Answered step by step

Verified Expert Solution

Question

1 Approved Answer

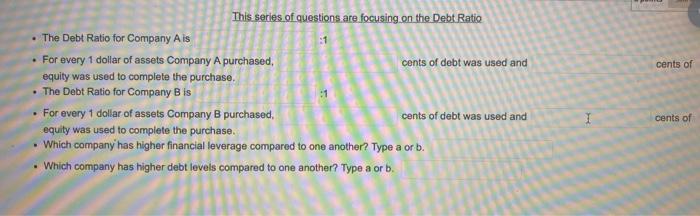

This series of questions are focusing on the Debt Ratio 1 The Debt Ratio for Company A is For every 1 dollar of assets

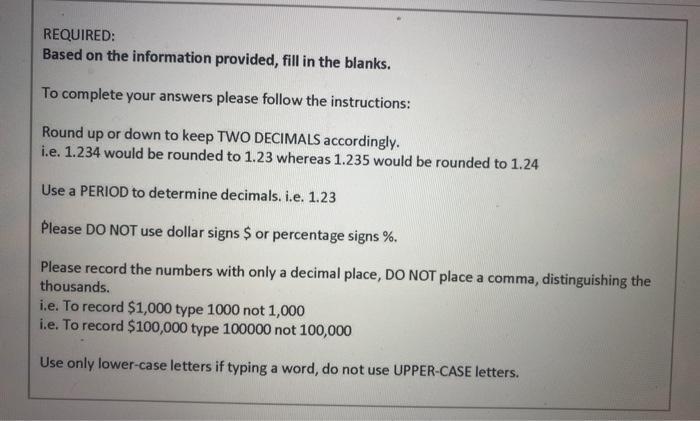

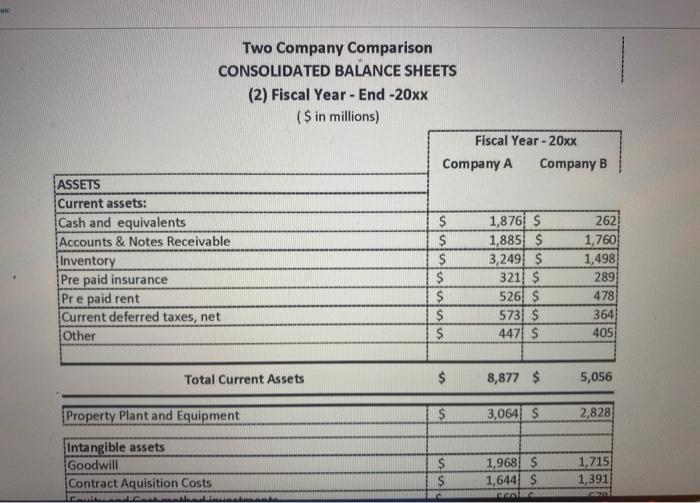

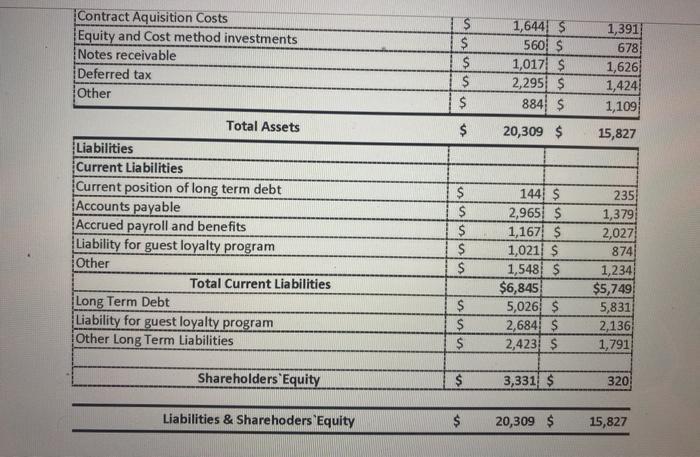

This series of questions are focusing on the Debt Ratio 1 The Debt Ratio for Company A is For every 1 dollar of assets Company A purchased, equity was used to complete the purchase. The Debt Ratio for Company B is cents of debt was used and For every 1 dollar of assets Company B purchased. equity was used to complete the purchase. Which company has higher financial leverage compared to one another? Type a or b. Which company has higher debt levels compared to one another? Type a or b. cents of debt was used and I cents of cents of REQUIRED: Based on the information provided, fill in the blanks. To complete your answers please follow the instructions: Round up or down to keep TWO DECIMALS accordingly. i.e. 1.234 would be rounded to 1.23 whereas 1.235 would be rounded to 1.24 Use a PERIOD to determine decimals. i.e. 1.23 Please DO NOT use dollar signs $ or percentage signs %. Please record the numbers with only a decimal place, DO NOT place a comma, distinguishing the thousands. i.e. To record $1,000 type 1000 not 1,000 i.e. To record $100,000 type 100000 not 100,000 Use only lower-case letters if typing a word, do not use UPPER-CASE letters. UK: Two Company Comparison CONSOLIDATED BALANCE SHEETS (2) Fiscal Year-End -20xx ($ in millions) ASSETS Current assets: Cash and equivalents Accounts & Notes Receivable Inventory Pre paid insurance Pre paid rent Current deferred taxes, net Other Total Current Assets Property Plant and Equipment Intangible assets Goodwill Contract Aquisition Costs Fami Company A $ $ $ $ $ $ $ $ $ Fiscal Year-20xx $ $ 1,876 $ 1,885 $ 3,249 $ 321 $ 526 $ 573 $ 447 $ 8,877 $ Company B 3,064 $ 1,968 $ 1,644 $ FCO C 2625 1,760 1,498 289 478 364 405 5,056 2,828 1,715 1,391 Contract Aquisition Costs Equity and Cost method investments Notes receivable Deferred tax Other Total Assets Liabilities Current Liabilities Current position of long term debt Accounts payable Accrued payroll and benefits Liability for guest loyalty program Other Total Current Liabilities Long Term Debt Liability for guest loyalty program Other Long Term Liabilities Shareholders Equity Liabilities & Sharehoders Equity SSSSS $ $ $ $ $ $ $ $ SS $ $ $ S55 $ $ $ $ 1,644 $ 560 $ 1,017 $ 2,295 $ 884 $ 20,309 $ 144 $ 2,965 $ 1,167 $ 1,021 $ 1,548 $ $6,845 5,026 $ 2,684 $ 2,423 $ 3,331 $ 20,309 $ 1,391 678 1,626 1,424 1,109 15,827 235 1,379 2,027 874 1,234 $5,749 5,831 2,136 1,791 320 15,827

Step by Step Solution

★★★★★

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a 0841 b 084 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started