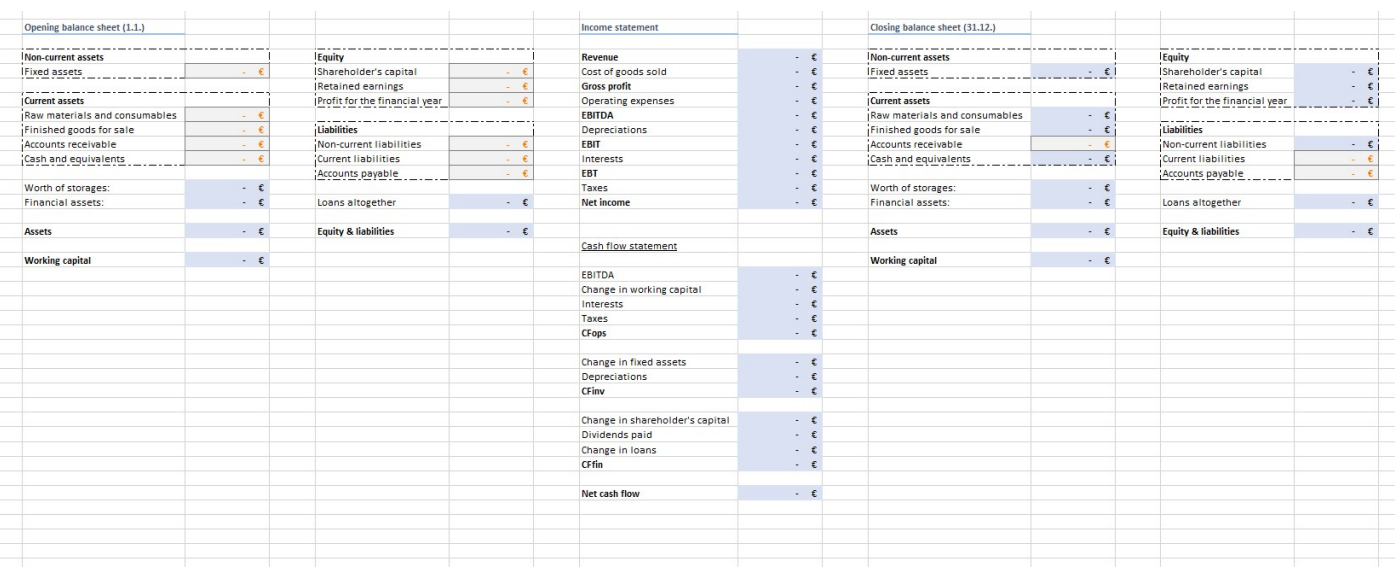

Opening balance sheet (1.1.) ---- ---- INon-current assets IFixed assets --- Current assets Raw materials and consumables Finished goods for sale Accounts receivable Cash and equivalents Worth of storages: Financial assets: Assets Working capital Equity IShareholder's capital Retained earnings Profit for the financial year Liabilities Non-current liabilities. Current liabilities Accounts payable Loans altogether Equity & liabilities Income statement Revenue Cost of goods sold Gross profit Operating expenses EBITDA Depreciations EBIT Interests EBT Taxes Net income Cash flow statement EBITDA Change in working capital Interests Taxes CFops Change in fixed assets Depreciations CFinv Change in shareholder's capital Dividends paid Change in loans CFfin Net cash flow - - . - . - - - Closing balance sheet (31.12.) INon-current assets IFixed assets ------ Current assets Raw materials and consumables Finished goods for sale Accounts receivable Cash and equivalents Worth of storages: Financial assets: Assets Working capital 1 - Equity IShareholder's capital Retained earnings Profit for the financial year Liabilities Non-current liabilities Current liabilities Accounts payable Loans altogether Equity & liabilities Opening balance sheet (1.1.) ---- ---- INon-current assets IFixed assets --- Current assets Raw materials and consumables Finished goods for sale Accounts receivable Cash and equivalents Worth of storages: Financial assets: Assets Working capital Equity IShareholder's capital Retained earnings Profit for the financial year Liabilities Non-current liabilities. Current liabilities Accounts payable Loans altogether Equity & liabilities Income statement Revenue Cost of goods sold Gross profit Operating expenses EBITDA Depreciations EBIT Interests EBT Taxes Net income Cash flow statement EBITDA Change in working capital Interests Taxes CFops Change in fixed assets Depreciations CFinv Change in shareholder's capital Dividends paid Change in loans CFfin Net cash flow - - . - . - - - Closing balance sheet (31.12.) INon-current assets IFixed assets ------ Current assets Raw materials and consumables Finished goods for sale Accounts receivable Cash and equivalents Worth of storages: Financial assets: Assets Working capital 1 - Equity IShareholder's capital Retained earnings Profit for the financial year Liabilities Non-current liabilities Current liabilities Accounts payable Loans altogether Equity & liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started