Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The subject is a small, multitenant office building with six tenants and one vacant suite. Leases in this market are typically written for five

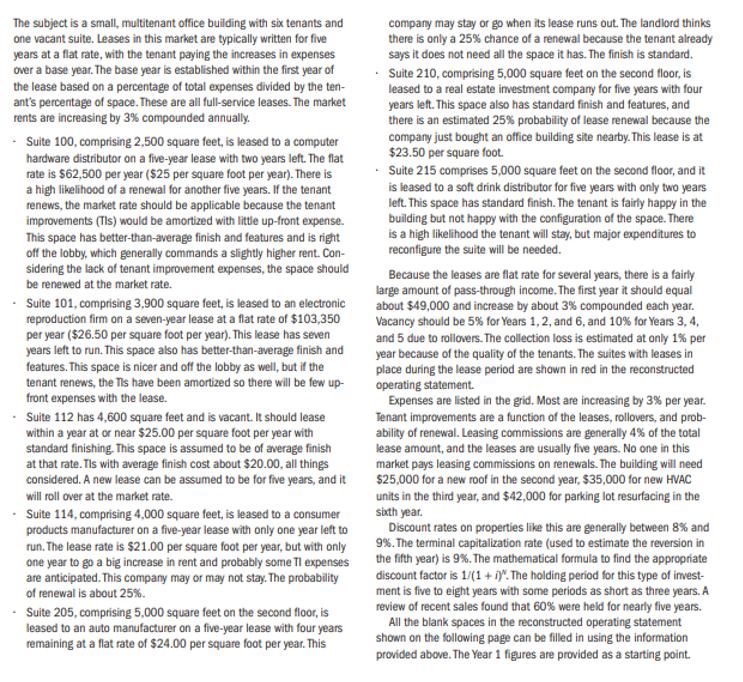

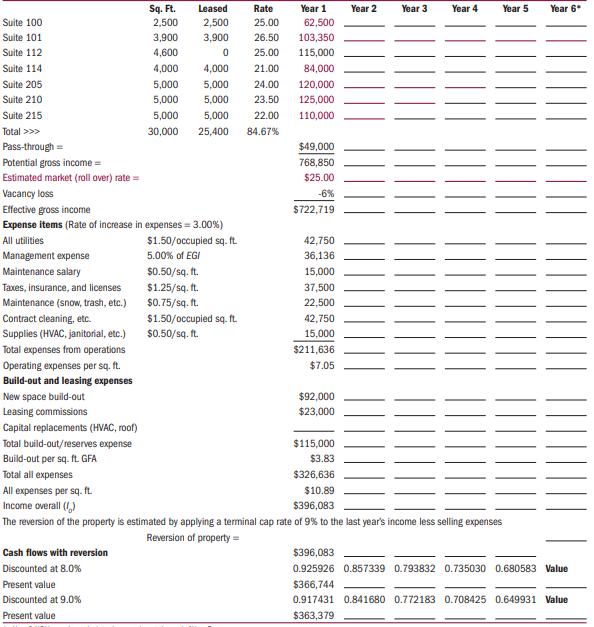

The subject is a small, multitenant office building with six tenants and one vacant suite. Leases in this market are typically written for five years at a flat rate, with the tenant paying the increases in expenses over a base year. The base year is established within the first year of the lease based on a percentage of total expenses divided by the ten- ant's percentage of space. These are all full-service leases. The market rents are increasing by 3% compounded annually. *Suite 100, comprising 2,500 square feet, is leased to a computer hardware distributor on a five-year lease with two years left. The flat rate is $62,500 per year ($25 per square foot per year). There is a high likelihood of a renewal for another five years. If the tenant renews, the market rate should be applicable because the tenant improvements (Tls) would be amortized with little up-front expense. This space has better-than-average finish and features and is right off the lobby, which generally commands a slightly higher rent. Con- sidering the lack of tenant improvement expenses, the space should be renewed at the market rate. - Suite 101, comprising 3,900 square feet, is leased to an electronic reproduction firm on a seven-year lease at a flat rate of $103,350 per year ($26.50 per square foot per year). This lease has seven years left to run. This space also has better-than-average finish and features. This space is nicer and off the lobby as well, but if the tenant renews, the Tls have been amortized so there will be few up- front expenses with the lease. Suite 112 has 4,600 square feet and is vacant. It should lease within a year at or near $25.00 per square foot per year with standard finishing. This space is assumed to be of average finish at that rate. Tls with average finish cost about $20.00, all things considered. A new lease can be assumed to be for five years, and it will roll over at the market rate. Suite 114, comprising 4,000 square feet, is leased to a consumer products manufacturer on a five-year lease with only one year left to run. The lease rate is $21.00 per square foot per year, but with only one year to go a big increase in rent and probably some TI expenses are anticipated. This company may or may not stay. The probability of renewal is about 25%. Suite 205, comprising 5,000 square feet on the second floor, is leased to an auto manufacturer on a five-year lease with four years remaining at a flat rate of $24.00 per square foot per year. This company may stay or go when its lease runs out. The landlord thinks there is only a 25% chance of a renewal because the tenant already says it does not need all the space it has. The finish is standard. Suite 210, comprising 5,000 square feet on the second floor, is leased to a real estate investment company for five years with four years left. This space also has standard finish and features, and there is an estimated 25% probability of lease renewal because the company just bought an office building site nearby. This lease is at $23.50 per square foot. - Suite 215 comprises 5,000 square feet on the second floor, and it is leased to a soft drink distributor for five years with only two years left. This space has standard finish. The tenant is fairly happy in the building but not happy with the configuration of the space. There is a high likelihood the tenant will stay, but major expenditures to reconfigure the suite will be needed. Because the leases are flat rate for several years, there is a fairly large amount of pass-through income. The first year it should equal about $49,000 and increase by about 3% compounded each year. Vacancy should be 5% for Years 1, 2, and 6, and 10% for Years 3, 4, and 5 due to rollovers. The collection loss is estimated at only 1% per year because of the quality of the tenants. The suites with leases in place during the lease period are shown in red in the reconstructed operating statement. Expenses are listed in the grid. Most are increasing by 3% per year. Tenant improvements are a function of the leases, rollovers, and prob- ability of renewal. Leasing commissions are generally 4% of the total lease amount, and the leases are usually five years. No one in this market pays leasing commissions on renewals. The building will need $25,000 for a new roof in the second year, $35,000 for new HVAC units in the third year, and $42,000 for parking lot resurfacing in the sixth year. Discount rates on properties like this are generally between 8% and 9%. The terminal capitalization rate (used to estimate the reversion in the fifth year) is 9%. The mathematical formula to find the appropriate discount factor is 1/(1+i). The holding period for this type of invest- ment is five to eight years with some periods as short as three years. A review of recent sales found that 60% were held for nearly five years. All the blank spaces in the reconstructed operating statement shown on the following page can be filled in using the information provided above. The Year 1 figures are provided as a starting point. All utilities Management expense Maintenance salary Taxes, insurance, and licenses Maintenance (snow, trash, etc.) Contract cleaning, etc. Supplies (HVAC, janitorial, etc.) Suite 100 Suite 101 Suite 112 Suite 114 Suite 205 Suite 210 Suite 215 Total >>> Pass-through == Potential gross income = Estimated market (roll over) rate= Vacancy loss Effective gross income Expense items (Rate of increase in expenses = 3.00%) Total expenses from operations Operating expenses per sq. ft. Build-out and leasing expenses New space build-out Leasing commissions Capital replacements (HVAC, roof) Total build-out/reserves expense Build-out per sq. ft. GFA Sq. Ft. 2,500 Total all expenses All expenses per sq. ft. Cash flows with reversion Discounted at 8.0% Present value Discounted at 9.0% Present value 3,900 4,600 4,000 Leased 2,500 3,900 0 5,000 5,000 5,000 30,000 4,000 5,000 5,000 5,000 25,400 $1.50/occupied sq. ft. 5.00% of EGI $0.50/sq. ft. $1.25/sq.ft. $0.75/sq.ft. $1.50/occupied sq. ft. $0.50/sq. ft. Rate 25.00 26.50 25.00 Year 1 62,500 103,350 115,000 84,000 21.00 24.00 120,000 23.50 125,000 22.00 110,000 84.67% $49,000 768,850 $25.00 -6% $722,719 42,750 36,136 15,000 37,500 22,500 42,750 15,000 $211,636 $7.05 $92,000 $23,000 $115,000 $3.83 Year 2 Year 3 Year 4 $326,636 $10.89 Income overall (1) $396,083 The reversion of the property is estimated by applying a terminal cap rate of 9% to the last year's income less selling expenses Reversion of property = Year 5 Year 6* $396,083 0.925926 0.857339 0.793832 0.735030 0.680583 Value $366,744 0.917431 0.841680 0.772183 0.708425 0.649931 Value $363,379

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Office space rental is often a big expense for a small company But it can be unnecessarily expensive if you dont understand the hidden costs and restrictions that are buried in many leases The first t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started