Answered step by step

Verified Expert Solution

Question

1 Approved Answer

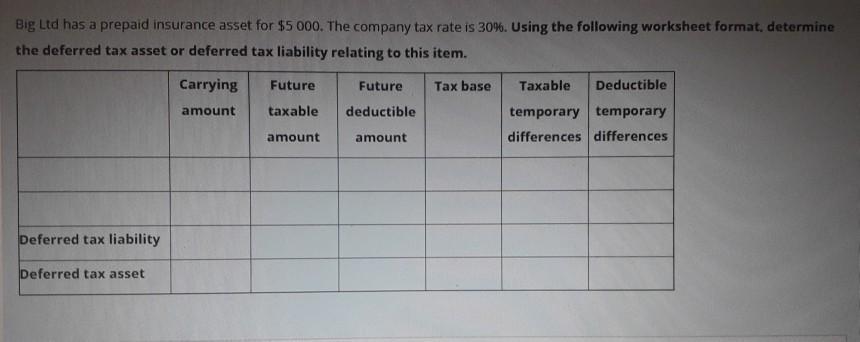

Big Ltd has a prepaid insurance asset for $5 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred

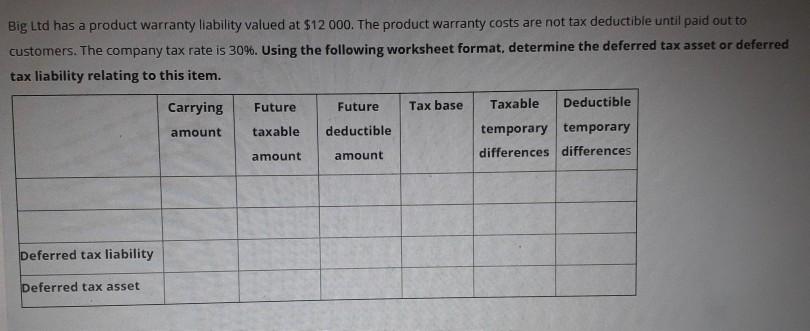

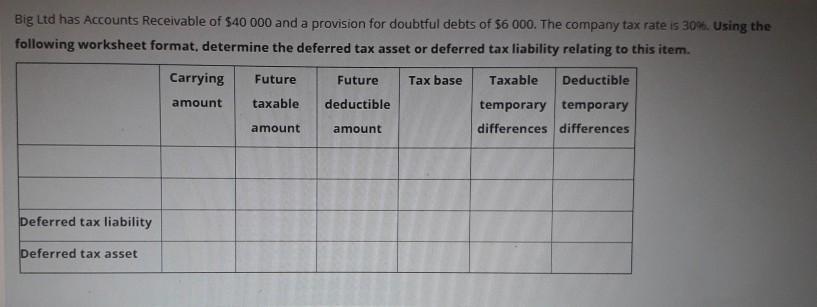

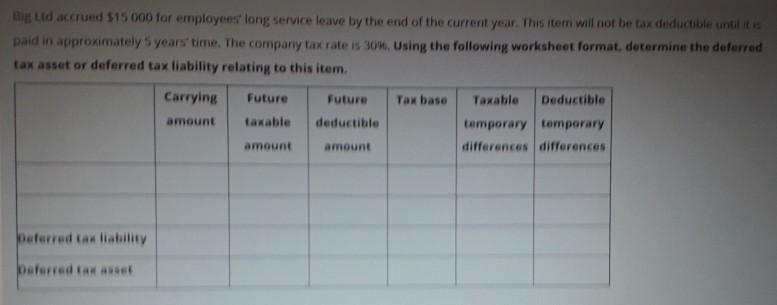

Big Ltd has a prepaid insurance asset for $5 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base Taxable Deductible taxable temporary temporary amount deductible amount amount differences differences Deferred tax liability Deferred tax asset Big Ltd has a product warranty liability valued at $12 000. The product warranty costs are not tax deductible until paid out to customers. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Tax base ble Deductible Future Future taxable deductible temporary temporary amount differences differences amount amount Deferred tax liability Deferred tax asset Big Ltd has Accounts Receivable of $40 000 and a provision for doubtful debts of $6 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible amount taxable temporary temporary differences differences deductible amount amount Deferred tax liability Deferred tax asset Big Ltd accrued $15 000 for employees long service leave by the end of the current year. This item will not be tax deductible until it s paid in approximately 5 years' time. The company tax rate is 30%, Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible temporary temporary differences differences amount taxable deductible amount amount peferred tax liability Deferred tax aset Big Ltd has a prepaid insurance asset for $5 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base Taxable Deductible taxable temporary temporary amount deductible amount amount differences differences Deferred tax liability Deferred tax asset Big Ltd has a product warranty liability valued at $12 000. The product warranty costs are not tax deductible until paid out to customers. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Tax base ble Deductible Future Future taxable deductible temporary temporary amount differences differences amount amount Deferred tax liability Deferred tax asset Big Ltd has Accounts Receivable of $40 000 and a provision for doubtful debts of $6 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible amount taxable temporary temporary differences differences deductible amount amount Deferred tax liability Deferred tax asset Big Ltd accrued $15 000 for employees long service leave by the end of the current year. This item will not be tax deductible until it s paid in approximately 5 years' time. The company tax rate is 30%, Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible temporary temporary differences differences amount taxable deductible amount amount peferred tax liability Deferred tax aset Big Ltd has a prepaid insurance asset for $5 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base Taxable Deductible taxable temporary temporary amount deductible amount amount differences differences Deferred tax liability Deferred tax asset Big Ltd has a product warranty liability valued at $12 000. The product warranty costs are not tax deductible until paid out to customers. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Tax base ble Deductible Future Future taxable deductible temporary temporary amount differences differences amount amount Deferred tax liability Deferred tax asset Big Ltd has Accounts Receivable of $40 000 and a provision for doubtful debts of $6 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible amount taxable temporary temporary differences differences deductible amount amount Deferred tax liability Deferred tax asset Big Ltd accrued $15 000 for employees long service leave by the end of the current year. This item will not be tax deductible until it s paid in approximately 5 years' time. The company tax rate is 30%, Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible temporary temporary differences differences amount taxable deductible amount amount peferred tax liability Deferred tax aset Big Ltd has a prepaid insurance asset for $5 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base Taxable Deductible taxable temporary temporary amount deductible amount amount differences differences Deferred tax liability Deferred tax asset Big Ltd has a product warranty liability valued at $12 000. The product warranty costs are not tax deductible until paid out to customers. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Tax base ble Deductible Future Future taxable deductible temporary temporary amount differences differences amount amount Deferred tax liability Deferred tax asset Big Ltd has Accounts Receivable of $40 000 and a provision for doubtful debts of $6 000. The company tax rate is 30%. Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible amount taxable temporary temporary differences differences deductible amount amount Deferred tax liability Deferred tax asset Big Ltd accrued $15 000 for employees long service leave by the end of the current year. This item will not be tax deductible until it s paid in approximately 5 years' time. The company tax rate is 30%, Using the following worksheet format, determine the deferred tax asset or deferred tax liability relating to this item. Carrying Future Future Tax base able Deductible temporary temporary differences differences amount taxable deductible amount amount peferred tax liability Deferred tax aset

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Carrying Amount Future Taxable Amount Future Deductable amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started