Question

Bruce is considering buying his dream home and has arranged a $700,000 mortgage loan at an interest rate of 3.75% per annum, compounded semi-annually,

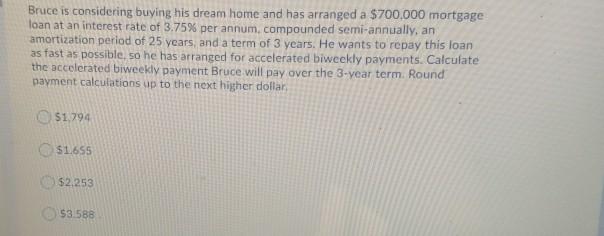

Bruce is considering buying his dream home and has arranged a $700,000 mortgage loan at an interest rate of 3.75% per annum, compounded semi-annually, an amortization period of 25 years, and a term of 3 years. He wants to repay this loan as fast as possible, so he has arranged for accelerated biweekly payments. Calculate the accelerated biweekly payment Bruce will pay over the 3-vear term. Round payment calculations up to the next higher dollar, O$1.794 O$1.655 $2,253 $3.588

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Question The Answer is 1794 Monthly Payment As Per EMI Calculator Monthly EMI 3588 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Algebra advanced algebra with financial applications

Authors: Robert K. Gerver

1st edition

978-1285444857, 128544485X, 978-0357229101, 035722910X, 978-0538449670

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App