Answered step by step

Verified Expert Solution

Question

1 Approved Answer

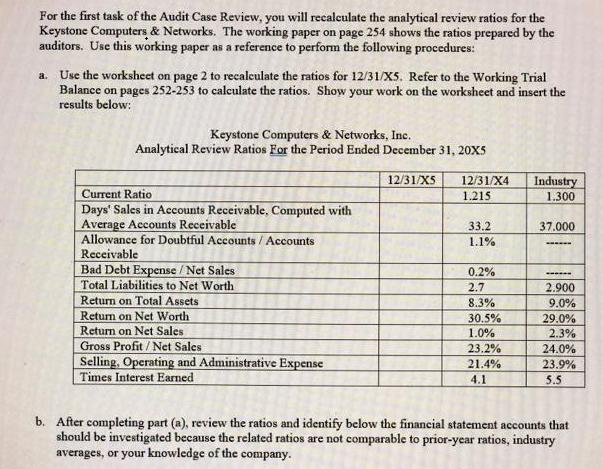

For the first task of the Audit Case Review, you will recalculate the analytical review ratios for the Keystone Computers & Networks. The working

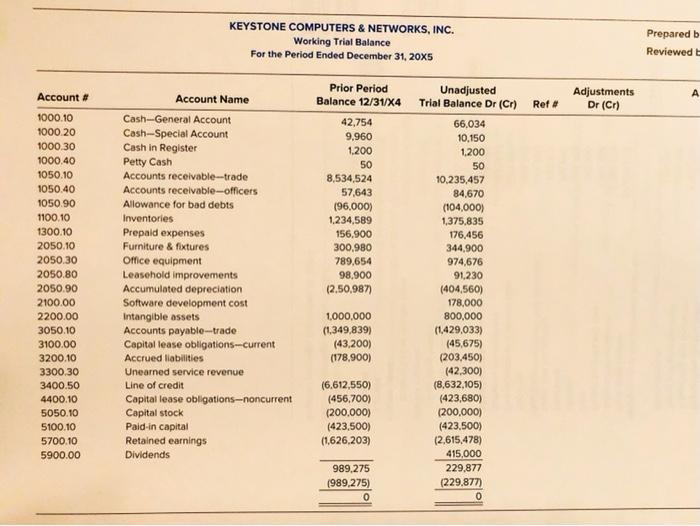

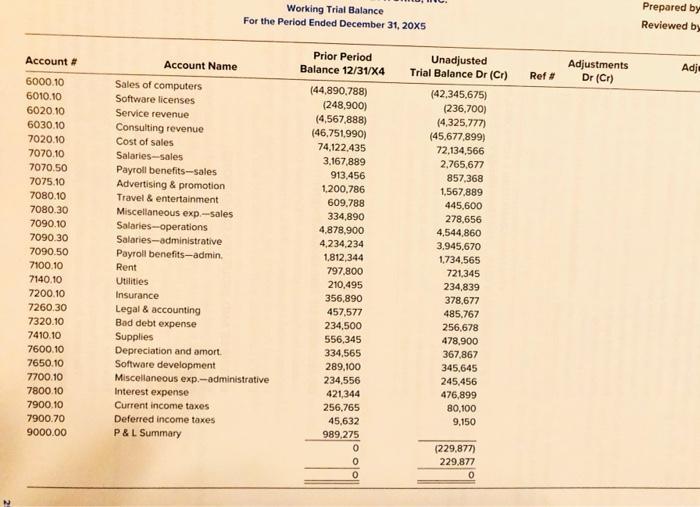

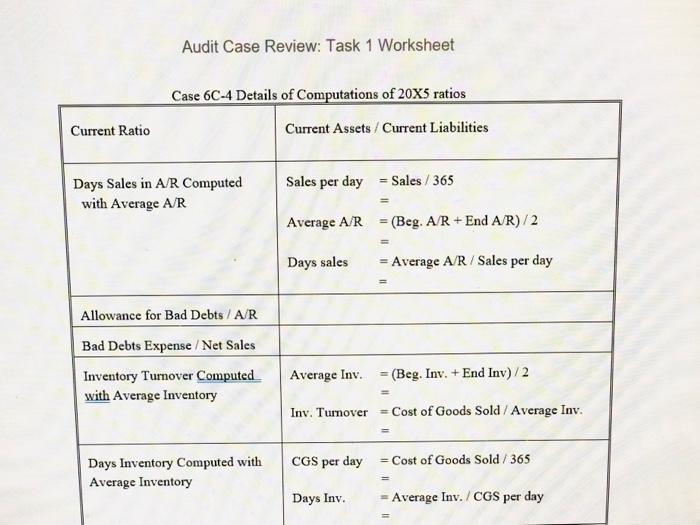

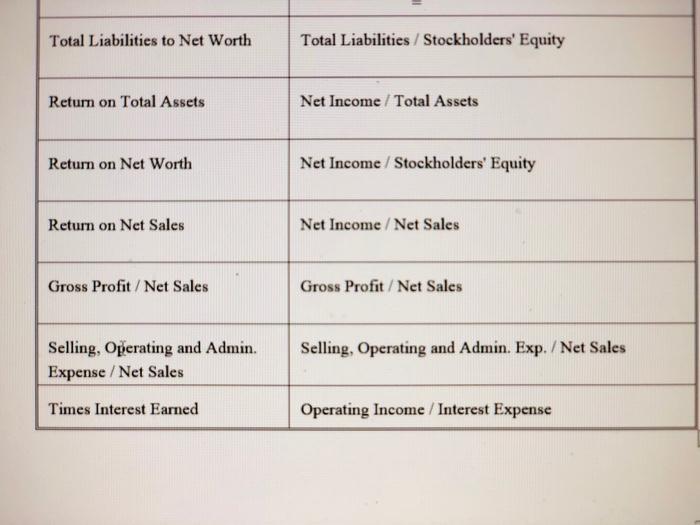

For the first task of the Audit Case Review, you will recalculate the analytical review ratios for the Keystone Computers & Networks. The working paper on page 254 shows the ratios prepared by the auditors. Use this working paper as a reference to perform the following procedures: Use the worksheet on page 2 to recalculate the ratios for 12/31/XS. Refer to the Working Trial Balance on pages 252-253 to calculate the ratios. Show your work on the worksheet and insert the results below: a. Keystone Computers & Networks, Inc. Analytical Review Ratios For the Period Ended December 31, 20X5 12/31/XS 12/31/X4 Industry Current Ratio 1.215 1.300 Days' Sales in Accounts Receivable, Computed with Average Accounts Receivable Allowance for Doubtful Accounts / Accounts Receivable Bad Debt Expense/Net Sales Total Liabilities to Net Worth Return on Total Assets Retum on Net Worth Return on Net Sales Gross Profit / Net Sales Selling, Operating and Administrative Expense Times Interest Earned 33.2 37.000 1.1% 0.2% 2.7 2.900 9.0% 8.3% 30.5% 1.0% 29.0% 2.3% 23.2% 24.0% 21.4% 23.9% 4.1 5.5 b. After completing part (a), review the ratios and identify below the financial statement accounts that should be investigated because the related ratios are not comparable to prior-year ratios, industry averages, or your knowledge of the company. KEYSTONE COMPUTERS & NETWORKS, INC. Prepared b Working Trial Balance For the Period Ended December 31, 20X5 Reviewed E Prior Period Unadjusted Trial Balance Dr (Cr) Adjustments Dr (Cr) A Account # Account Name Balance 12/31/X4 Ref # 1000.10 Cash-General Account 42,754 66,034 1000.20 Cash-Special Account 9,960 10,150 1000.30 Cash in Register Petty Cash Accounts receivable-trade 1,200 1,200 1000.40 50 50 1050.10 8,534,524 10,235,457 1050.40 Accounts receivable-officers 57,643 84,670 1050.90 Allowance for bad debts (96,000) (104,000) 1100.10 Inventories 1,234,589 1,375,835 1300.10 Prepaid expenses Furniture & fixtures Office equipment 156,900 176,456 2050.10 300,980 344,900 2050.30 789,654 974,676 2050.80 Leasehold improvements 98,900 91,230 2050.90 Accumulated depreciation Software development cost (2.50,987) (404,560) 178,000 2100.00 2200.00 1,000,000 800,000 Intangible assets Accounts payable-trade (1,349,839) (43,200) (178,900) 3050.10 (1,429,033) 3100.00 (45,675) (203,450) Capital lease obligations-current 3200.10 Accrued liabilities 3300.30 Unearned service revenue (42,300) (8,632,105) (423,680) 3400.50 Line of credit (6.612,550) (456,700) (200,000) 4400.10 Capital lease obligations-noncurrent 5050.10 (200,000) Capital stock Paid-in capital (423,500) (1,626.203) 5100.10 (423,500) (2,615,478) 415,000 5700.10 Retained earnings 5900.00 Dividends 989,275 229,877 (989,275) (229,877) Prepared by Working Trial Balance For the Period Ended December 31, 20X5 Reviewed by Prior Period Unadjusted Trial Balance Dr (Cr) Account # Account Name Adjustments Dr (Cr) Balance 12/31/X4 Adja Ref # 6000.10 Sales of computers (44,890,788) (248,900) (4,567,888) (46,751,990) (42,345,675) (236,700) (4,325,777) (45,677,899) 72,134,566 6010.10 Software licenses 6020.10 Service revenue 6030.10 Consulting revenue Cost of sales 7020.10 74,122,435 7070.10 Salaries-sales 7070.50 3,167,889 2,765,677 Payroll benefits-sales Advertising & promotion Travel & entertainment 913,456 857,368 7075.10 1,200,786 1,567,889 7080.10 7080.30 609,788 445,600 Miscellaneous exp.-sales Salaries-operations Salaries-administrative 334,890 4,878,900 4,234,234 278,656 7090.10 4,544,860 7090.30 3,945,670 7090.50 Payroll benefits-admin. 1,812,344 1,734,565 7100.10 Rent 797,800 721,345 7140.10 Utilities 210,495 234,839 7200.10 Insurance 356,890 378,677 7260.30 Legal & accounting Bad debt expense 457,577 485,767 7320.10 234,500 556,345 256,678 7410.10 Supplies Depreciation and amort. 478,900 7600.10 334,565 367,867 7650.10 Software development Miscellaneous exp.-administrative Interest expense 289,100 345,645 7700.10 234,556 245,456 7800.10 421,344 476,899 7900.10 Current income taxes 256,765 80,100 7900.70 Deferred income taxes 45,632 9,150 9000.00 P&L Summary 989,275 (229,877) 229,877 Audit Case Review: Task 1 Worksheet Case 6C-4 Details of Computations of 20X5 ratios Current Ratio Current Assets / Current Liabilities Sales per day = Sales / 365 Days Sales in A/R Computed with Average A/R Average A/R = (Beg. A/R + End A/R) /2 Days sales = Average A/R / Sales per day Allowance for Bad Debts / A/R Bad Debts Expense / Net Sales (Beg. Inv. + End Inv) /2 Inventory Turnover Computed with Average Inventory Average Inv. Inv. Turnover = Cost of Goods Sold / Average Inv. CGS per day = Cost of Goods Sold / 365 Days Inventory Computed with Average Inventory Days Inv. = Average Inv. / CGS per day Total Liabilities to Net Worth Total Liabilities /Stockholders' Equity Return on Total Assets Net Income / Total Assets Return on Net Worth Net Income / Stockholders' Equity Return on Net Sales Net Income / Net Sales Gross Profit / Net Sales Gross Profit / Net Sales Selling, Operating and Admin. Expense / Net Sales Selling, Operating and Admin. Exp./Net Sales Times Interest Earned Operating Income / Interest Expense

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Current ratio 114 Day sales in AR computed with Average AR 5363 Allowance for Bad debts AR 101 Bad debts Net sales 028 Total Liabilities to Net Worth 333 Return on Total Assets 1159 Return on N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started