Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Change the estimated total amount of the allocation base back to 80,000 machine-hours, so that the data area of you worksheet looks exactly the same

Change the estimated total amount of the allocation base back to 80,000 machine-hours, so that the data area of you worksheet looks exactly the same as in Requirement 2. Now change the actual manufacturing overhead cost from $604,000 to $595,800. The data area of your worksheet should now look like this:

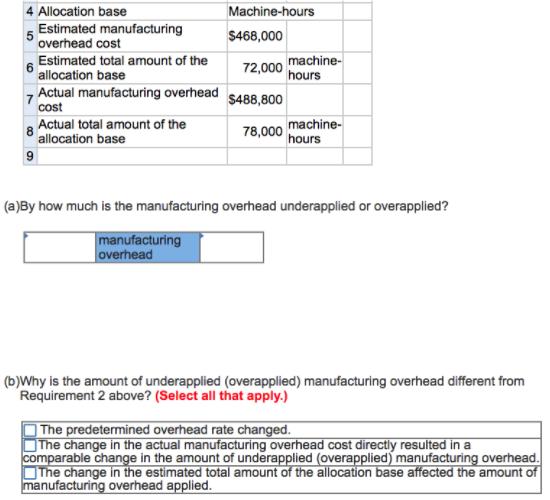

4 Allocation base Machine-hours Estimated manufacturing overhead cost $468,000 Estimated total amount of the allocation base machine- 72,000 hours Actual manufacturing overhead cost $488,800 Actual total amount of the machine- 8 78,000 allocation base hours (a)By how much is the manufacturing overhead underapplied or overapplied? manufacturing overhead (b)Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (Select all that apply.) The predetermined overhead rate changed. The change in the actual manufacturing overhead cost directly resulted in a comparable change in the amount of underapplied (overapplied) manufacturing overhead. OThe change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Predetermined OH rate 46800072000 650 Overhead ap...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started