Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Curbstone, Inc. borrows $140,000 by issuing an 8%, 5-year note on January 1, 2020. Curbstone must make payments of principal and interest every 3

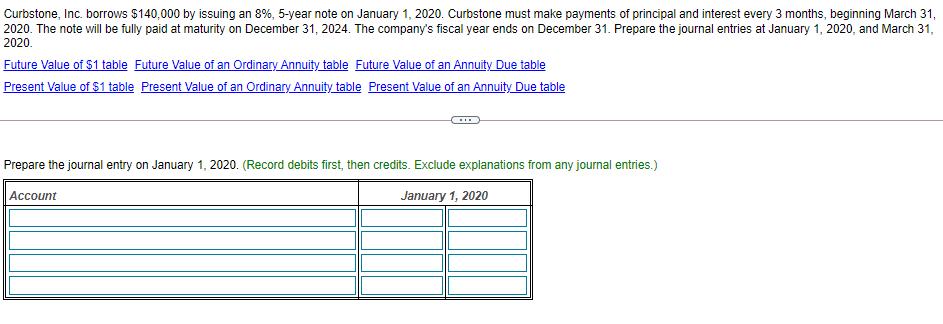

Curbstone, Inc. borrows $140,000 by issuing an 8%, 5-year note on January 1, 2020. Curbstone must make payments of principal and interest every 3 months, beginning March 31, 2020. The note will be fully paid at maturity on December 31, 2024. The company's fiscal year ends on December 31. Prepare the journal entries at January 1, 2020, and March 31, 2020. Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Prepare the journal entry on January 1, 2020. (Record debits first, then credits. Exclude explanations from any journal entries.) Account January 1, 2020

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Amount of borrowing by issuing note Interest Rate 84 Period 5 years 4 Pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started