Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss whether the accounting Auto Parts used in the prior year was correct and whether the accounting Auto Parts is used in the current year

Discuss whether the accounting Auto Parts used in the prior year was correct and whether the accounting Auto Parts is used in the current year is correct. Provide the appropriate accounting rules/principles that you are using to make this determination. You may want to consider rules on capitalization, definitions of assets and expense, revenue recognition, the matching principle, and/or materiality. (All or some of these may be helpful, and there may be others you will want to consider as well.)

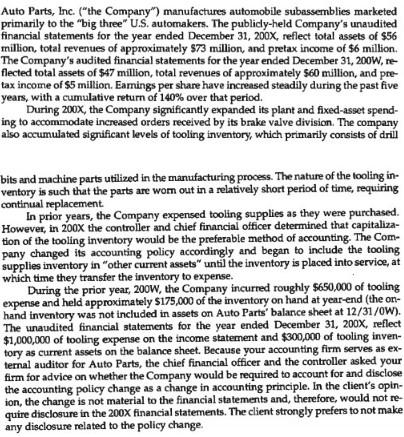

Auto Parts, Inc. ("the Company") manufactures automobile subassemblies marketed primarily to the "big three" U.S. automakers. The publicly-held Company's unaudited financial statements for the year ended December 31, 200X, reflect total assets of $56 million, total revenues of approximately $73 million, and pretax income of $6 million. The Company's audited financial statements for the year ended December 31, 200W, re- flected total assets of $47 million, total revenues of approximately $60 million, and pre- tax income of $5 million. Earnings per share have increased steadily during the past five years, with a cumulative return of 140% over that period. During 200X, the Company significantly expanded its plant and fixed-asset spend- ing to accommodate increased orders received by its brake valve division. The company also accumulated significant levels of tooling inventory, which primarily consists of drill bits and machine parts utilized in the manufacturing process. The nature of the tooling in- ventory is such that the parts are worn out in a relatively short period of time, requiring continual replacement. In prior years, the Company expensed tooling supplies as they were purchased. However, in 200X the controller and chief financial officer determined that capitaliza- tion of the tooling inventory would be the preferable method of accounting. The Com- pany changed its accounting policy accordingly and began to include the tooling supplies inventory in "other current assets" until the inventory is placed into service, at which time they transfer the inventory to expense. During the prior year, 200W, the Company incurred roughly $650,000 of tooling expense and held approximately $175,000 of the inventory on hand at year-end (the on- hand inventory was not included in assets on Auto Parts' balance sheet at 12/31/0W). The unaudited financial statements for the year ended December 31, 200X, reflect $1,000,000 of tooling expense on the income statement and $300,000 of tooling inven- tory as current assets on the balance sheet. Because your accounting firm serves as ex- ternal auditor for Auto Parts, the chief financial officer and the controller asked your firm for advice on whether the Company would be required to account for and disclose the accounting policy change as a change in accounting principle. In the client's opin- ion, the change is not material to the financial statements and, therefore, would not re- quire disclosure in the 200X financial statements. The client strongly prefers to not make any disclosure related to the policy change.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The accounting used by Auto Parts in the prior year was correct The company was required to expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started