Accounting

Accounting

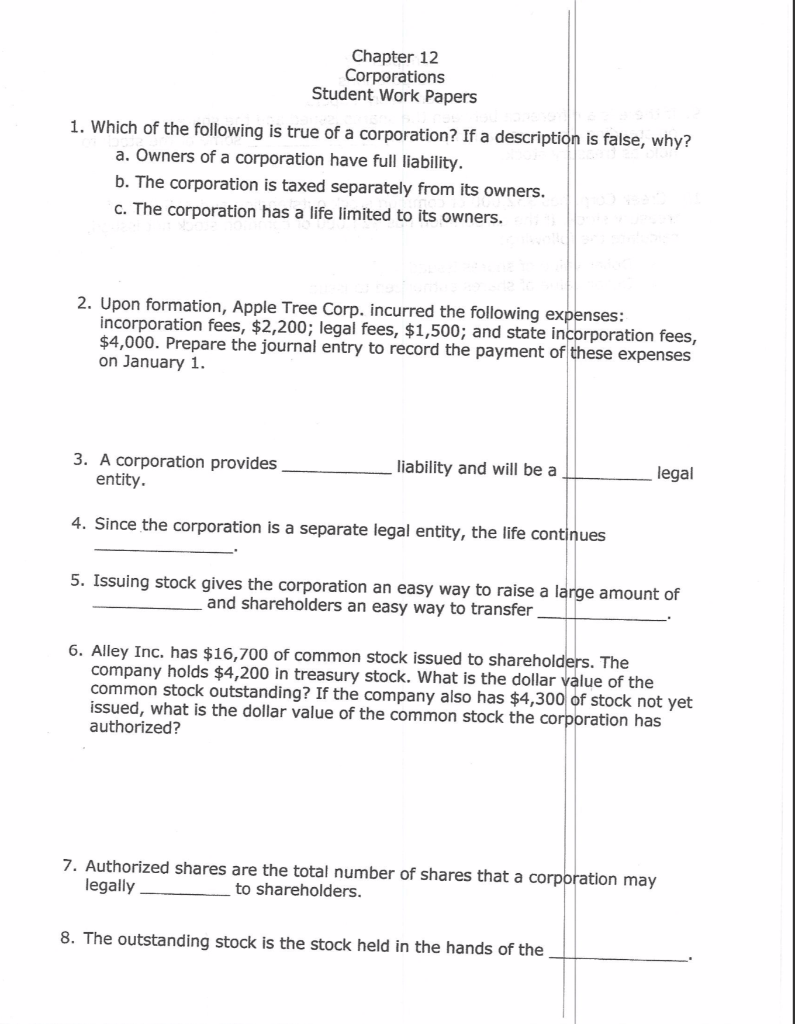

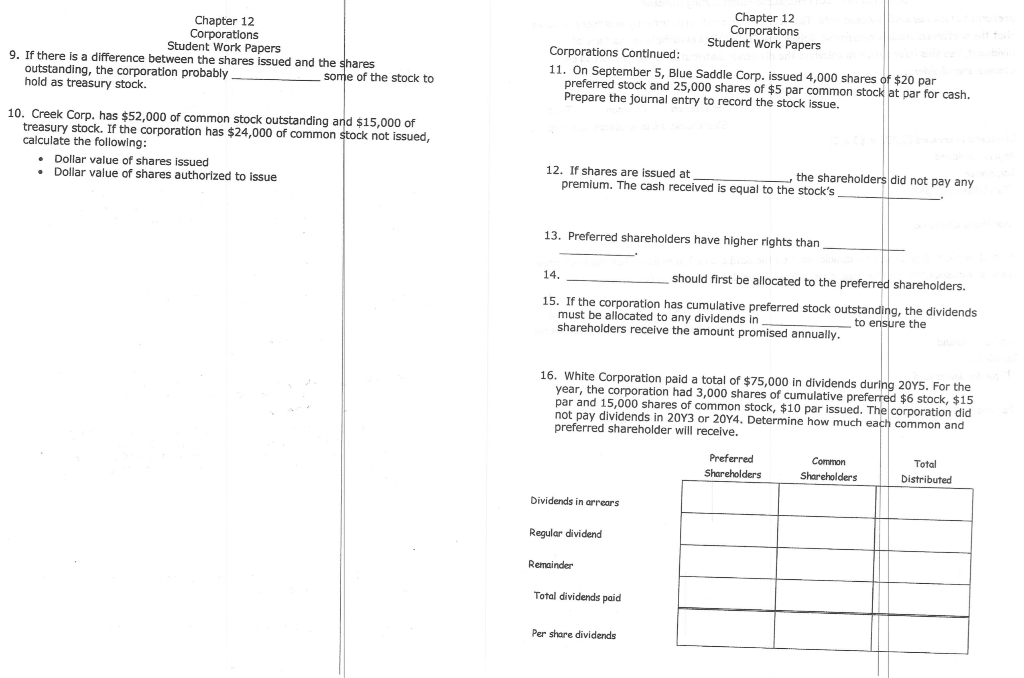

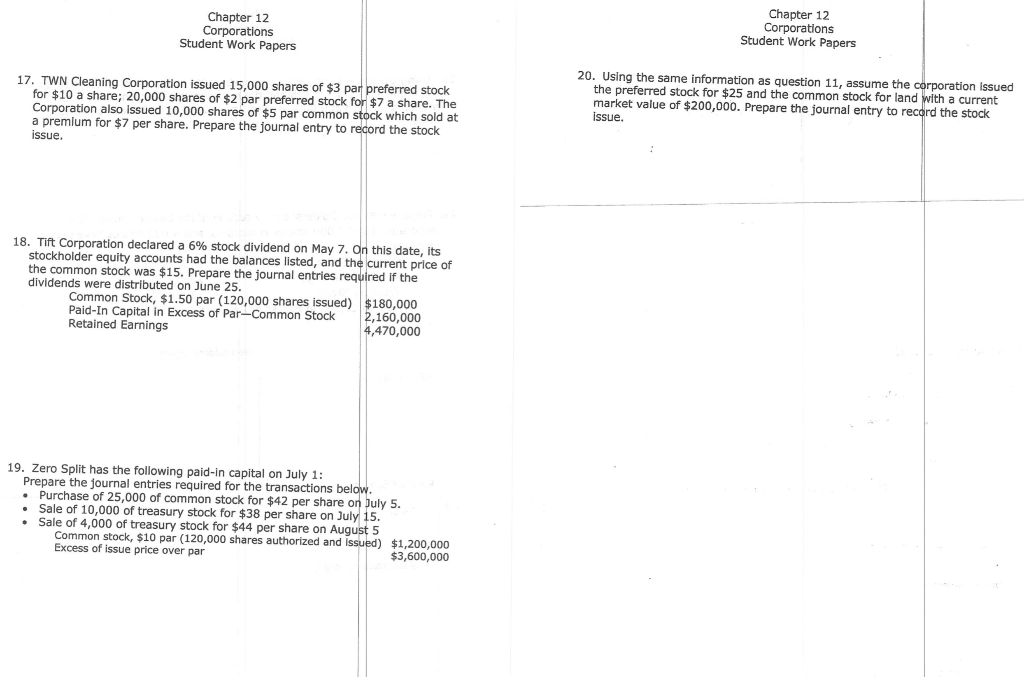

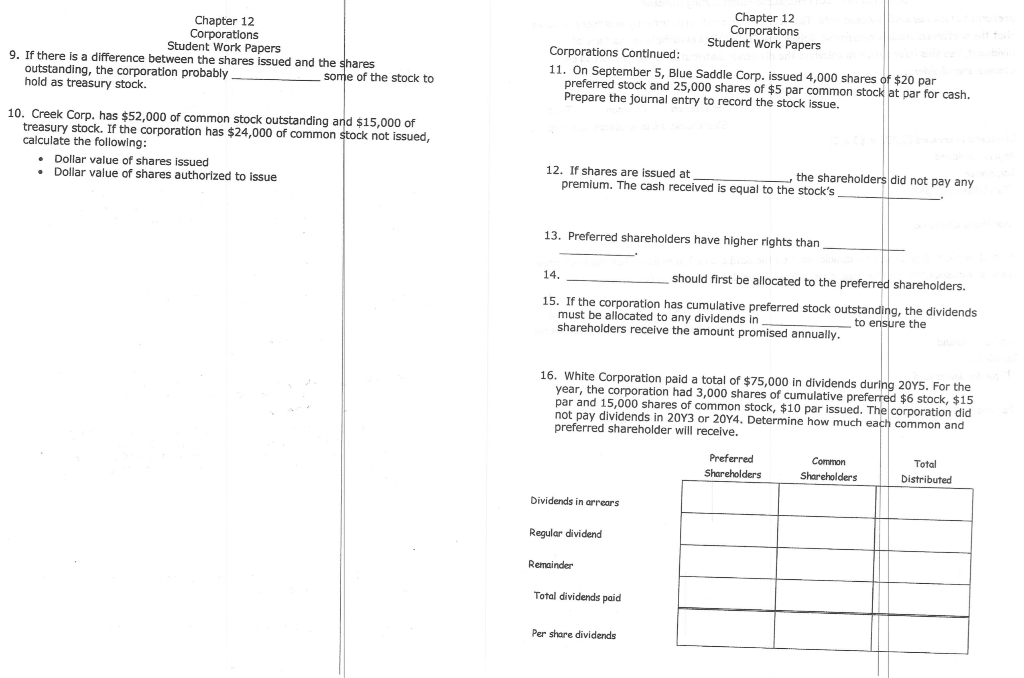

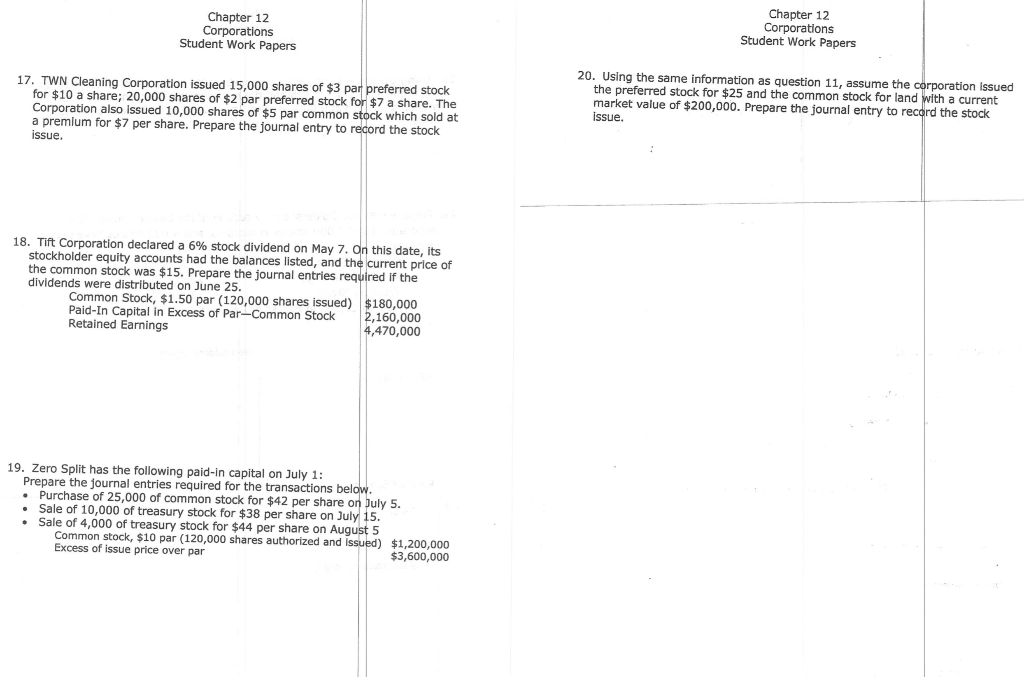

Chapter 12 Corporations Student Work Papers 1. Which of the following is true of a corporation? If a description is false, why? a. Owners of a corporation have full liability. b. The corporation is taxed separately from its owners. C. The corporation has a life limited to its owners. 2. Upon formation, Apple Tree Corp. incurred the following expenses: incorporation fees, $2,200; legal fees, $1,500; and state incorporation fees, $4,000. Prepare the journal entry to record the payment of these expenses on January 1. liability and will be a legal 3. A corporation provides entity. 4. Since the corporation is a separate legal entity, the life continues 5. Issuing stock gives the corporation an easy way to raise a large amount of and shareholders an easy way to transfer_ 6. Alley Inc. has $16,700 of common stock issued to shareholders. The company holds $4,200 in treasury stock. What is the dollar value of the common stock outstanding? If the company also has $4,300 of stock not yet issued, what is the dollar value of the common stock the corporation has authorized? 7. Authorized shares are the total number of shares that a corporation may legally to shareholders. 8. The outstanding stock is the stock held in the hands of the Chapter 12 Corporations Student Work Papers 9. If there is a difference between the shares issued and the shares outstanding, the corporation probably some of the stock to hold as treasury stock. Chapter 12 Corporations Student Work Papers Corporations Continued: 11. On September 5, Blue Saddle Corp. issued 4,000 shares of $20 par preferred stock and 25,000 shares of $5 par common stock at par for cash. Prepare the journal entry to record the stock issue. 10. Creek Corp. has $52,000 of common stock outstanding and $15,000 of treasury stock. If the corporation has $24,000 of common stock not issued, calculate the following: Dollar value of shares issued Dollar value of shares authorized to issue 12. If shares are issued at the shareholders did not pay any premium. The cash received is equal to the stock's 13. Preferred shareholders have higher rights than 14. should first be allocated to the preferred shareholders. 15. If the corporation has cumulative preferred stock outstanding, the dividends must be allocated to any dividends in to ensure the shareholders receive the amount promised annually. 16. White Corporation paid a total of $75,000 in dividends during 2015. For the year, the corporation had 3,000 shares of cumulative preferred $6 stock, $15 par and 15,000 shares of common stock, $10 par issued. The corporation did not pay dividends in 20Y3 or 2014. Determine how much each common and preferred shareholder will receive. Preferred Shareholders Common Shareholders Total Distributed Dividends in arrears Regular dividend Remainder Total dividends paid Per share dividends Chapter 12 Corporations Student Work Papers Chapter 12 Corporations Student Work Papers 17. TWN Cleaning Corporation issued 15,000 shares of $3 par preferred stock for $10 a share; 20,000 shares of $2 par preferred stock for $7 a share. The Corporation also issued 10,000 shares of $5 par common stock which sold at a premium for $7 per share. Prepare the journal entry to record the stock issue. 20. Using the same information as question 11, assume the corporation issued the preferred stock for $25 and the common stock for land with a current market value of $200,000. Prepare the journal entry to record the stock issue. 18. Tift Corporation declared a 6% stock dividend on May 7. On this date, its equity accounts had the balances listed, and the current price of the common stock was $15. Prepare the journal entries required if the dividends were distributed on June 25. Common Stock, $1.50 par (120,000 shares issued) $180,000 Paid-In Capital in Excess of Par-Common Stock 2,160,000 Retained Earnings 4,470,000 19. Zero Split has the following paid-in capital on July 1: Prepare the journal entries required for the transactions below. urchase of 25,000 of common stock for $42 per share on July 5. Sale of 10,000 of treasury stock for $38 per share on July 15. Sale of 4,000 of treasury stock for $44 per share on August 5 Common stock, $10 par (120,000 shares authorized and Issued) $1,200,000 Excess of issue price over par $3,600,000

Accounting

Accounting