accounting

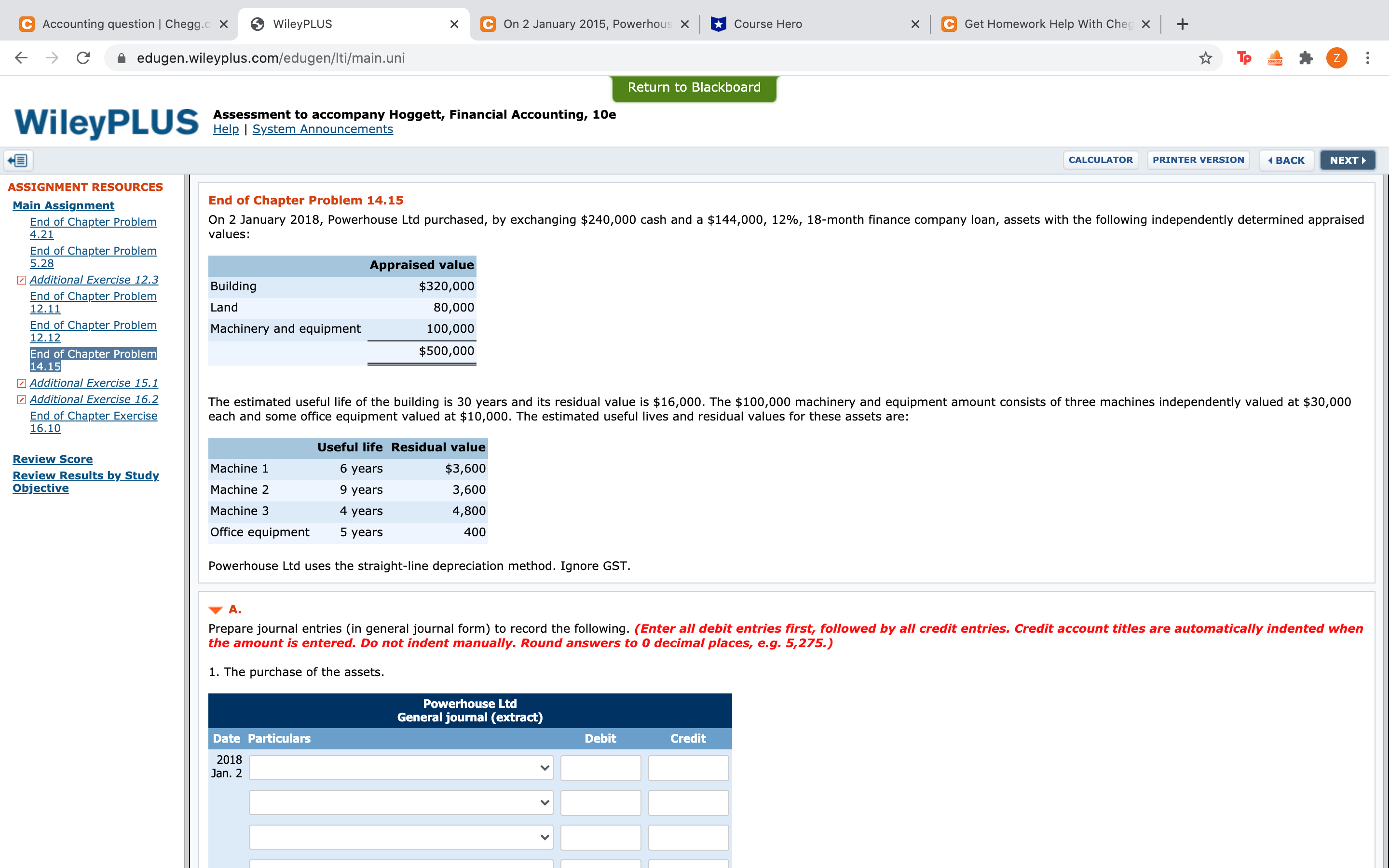

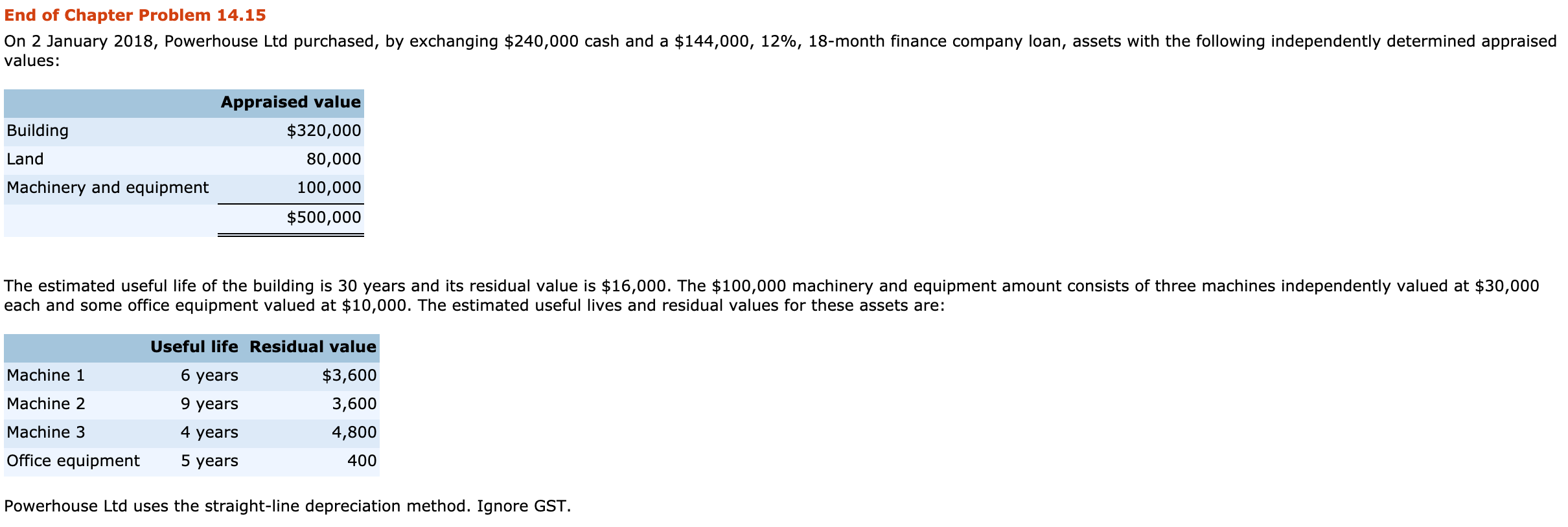

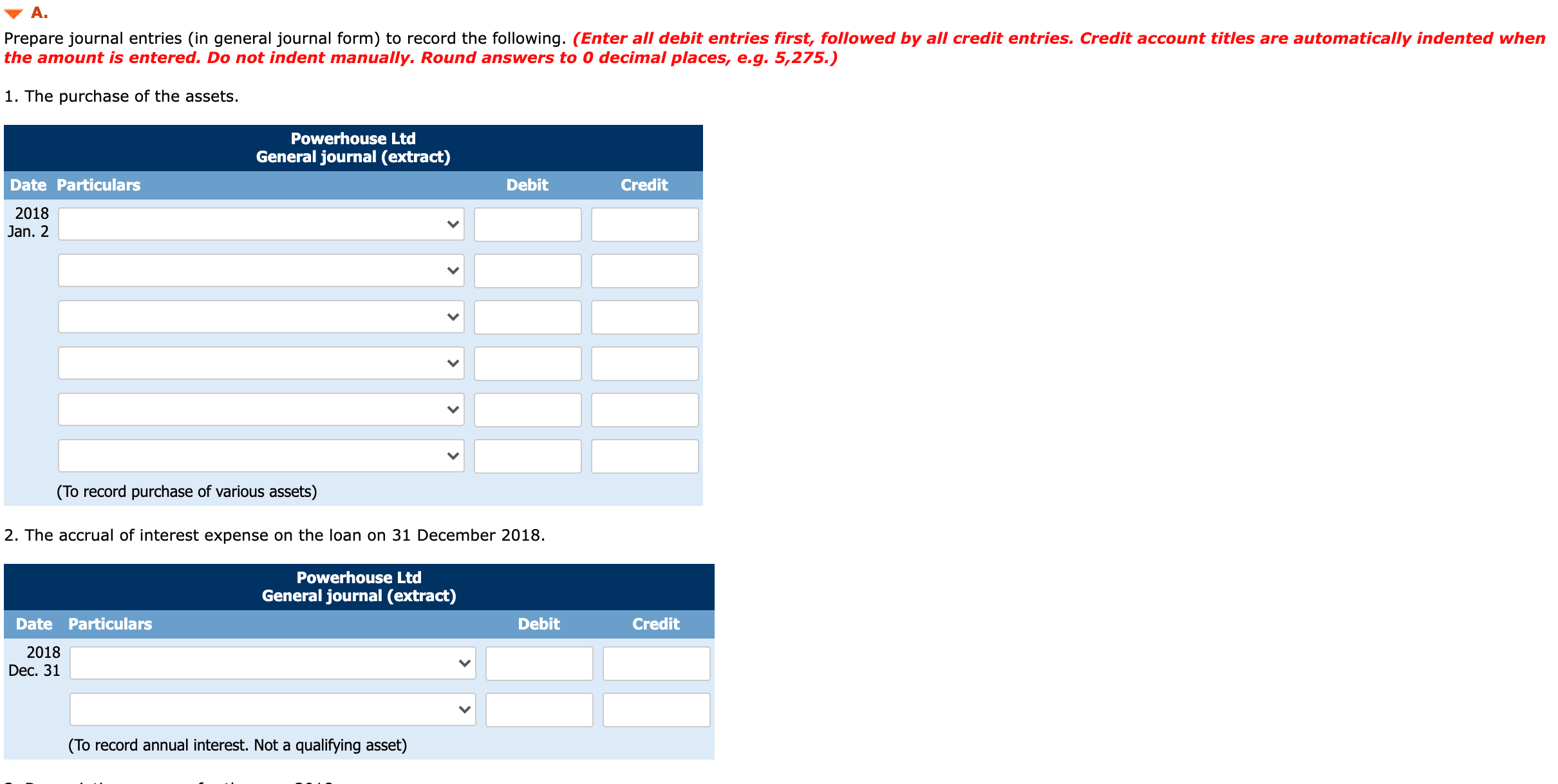

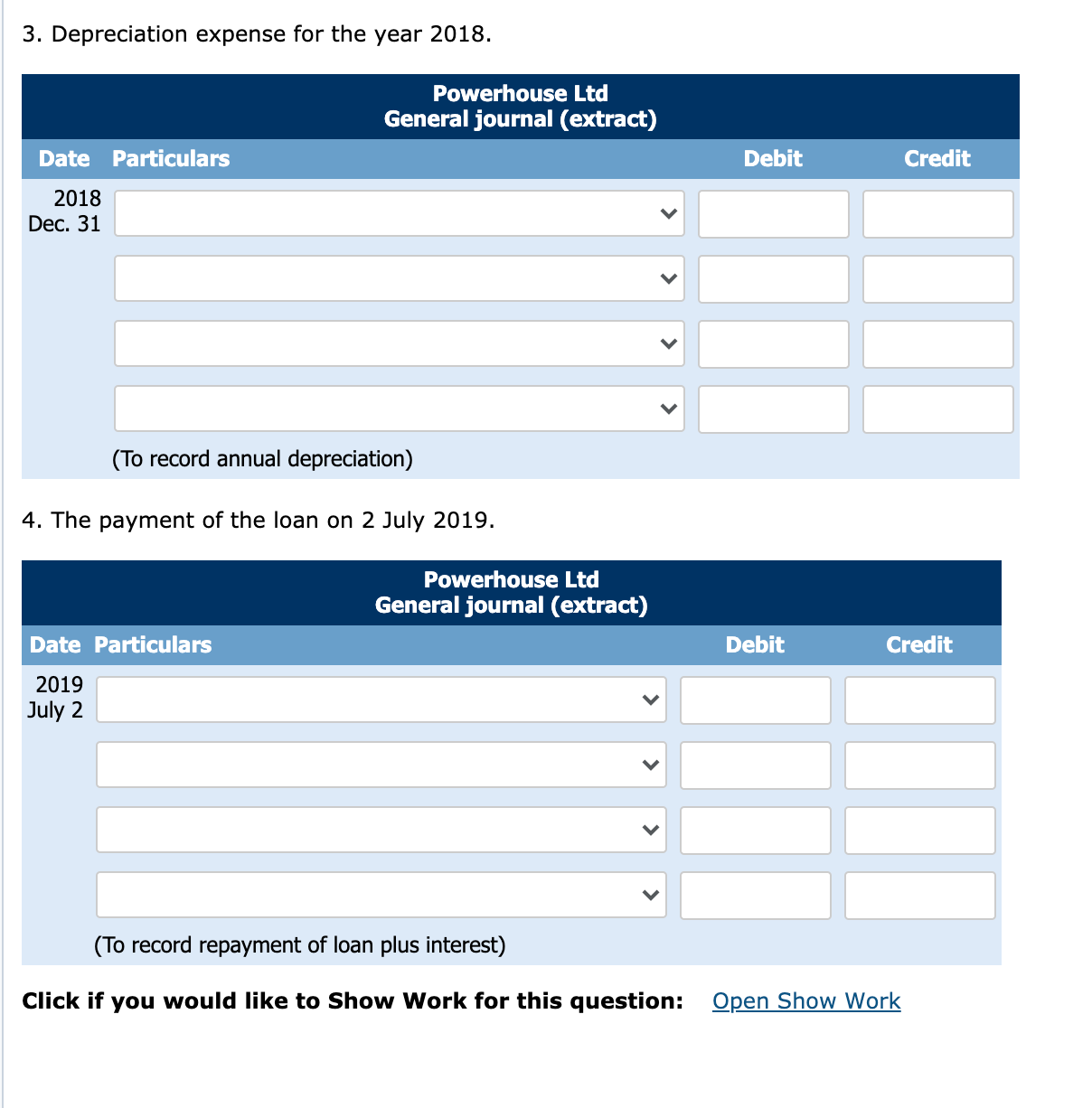

C Accounting question | Chegg.c X WileyPLUS X C On 2 January 2015, Powerhous X Course Hero C Get Homework Help With Cheg X + a edugen.wileyplus.com/edugen/Iti/main.uni TP Z . .. Return to Blackboard WileyPLUS Assessment to accompany Hoggett, Financial Accounting, 10e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT ASSIGNMENT RESOURCES Main Assignment End of Chapter Problem 14.15 End of Chapter Problem On 2 January 2018, Powerhouse Ltd purchased, by exchanging $240,000 cash and a $144,000, 12%, 18-month finance company loan, assets with the following independently determined appraised 4.21 values: End of Chapter Problem 5.28 Appraised value Additional Exercise 12.3 End of Chapter Problem Building $320,000 12.11 Land 80,000 End of Chapter Problem 12.12 Machinery and equipment 100,000 End of Chapter Problem $500,000 4.15 Additional Exercise 15.1 Additional Exercise 16.2 The estimated useful life of the building is 30 years and its residual value is $16,000. The $100,000 machinery and equipment amount consists of three machines independently valued at $30,000 End of Chapter Exercise each and some office equipment valued at $10,000. The estimated useful lives and residual values for these assets are: 16.10 Useful life Residual value Review Score Review Results by Study Machine 1 6 years $3,600 Objective Machine 2 9 years 3,600 Machine 3 4 years 4,800 Office equipment 5 years 400 Powerhouse Ltd uses the straight-line depreciation method. Ignore GST. VA. Prepare journal entries (in general journal form) to record the following. (Enter all debit entries first, followed by all credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) 1. The purchase of the assets. Powerhouse Ltd General journal (extract) Date Particulars Debit Credit 2018 Jan. 2End of Chapter Problem 14.15 On 2 January 2018, Powerhouse Ltd purchased, by exchanging $240,000 cash and a $144,000, 12%, 18-month finance company loan, assets with the following independently determined appraised values: Appraised value Building $320,000 Land 80,000 Machinery and equipment 100,000 $500,000 The estimated useful life of the building is 30 years and its residual value is $16,000. The $100,000 machinery and equipment amount consists of three machines independently valued at $30,000 each and some office equipment valued at $10,000. The estimated useful lives and residual values for these assets are: Useful life Residual value Machine 1 6 years $3,600 Machine 2 9 years 3,600 Machine 3 4 years 4,800 Office equipment 5 years 400 Powerhouse Ltd uses the straight-line depreciation method. Ignore GST.VA. Prepare journal entries (in general journal form) to record the following. (Enter all debit entries rst, followed by all credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) 1. The purchase of the assets. Powerhouse Ltd General journal (extract) Date Particulars 2018 Jan. 2 v' l ' ' l vii l l | vii l i (To reoord purchase of various assets) 2. The accrual of interest expense on the loan on 31 December 2018. Powerhouse Ltd General journal (extract) Date Particulars 2018 (To record annual interest. Not a qualifying asset) 3. Depreciation expense for the year 2018. Powerhouse Ltd General journal (extract) Date Particulars Debit Credit 2018 Dec. 31 V (To record annual depreciation) 4. The payment of the loan on 2 July 2019. Powerhouse Ltd General journal (extract) Date Particulars Debit Credit 2019 July 2 (To record repayment of loan plus interest) Click if you would like to Show Work for this question: Open Show Work