Answered step by step

Verified Expert Solution

Question

1 Approved Answer

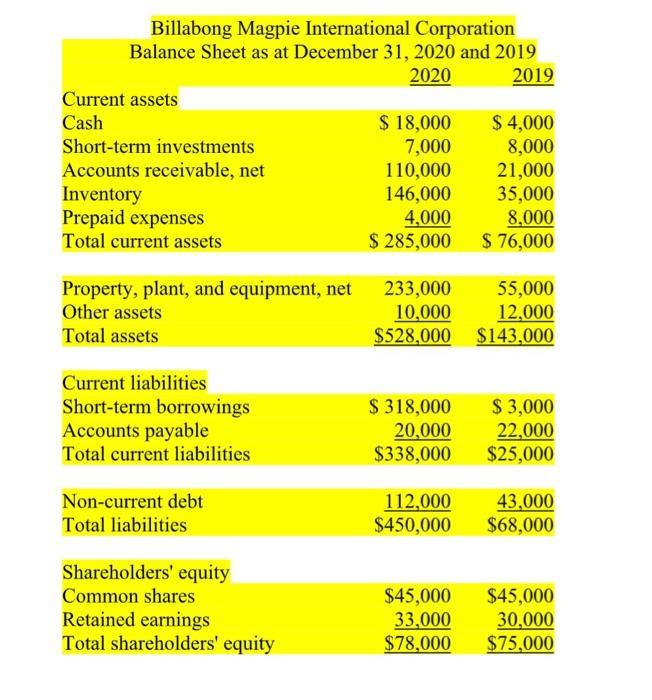

Billabong Magpie International Corporation Balance Sheet as at December 31, 2020 and 2019 2019 2020 Current assets $ 18,000 7,000 110,000 146,000 4,000 $

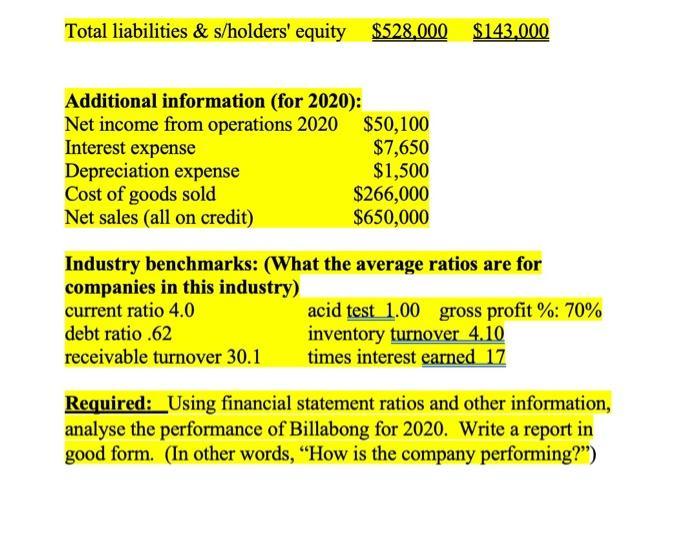

Billabong Magpie International Corporation Balance Sheet as at December 31, 2020 and 2019 2019 2020 Current assets $ 18,000 7,000 110,000 146,000 4,000 $ 285,000 $ 4,000 8,000 21,000 35,000 8,000 $ 76,000 Cash Short-term investments Accounts receivable, net Inventory Prepaid expenses Total current assets Property, plant, and equipment, net Other assets 55,000 12,000 $528,000 $143,000 233,000 10,000 Total assets Current liabilities Short-term borrowings Accounts payable Total current liabilities $ 318,000 20,000 $338,000 $ 3,000 22,000 $25,000 112,000 $450,000 Non-current debt 43,000 $68,000 Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity $45,000 33,000 $78,000 $45,000 30,000 $75,000 Total liabilities & s/holders' equity $528,000 $143,000 Additional information (for 2020): Net income from operations 2020 $50,100 Interest expense Depreciation expense Cost of goods sold Net sales (all on credit) $7,650 $1,500 $266,000 $650,000 Industry benchmarks: (What the average ratios are for companies in this industry) current ratio 4.0 debt ratio .62 receivable turnover 30.1 acid test 1.00 gross profit %: 70% inventory turnover 4.10 times interest earned 17 Required: Using financial statement ratios and other information, analyse the performance of Billabong for 2020. Write a report in good form. (In other words, "How is the company performing?")

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

RATIOS 2020 2019 BETTERWORSE Current ratio current assets current liabilities 285000 338000 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started