Question: Ellen considered saving $10,000 per year for her retirement. Although $10,000 is the most she can save in the first year, she expects her

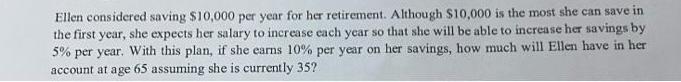

Ellen considered saving $10,000 per year for her retirement. Although $10,000 is the most she can save in the first year, she expects her salary to increase each year so that she will be able to increase her savings by 5% per year. With this plan, if she earns 10% per year on her savings, how much will Ellen have in her account at age 65 assuming she is currently 35?

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

To calculate how much Ellen will have in her retirement account at age 65 we can use the concept of compound interest Given that Ellen is currently 35 ... View full answer

Get step-by-step solutions from verified subject matter experts